Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces significant hurdles due to an increasingly strict regulatory landscape regarding firearm ownership and trade. Manufacturers encounter complex compliance mandates and tightening gun control laws across various international jurisdictions, which create formidable barriers to entry and operation. These regulatory constraints complicate global distribution strategies and effectively restrict sales potential, posing a substantial challenge to broader industry growth.

Market Drivers

The modernization of military and law enforcement arsenals serves as a primary catalyst for the Global Shotgun and Rifles Market, as defense agencies prioritize replacing aging service weapons with modular, high-performance platforms. Governments globally are increasing defense spending to equip infantry units with advanced assault rifles that offer superior ergonomics, caliber flexibility, and integration with modern optical systems, largely in response to evolving geopolitical threats. This trend is evident in robust procurement activity among major defense contractors supplying NATO members and allied nations. For instance, Heckler & Koch reported a record order intake of 426.2 million euros in the 2024 fiscal year, driven significantly by high trust and demand from security forces within the transatlantic alliance.Technological innovations in firearm precision and smart features act as a second major driver, stimulating demand within the civilian and competitive shooting sectors. Manufacturers are heavily investing in research and development to introduce firearms featuring lightweight composite materials, enhanced modularity, and compatibility with digital ballistics technologies, appealing to both new enthusiasts and seasoned marksmen. This continuous cycle of innovation creates a replacement market where consumers upgrade to the latest models for improved performance. According to Sturm, Ruger & Company, Inc., sales of new products represented $159.3 million, or 32% of total firearm sales in 2024. The scale of the industry is further underscored by Beretta Holding, which generated $1.7 billion in revenues in 2024, largely driven by civilian and defense sales.

Market Challenges

The stringent regulatory environment governing firearm ownership and trade acts as a substantial constraint on the global shotgun and rifles market. Manufacturers face complex and varying compliance standards across different international jurisdictions, which disrupts supply chains and increases operational costs. These legal hurdles often manifest as rigorous licensing procedures, import-export restrictions, and outright bans on specific firearm categories, effectively severing access to lucrative consumer bases abroad. Consequently, companies must allocate significant resources to legal navigation rather than product innovation or market expansion, slowing overall growth.This regulatory tightening has tangible financial repercussions for the industry's global performance. The implementation of stricter export controls limits the ability of manufacturers to fulfill international orders and maintain foreign partnerships, directly reducing revenue streams. According to the National Shooting Sports Foundation, in 2025, restrictive export controls and regulatory burdens were estimated to have cost the industry approximately $500 million in annual lost business revenue. Such financial contraction underscores how legislative barriers complicate distribution strategies and prevent the market from realizing its full commercial potential in regions with high demand.

Market Trends

Emerging smart firearm technologies and biometric integration are fundamentally reshaping the market by introducing personalized access control systems that prevent unauthorized use. Unlike traditional mechanical safeties, these innovative platforms utilize fingerprint and facial recognition sensors to unlock the firing mechanism instantly for authorized users, addressing long-standing consumer demand for enhanced home defense safety. This technological advancement has moved beyond prototypes into commercial reality, with manufacturers delivering fully functional units to the civilian market. According to Biofire Technologies, the company successfully shipped the first production units of its biometric Smart Gun to customers in August 2024, validating the scalability of this safety-focused technology.The mainstreaming of suppressor-ready barrel configurations has become a dominant trend as consumer preference shifts toward hearing protection and recoil reduction. A surge in civilian ownership of sound suppressors, driven by expedited regulatory processing, has compelled rifle and shotgun manufacturers to standardize threaded muzzles across their product lines, effectively making noise mitigation a baseline feature rather than an aftermarket modification. This alignment between regulatory efficiency and manufacturing output has resulted in unprecedented ownership levels for noise reduction devices. According to Guns.com, the number of NFA-compliant suppressors in circulation reached 4,857,897 as of June 2024, representing an 82 percent increase from 2021 levels.

Key Players Profiled in the Shotgun and Rifles Market

- Vista Outdoor Inc.

- Sturm, Ruger & Co., Inc.

- Sig Sauer, Inc.

- Heckler & Koch GmbH

- O. F. Mossberg & Sons, Inc.

- Kalashnikov Concern JSC

- Fabbrica d'Armi Pietro Beretta S.p.A.

- CheyTac USA

- FN HERSTAL

- Springfield, Inc,

Report Scope

In this report, the Global Shotgun and Rifles Market has been segmented into the following categories:Shotgun and Rifles Market, by Range:

- Short-Range

- Medium-Range

- Long-Range

Shotgun and Rifles Market, by End User:

- Military

- Civilian

- Law Enforcement

Shotgun and Rifles Market, by Weapon Loading Mechanism:

- Manual

- Semi-Automatic/ Automatic

Shotgun and Rifles Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Shotgun and Rifles Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Shotgun and Rifles market report include:- Vista Outdoor Inc.

- Sturm, Ruger & Co., Inc.

- Sig Sauer, Inc.

- Heckler & Koch GmbH

- O. F. Mossberg & Sons, Inc.

- Kalashnikov Concern JSC

- Fabbrica d'Armi Pietro Beretta S.p.A.

- CheyTac USA

- FN HERSTAL

- Springfield, Inc,

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

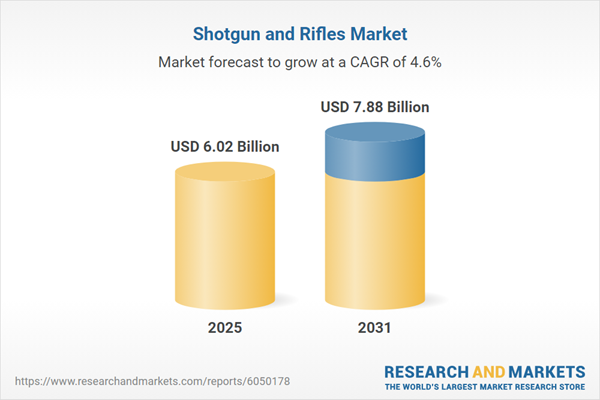

| Estimated Market Value ( USD | $ 6.02 Billion |

| Forecasted Market Value ( USD | $ 7.88 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |