Free Webex Call

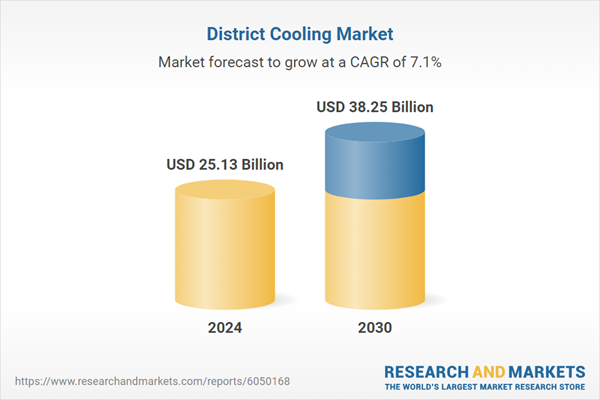

The District Cooling Market was valued at USD 25.13 Billion in 2024, and is expected to reach USD 38.25 Billion by 2030, rising at a CAGR of 7.09%. The global district cooling market is experiencing significant growth due to increasing demand for energy-efficient and environmentally sustainable cooling solutions in urban areas. District cooling systems distribute chilled water or air through a centralized network to multiple buildings, offering a cost-effective and energy-efficient alternative to traditional air conditioning systems. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This market expansion is driven by rising urbanization, stringent environmental regulations, and the growing adoption of green building initiatives. Governments and organizations are focusing on reducing greenhouse gas emissions and enhancing energy efficiency, making district cooling a preferred choice for commercial, residential, and industrial applications. The integration of renewable energy sources, such as solar and geothermal, into district cooling systems further enhances their sustainability.

Technological advancements, including smart energy management systems and automation, are revolutionizing the market by optimizing operational efficiency and reducing energy consumption. The construction of modern infrastructure projects, particularly in developing regions, is fostering the adoption of district cooling systems. The Asia-Pacific region, led by rapid urbanization in countries like India, China, and Southeast Asia, is emerging as a key growth market due to rising temperatures, energy demand, and supportive government policies promoting energy-efficient solutions. In North America and Europe, stringent environmental regulations and the growing emphasis on reducing carbon footprints are propelling the market. The Middle East is also a prominent region in the district cooling market, driven by high cooling demand, supportive government initiatives, and the integration of advanced technologies. However, the market faces challenges such as high initial capital investment and infrastructure development costs, which may deter small-scale deployments.

Key Market Drivers

Rising Urbanization and Population Growth

The rapid pace of urbanization is a significant driver of the global district cooling market. According to the United Nations, 56% of the global population resided in urban areas in 2020, a figure projected to rise to 68% by 2050. This urban growth increases the density of buildings in cities, requiring efficient and sustainable cooling solutions to manage the growing energy demand. District cooling systems are particularly well-suited for high-density urban environments, as they reduce the need for individual cooling systems in buildings and offer a centralized approach to cooling.Urbanization also drives infrastructure development, including residential complexes, commercial spaces, and industrial hubs, all of which are significant users of district cooling systems. In addition, urban heat island effects, where cities experience higher temperatures due to concrete and asphalt, further emphasize the need for effective cooling systems. For instance, studies indicate that urban areas can be 1-7°C hotter than surrounding rural regions, leading to increased energy consumption for cooling. District cooling provides an energy-efficient alternative, with efficiency rates of 20-50% higher than conventional cooling systems, thereby catering to the rising urban cooling demand.

Climate Change and Rising Global Temperatures

The increasing frequency of heatwaves and rising global temperatures due to climate change have intensified the need for efficient cooling systems. According to the World Meteorological Organization, the decade 2011-2020 was the warmest on record, and the global temperature is expected to increase further by 1.5°C by 2030-2050. These changes are escalating the cooling requirements in regions across the globe, particularly in countries with hot climates. District cooling systems, which consume up to 50% less electricity than traditional cooling methods, offer a sustainable solution to meet this growing demand.In regions like the Middle East, where cooling accounts for 70% of energy consumption during peak summer months, district cooling systems have already demonstrated their potential. For example, the UAE implemented district cooling in over 16% of its urban areas, saving an estimated 2 billion liters of water annually through reduced cooling tower requirements. The ability of district cooling to address climate challenges positions it as a vital component of global energy transition strategies.

Government Policies and Incentives for Energy Efficiency

Governments worldwide are implementing stringent regulations and offering incentives to promote energy efficiency and reduce carbon emissions. Policies such as the European Union’s Energy Efficiency Directive and the U.S. Energy Policy Act encourage the adoption of technologies like district cooling. These systems align with national and international goals to achieve net-zero emissions by 2050.For instance, district cooling systems are recognized for their ability to reduce energy consumption by 30-40%, significantly contributing to emission reduction targets. In Singapore, the government-backed Marina Bay district cooling system has reduced carbon emissions by an estimated 34,500 tons annually, equivalent to taking 10,000 cars off the road. Similarly, in Saudi Arabia, the government’s Vision 2030 initiative supports sustainable urban development, encouraging the deployment of district cooling networks. Such supportive policies and initiatives are propelling market growth by fostering adoption among businesses and municipal authorities.

Integration of Renewable Energy Sources

The integration of renewable energy sources such as solar, wind, and geothermal energy into district cooling systems is emerging as a key market driver. Renewable energy integration not only enhances the sustainability of district cooling but also reduces operational costs. For example, solar cooling systems can reduce electricity consumption by 80-90% compared to traditional systems.In the Middle East, Abu Dhabi’s Masdar City employs solar-powered district cooling systems, saving approximately 40% of energy costs annually. Additionally, advancements in thermal energy storage technologies, such as ice storage and chilled water tanks, complement renewable energy integration by allowing excess energy generated during off-peak periods to be stored and used during peak demand. This alignment with global renewable energy goals strengthens the appeal of district cooling systems.

Growing Investments in Smart Cities

The growing development of smart cities globally is a major driver for the district cooling market. Governments and private stakeholders are investing heavily in smart city projects, where district cooling systems are a critical component for achieving sustainability and efficiency. According to the International Data Corporation, global spending on smart city initiatives was projected to reach USD189.5 billion in 2023.Smart cities leverage advanced technologies such as IoT and AI for energy management, and district cooling systems seamlessly integrate with these technologies. For instance, in Qatar’s Lusail City, district cooling networks save 65% of electricity consumption compared to conventional systems. These systems provide real-time monitoring and optimization, further enhancing their efficiency and reducing operational costs. With over 200 smart city projects underway globally, district cooling systems are set to benefit from the increased emphasis on sustainable infrastructure.

Key Market Challenges

High Initial Capital Investment

The adoption of district cooling systems often requires substantial upfront capital investment for infrastructure development, including central plants, distribution networks, and advanced technology integration. This high cost poses a significant barrier for both public and private entities, particularly in emerging economies with budget constraints. The financial burden is further compounded by the long payback period associated with such systems, which may deter stakeholders from adopting district cooling solutions despite their long-term energy efficiency and environmental benefits. Moreover, securing funding for large-scale projects can be challenging, limiting the market's expansion, especially in regions with limited financial resources.Complexity in Infrastructure Development

Implementing district cooling systems involves complex infrastructure planning and development, including the establishment of centralized plants, pipeline networks, and integration with existing building systems. This process requires careful coordination among multiple stakeholders, including governments, urban planners, and private entities. Urban congestion and limited space in densely populated cities further complicate the installation of such systems. Additionally, disruptions caused by construction activities, such as road closures and utility relocations, can lead to delays and increased costs. The intricate nature of infrastructure development often acts as a hurdle for widespread adoption, particularly in regions with poorly developed urban planning frameworks.Dependence on Stable Energy Sources

District cooling systems rely heavily on stable and reliable energy sources, including electricity and renewable energy. Fluctuations in energy supply, grid reliability issues, or dependency on fossil fuels can impact the operational efficiency of these systems. In regions where energy infrastructure is underdeveloped or prone to outages, the implementation of district cooling becomes less feasible. Furthermore, the integration of renewable energy, while environmentally beneficial, requires advanced technology and infrastructure, which adds to the complexity and cost of implementation, making it a challenge for many market players to achieve energy security.Limited Awareness and Market Penetration

Awareness of the benefits of district cooling systems remains limited in certain regions, particularly in developing economies. Many stakeholders, including policymakers, building owners, and end-users, may lack understanding of the long-term cost savings, environmental benefits, and energy efficiency associated with these systems. The absence of adequate promotional campaigns, educational initiatives, and government advocacy further exacerbates this issue. Limited market penetration in untapped regions also stems from a lack of collaboration between key players and insufficient demonstration projects that could highlight the advantages and feasibility of district cooling solutions.Regulatory and Policy Barriers

The regulatory landscape for district cooling varies significantly across regions, creating challenges for uniform adoption. In some areas, the absence of clear policies or incentives for district cooling implementation hinders market growth. For instance, countries without well-defined energy efficiency standards or carbon reduction goals may lack the necessary framework to support district cooling projects. Additionally, navigating bureaucratic procedures and acquiring necessary approvals can delay projects, increasing costs and discouraging investment. Harmonizing regulations and offering supportive policies, such as subsidies and tax incentives, are crucial to overcoming this challenge and fostering market growth globally.Key Market Trends

Expansion of District Cooling in Urban Smart Cities

The rapid development of smart cities worldwide is driving the adoption of district cooling systems. Urban planners are incorporating district cooling into infrastructure projects to promote energy efficiency and sustainability. High-density urban areas, such as those in Asia-Pacific and the Middle East, are increasingly integrating district cooling systems into residential, commercial, and mixed-use developments. These systems offer centralized solutions for large-scale cooling needs, aligning with smart city goals to reduce energy consumption and carbon emissions. The market is witnessing growing collaboration between governments, technology providers, and private stakeholders to establish district cooling as a cornerstone of smart city initiatives.Rising Focus on Energy Efficiency and Carbon Reduction

Global efforts to combat climate change and adhere to international environmental standards are significantly influencing the district cooling market. The systems’ ability to achieve high energy efficiency and reduce carbon emissions makes them an attractive alternative to conventional cooling methods. Several governments are introducing stringent energy efficiency regulations and incentivizing the adoption of district cooling to reduce reliance on fossil fuels. For instance, carbon trading schemes and green certifications are encouraging industries to shift toward energy-efficient cooling systems. This trend is particularly strong in Europe, North America, and the Middle East, where climate policies are stringent.Growth in Public-Private Partnerships (PPPs) for Infrastructure Development

Public-private partnerships (PPPs) are emerging as a significant enabler for the growth of the district cooling market. These collaborations are helping to overcome financial barriers and accelerate infrastructure development, particularly in developing economies. Governments provide regulatory frameworks and incentives, while private stakeholders bring technological expertise and investment. Notable examples include large-scale projects in the Middle East and Asia-Pacific, where PPP models have been instrumental in expanding district cooling networks. These partnerships are ensuring the scalability and sustainability of projects, contributing to the global market’s rapid development and offering a model for future growth in other regions.Segmental Insights

Type Insights

Free Cooling segment dominates in the Global District Cooling market in 2024 due to its energy efficiency, cost-effectiveness, and alignment with sustainability goals. Free cooling leverages natural cooling sources such as cold air, water bodies, or underground temperatures to provide cooling without extensive reliance on energy-intensive mechanical systems like chillers.This approach significantly reduces operational costs, making it highly appealing for businesses and governments striving to meet climate goals and reduce energy consumption. One of the primary drivers for free cooling’s dominance is its suitability for regions with favorable climatic conditions. In colder climates such as those in parts of Europe, North America, and Asia-Pacific, free cooling can operate throughout much of the year, delivering substantial energy savings. Countries in these regions have implemented supportive policies and regulations encouraging energy-efficient technologies, further boosting the adoption of free cooling systems.

The rising integration of smart technology and advanced controls into district cooling systems has enhanced the operational efficiency of free cooling. Innovations such as IoT-enabled sensors and AI-driven optimization allow operators to monitor and manage cooling systems dynamically, maximizing the use of natural cooling sources and minimizing reliance on mechanical cooling. Increased awareness of environmental sustainability has also accelerated the adoption of free cooling.

Organizations and governments are prioritizing green building certifications such as LEED and BREEAM, which recognize energy-efficient cooling technologies. Free cooling aligns seamlessly with these certifications by reducing carbon footprints and promoting energy conservation. Moreover, the growing demand for district cooling in data centers and industrial applications has fueled free cooling's expansion. Data centers, in particular, require continuous cooling and benefit significantly from the cost savings and efficiency of free cooling, especially in regions with cool ambient temperatures.

Regional Insights

North America dominated the Global District Cooling market in 2024 due to the region's advanced infrastructure, supportive policies, and increasing demand for energy-efficient cooling systems. The adoption of district cooling in North America is fueled by rising urbanization, the need for sustainable energy solutions, and the rapid expansion of commercial and residential buildings. The region’s focus on sustainability and reducing greenhouse gas emissions has significantly boosted district cooling. Governments and municipalities in North America have introduced various incentives and regulations encouraging the use of energy-efficient cooling systems.For instance, cities like Toronto and Chicago have implemented district cooling networks powered by renewable and low-carbon energy sources, setting benchmarks for others to follow. Technological advancements in the region have also played a key role. The integration of advanced control systems, IoT-enabled monitoring, and AI-driven optimization has improved the efficiency and reliability of district cooling systems. This technological edge has positioned North America as a leader in adopting innovative cooling solutions. The growing demand for district cooling in sectors such as data centers, healthcare, and education further drives the market.

Data centers, in particular, require constant cooling and are increasingly adopting district cooling to achieve cost savings and energy efficiency. The healthcare sector also contributes significantly, with hospitals and research facilities prioritizing sustainable cooling solutions. Moreover, the presence of key market players and strong investment in research and development have propelled the growth of the district cooling market in the region. These companies actively collaborate with governments and private entities to expand district cooling networks, catering to the region's increasing cooling demands.

Key Market Players

- Fortum Corporation

- National Central Cooling Company PJSC

- Veolia Group

- AtkinsRéalis

- Keppel Corporation Limited

- Siemens AG

- ADC Energy Systems

- Danfoss A/S

- Shinryo Corporation

- ENGIE Group

Report Scope:

In this report, the Global District Cooling Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:District Cooling Market, By Type:

- Free Cooling

- Absorption Cooling

- Others

District Cooling Market, By End Use Sector:

- Commercial

- Industrial

- Others

District Cooling Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global District Cooling Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

5. Global District Cooling Market Outlook

6. North America District Cooling Market Outlook

7. Europe District Cooling Market Outlook

8. Asia Pacific District Cooling Market Outlook

9. Middle East & Africa District Cooling Market Outlook

10. South America District Cooling Market Outlook

11. Market Dynamics

13. Company Profiles

Companies Mentioned

- Fortum Corporation

- National Central Cooling Company PJSC

- Veolia Group

- AtkinsRéalis

- Keppel Corporation Limited

- Siemens AG

- ADC Energy Systems

- Danfoss A/S

- Shinryo Corporation

- ENGIE Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.13 Billion |

| Forecasted Market Value ( USD | $ 38.25 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |