Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters substantial obstacles related to the high costs and technical complexities involved in system development. The necessity for high-speed analog-to-digital converters and specialized processing elements adds layers of difficulty to the design phase and elevates production expenses. This financial strain is further compounded by strict size, weight, and power limitations inherent to unmanned aerial vehicles and smaller naval craft. Consequently, these factors may hinder the widespread integration of these memory systems into cost-sensitive applications, potentially limiting their adoption across a broader range of platforms.

Market Drivers

The escalating demand for sophisticated electronic warfare capabilities acts as a primary catalyst for the Global Digital Radio Frequency Memory Market. As adversary radar systems evolve in complexity and agility, defense forces increasingly rely on digital radio frequency memory technology to capture, process, and retransmit signals with exceptional fidelity to mislead hostile targeting systems. This operational requirement stimulates significant industrial efforts dedicated to creating reprogrammable memory loops capable of effectively masking platform signatures within dense signal environments. For example, Mercury Systems announced in February 2024 that it had secured a five-year contract valued at $243.8 million from the U.S. Navy to supply electronic attack training subsystems based on this technology, highlighting the critical dependence on digital solutions to simulate near-peer threats and improve asset survivability.Market growth is further reinforced by accelerated military modernization efforts and rising defense expenditures, as nations prioritize replacing obsolete analog systems with versatile digital architectures. Governments are directing substantial portions of their defense budgets toward acquiring next-generation electronic attack and protection suites that utilize this technology for enhanced signal coherence and bandwidth management. This trend is visible in major procurement initiatives designed to upgrade tactical aircraft and naval capabilities against emerging threats. For instance, DefenseScoop reported in August 2024 that the U.S. Navy awarded L3Harris Technologies a $587.4 million contract for the development of the Next Generation Jammer Low Band system. Similarly, Army Recognition noted in June 2024 that BAE Systems received a $95 million contract to supply electronic warfare pods for the P-8A Poseidon, underscoring the strategic necessity of maintaining electromagnetic readiness.

Market Challenges

The Global Digital Radio Frequency Memory Market faces significant constraints due to the considerable financial and technical challenges associated with developing these advanced systems. The technology depends heavily on high-speed analog-to-digital converters and specialized processing units, which are both intricate to design and costly to manufacture. Integrating these components while preserving signal fidelity requires complex engineering, creating a high barrier to entry and driving up the per-unit cost of the final products. As a result, this elevated price point restricts the addressable market, particularly impacting smaller platforms where budget efficiency is a critical consideration.These financial burdens directly hinder market expansion by limiting the deployment of memory systems in cost-sensitive applications, such as unmanned aerial vehicles and smaller naval vessels. The rigid size, weight, and power constraints associated with these platforms further aggravate development costs, making widespread adoption challenging for defense contractors operating under tight budgetary limits. According to IPC, in 2024, 59 percent of electronics manufacturers reported increasing labor costs, while 45 percent faced rising material costs, resulting in a compounded financial strain that impedes the scalable production of complex defense electronics. As production expenses climb, procurement programs risk being scaled back or delayed, which slows the overall growth trajectory of the sector.

Market Trends

The integration of artificial intelligence for cognitive electronic warfare marks a fundamental transformation in how Digital Radio Frequency Memory systems manage threats. Moving away from legacy architectures dependent on static threat libraries, AI-enabled solutions employ machine learning algorithms to detect and counter unknown or agile radar signals in real time.This cognitive capacity enables the system to dynamically analyze pulse characteristics and generate optimized jamming profiles without human input, drastically lowering response latency in contested electromagnetic spectrums. Highlighting this technological advancement, the Southwest Research Institute reported in April 2024 that it received a $6.4 million contract from the U.S. Air Force to further develop cognitive electronic warfare algorithms designed to identify and respond to unidentified enemy radar threats.

Additionally, the proliferation of expendable active decoy systems is broadening the application of miniaturized technology beyond traditional onboard jamming pods. These compact, self-contained units are engineered to be ejected from standard chaff and flare dispensers, emitting high-fidelity jamming signals to lure incoming missiles away from the host aircraft. This trend meets the critical need for improved platform survivability against modern radio frequency seekers without imposing significant weight or aerodynamic penalties. Demonstrating this market traction, Defence Industry Europe reported in December 2024 that Leonardo UK was awarded a $33 million contract by the U.S. Navy to supply BriteCloud 218 Active Expendable Decoys for the F-35 Lightning II fleet.

Key Players Profiled in the Digital Radio Frequency Memory Market

- Airbus Group

- Northrop Grumman Corporation

- Raytheon Company

- Bae Systems PLC

- Elbit Systems Ltd.

- Thales Group

- Leonardo S.P.A

- Curtiss-Wright Corporation

- Israel Aerospace Industries

- Rohde & Schwarz.

Report Scope

In this report, the Global Digital Radio Frequency Memory Market has been segmented into the following categories:Digital Radio Frequency Memory Market, by Architecture:

- Processor

- Modulator

- Convertor

- Memory

- Others

Digital Radio Frequency Memory Market, by Application:

- Electronic Warfare

- Radar Test & Evaluation

- Electronic Warfare Training

- Radio & Cellular Network Jamming

Digital Radio Frequency Memory Market, by Platform:

- Defense

- Commercial & Civil

Digital Radio Frequency Memory Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Radio Frequency Memory Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Digital Radio Frequency Memory market report include:- Airbus Group

- Northrop Grumman Corporation

- Raytheon Company

- Bae Systems PLC

- Elbit Systems Ltd.

- Thales Group

- Leonardo S.P.A

- Curtiss-Wright Corporation

- Israel Aerospace Industries

- Rohde & Schwarz.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

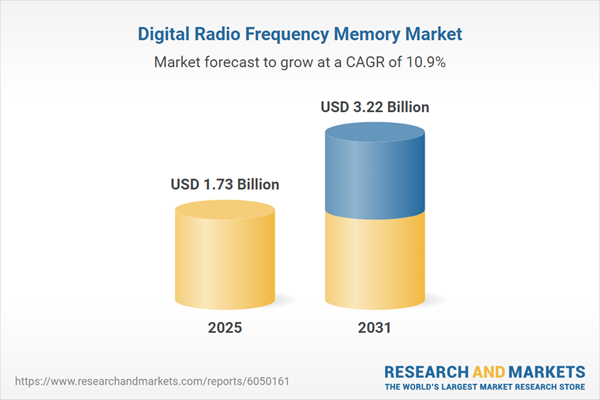

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.73 Billion |

| Forecasted Market Value ( USD | $ 3.22 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |