Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a significant hurdle in managing supply chain risks and component obsolescence, issues that frequently delay the acquisition of spare parts for legacy systems and inflate lifecycle costs. According to the Aerospace, Security and Defence Industries Association of Europe, the services sector generated €89 billion in turnover in 2024, highlighting the substantial economic scale of sustainment activities within the defense industrial base. This data underscores the critical role of support services in maintaining systems throughout their operational lifecycle despite the logistical challenges involved.

Market Drivers

Escalating geopolitical tensions and asymmetric security threats serve as the primary catalyst for the Global Military Vehicle Sustainment Market, compelling nations to prioritize the immediate readiness of land-based assets. High operational tempos in regions such as Eastern Europe and the Middle East accelerate wear on armored fleets, necessitating frequent deep maintenance and logistics support. This demand correlates with surging defense budgets; for instance, the Stockholm International Peace Research Institute reported in April 2025 that global military expenditure reached $2.71 trillion in 2024. Consequently, prime contractors are experiencing robust revenue growth, as evidenced by Rheinmetall AG’s March 2025 report showing its Vehicle Systems division generated €3.79 billion in sales for fiscal year 2024, a 45 percent increase driven by tactical vehicle programs.Market stability is further reinforced by the modernization and technological refreshment of legacy land platforms, as defense agencies prefer upgrading existing systems over developing new ones. This trend involves integrating advanced electronics, survivability packages, and power systems into existing chassis to manage obsolescence and bridge the gap to next-generation capabilities. These activities generate significant sustainment contracts, such as the $356.7 million award to BAE Systems reported by GovCon Wire in March 2025. This contract modification for Armored Multi-Purpose Vehicles (AMPVs) highlights the focus on replacing legacy fleets like the M113 to modernize the armored brigade combat team's logistical backbone.

Market Challenges

Supply chain risks and component obsolescence create a severe bottleneck for the Global Military Vehicle Sustainment Market, directly hampering the ability to maintain aging fleets. As defense forces strive to extend the service life of legacy platforms, the scarcity of out-of-production parts results in extended maintenance turnaround times. When essential components are no longer manufactured, providers must resort to costly reverse engineering or low-volume fabrication, preventing the market from efficiently meeting the demands of heightened conflict tempos. This operational friction leads to stalled contracts and reduced throughput for maintenance service providers, thereby limiting the revenue potential of the broader market.The fragility of these logistical networks is further exacerbated by a heavy reliance on foreign sources for raw materials, exposing the market to geopolitical volatility. According to the Aerospace Industries Association, in 2024, the defense sector faced a net import reliance of over 50 percent for 10 out of 12 critical minerals essential for manufacturing and sustaining defense systems. This dependency drives up material costs and introduces unpredictability into the acquisition process. Consequently, these compounding delays and financial burdens erode the purchasing power of defense budgets, restricting the overall growth potential of the sustainment market.

Market Trends

The adoption of AI-driven predictive maintenance models is fundamentally transforming sustainment strategies by shifting the focus from reactive repairs to proactive failure anticipation. Military organizations are embedding sensor-based algorithms into land platforms to analyze performance data in real-time, reducing unplanned downtime and optimizing spare parts supply chains.This technological pivot allows commanders to maintain higher fleet availability rates without expanding logistical footprints, addressing the inefficiencies of schedule-based servicing. A tangible indicator of this shift is the investment in algorithmic solutions; according to a September 2024 press release by PredictiveIQ, the company received a U.S. Army contract to demonstrate Generalized Physics Informed AI algorithms designed to enable prognostics for combat vehicles.

Simultaneously, the increasing reliance on Contractor Logistics Support (CLS) partnerships is redefining how armed forces manage the lifecycle of complex ground platforms. As vehicles become more technically intricate, defense departments are increasingly outsourcing Maintenance, Repair, and Overhaul (MRO) responsibilities to original equipment manufacturers to leverage their proprietary expertise and specialized supply networks. This strategy enhances fleet readiness by ensuring retrofits and repairs meet OEM-level precision, mitigating risks associated with internal technical gaps. Evidence of this trend includes General Dynamics Land Systems securing a $174.4 million contract in August 2024 for U.S. Army Stryker fleet retrofits, as reported by ExecutiveBiz, validating the growing dependency on private sector support.

Key Players Profiled in the Military Vehicle Sustainment Market

- Rheinmetall AG

- BAE Systesms

- Gneral Dynamics Corporation

- Elbit Systems Ltd.

- Oshkosh Corporation

- Lockheed Martin Corporation

- L3Harris Technologies Inc.

- Thales Group

- ManTech International Corporation

- Honeywell International Inc.

Report Scope

In this report, the Global Military Vehicle Sustainment Market has been segmented into the following categories:Military Vehicle Sustainment Market, by Vehicle Type:

- Armored Vehicles

- Military Trucks

Military Vehicle Sustainment Market, by Service:

- Maintenance

- Repair

- & Overhaul (MRO)

- Training and Support

- Parts and Components Supply

- Upgrades

- Modernization

Military Vehicle Sustainment Market, by End User:

- Army

- Navy

- Air Force

Military Vehicle Sustainment Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Military Vehicle Sustainment Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Military Vehicle Sustainment market report include:- Rheinmetall AG

- BAE Systesms

- Gneral Dynamics Corporation

- Elbit Systems Ltd.

- Oshkosh Corporation

- Lockheed Martin Corporation

- L3Harris Technologies Inc.

- Thales Group

- ManTech International Corporation

- Honeywell International Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

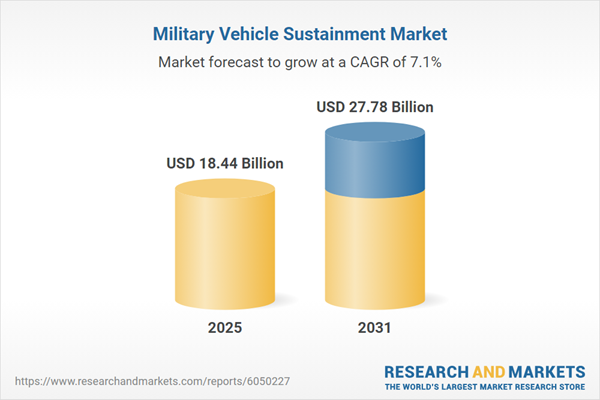

| Estimated Market Value ( USD | $ 18.44 Billion |

| Forecasted Market Value ( USD | $ 27.78 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |