Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

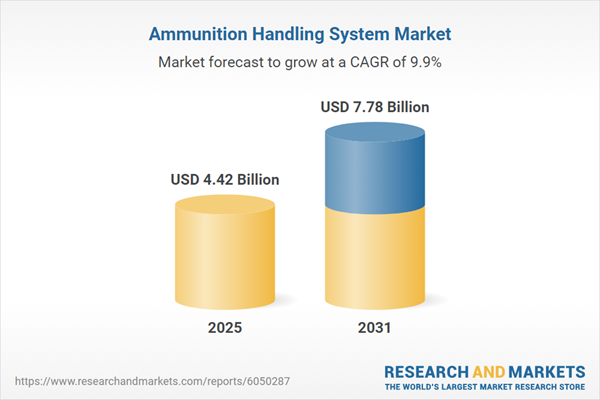

These systems are essential for maximizing operational effectiveness by ensuring precise ammunition management while greatly diminishing physical strain and danger to personnel. Growth is largely fueled by the rising need for rapid-fire capabilities during intense combat situations and the broad modernization of logistics to facilitate autonomous missions. Highlighting the strong economic backdrop supporting these procurements, the Aerospace Industries Association reported in 2024 that the United States aerospace and defense sector generated nearly $995 billion in total business activity.

One substantial hurdle impeding market growth is the technical complexity and considerable expense involved in retrofitting automated handling architectures onto legacy defense platforms. Integrating these sophisticated systems frequently necessitates extensive structural modifications and specialized engineering, which can result in potential budget overruns and prolonged project schedules. These challenges often discourage the adoption of such technologies in cost-conscious procurement programs, as the difficulty of upgrading older equipment can outweigh the immediate benefits.

Market Drivers

Rising geopolitical instability and regional security threats serve as the main drivers for the Global Ammunition Handling System Market, creating a critical need for expanded defense logistics capabilities. As nations encounter prolonged high-intensity conflicts, there is an urgent push to acquire platforms that ensure sustained firepower, directly boosting the demand for dependable ammunition management infrastructure. This climate of global insecurity has prompted historic rises in defense budgets, providing the necessary funds to acquire advanced loading mechanisms and upgrade existing inventories. According to the Stockholm International Peace Research Institute's April 2024 Fact Sheet on 2023 trends, global military spending increased by 6.8 percent in real terms to hit $2.44 trillion, signaling a prioritization of combat readiness that benefits subsystem suppliers.Simultaneously, the growing preference for robotic and automated ammunition loading systems is transforming procurement tactics to improve firing rates while reducing crew risks in dangerous zones. Modern naval and ground platforms are increasingly adopting autoloader technologies to ensure continuous engagement without the physical exhaustion linked to manual loading.

This technological transition is reflected in the financial results of leading defense firms; for instance, Rheinmetall’s March 2024 Annual Report noted that sales in its Vehicle Systems division, which produces platforms with integrated handling systems, grew by roughly 15 percent to €2.6 billion. Furthermore, the massive quantity of ordnance needed for these modern systems maintains market momentum, evidenced by the U.S. Department of Defense's 2024 President’s Budget Request for Fiscal Year 2025, which designated $29.8 billion specifically for munitions development and procurement.

Market Challenges

The expansion of the Global Ammunition Handling System Market is significantly hindered by the high costs and technical difficulties involved in retrofitting automated handling architectures onto older defense platforms. Incorporating these mechanisms necessitates extensive structural changes and specialized engineering, which often lead to exceeded budgets and delayed project completion. These integration obstacles deter the selection of automated solutions within cost-conscious procurement initiatives, as military operators frequently value immediate operational availability over complicated upgrades. As a result, the market experiences lower demand from countries possessing large inventories of aging equipment, where the expense of modernization exceeds the likely operational advantages.Despite the broader backdrop of increasing defense budgets, this financial friction acts as a persistent barrier. Data from the Stockholm International Peace Research Institute in 2024 indicates that total global military spending reached a record $2.44 trillion in 2023. However, even with this peak in spending, the strict allocation procedures common in defense budgeting often work against expensive retrofit projects. When confronted with the prohibitive costs of re-engineering legacy platforms to support modern handling systems, procurement officials often choose to allocate funds toward acquiring new platforms or addressing other logistical needs, thereby directly restricting the potential market for these handling technologies.

Market Trends

The market is being fundamentally transformed by the adoption of robotic and autonomous loading technologies, which remove the need for manual handling during ammunition transfer, thereby boosting sustained firing rates and improving crew safety. Contemporary armored vehicle and artillery systems are increasingly employing fully automated magazines and resupply vehicles that load ordnance directly into the weapon's breech without exposing personnel to dangerous combat environments. This trend is clearly demonstrated by the rising demand for self-propelled howitzers coupled with specialized robotic ammunition carriers, facilitating continuous operations in intense conflicts. For example, Defence Blog reported in February 2025 that Hanwha Aerospace reached a record annual sales figure of 11.24 trillion won in 2024, a success largely driven by strong global exports of its K9 howitzers and automated K10 ammunition resupply vehicles.A parallel transition from hydraulic to all-electric actuation mechanisms is rapidly rendering legacy fluid-based handling architectures obsolete. Manufacturers are now favoring electromechanical drives because they offer better precision, reduced weight, and lower maintenance needs compared to hydraulic systems, which are prone to leaks and present significant fire hazards. This move toward electrification corresponds with the wider trend of developing more electric vehicles and ships, where system reliability and power efficiency are critical for managing heavy munitions. As noted by Curtiss-Wright Corporation in its February 2025 financial results, the Naval and Power segment, a supplier of advanced electromechanical ammunition handling systems, recorded total net sales of $1.27 billion for 2024, highlighting the increasing procurement of modernized naval defense platforms.

Key Players Profiled in the Ammunition Handling System Market

- Meggitt PLC

- General Dynamics Corporation

- Nobles Worldwide, Inc.

- McNally Industries, LLC

- Curtiss-Wright Corporation

- Standard Armament Inc.

- Moog Inc.

- BAE Systems PLC

- Thales Group

- Calzoni S.r.l.

Report Scope

In this report, the Global Ammunition Handling System Market has been segmented into the following categories:Ammunition Handling System Market, by Platform:

- Land

- Naval

- Airborne

Ammunition Handling System Market, by Component:

- Loading Systems

- Drive Assembly

- Ammunition Storage Units

- Auxiliary Power Units

- Others

Ammunition Handling System Market, by Mode of Operation:

- Automatic

- Semi-automatic

Ammunition Handling System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ammunition Handling System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Ammunition Handling System market report include:- Meggitt PLC

- General Dynamics Corporation

- Nobles Worldwide, Inc.

- McNally Industries, LLC

- Curtiss-Wright Corporation

- Standard Armament Inc.

- Moog Inc.

- BAE Systems PLC

- Thales Group

- Calzoni S.r.l.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.42 Billion |

| Forecasted Market Value ( USD | $ 7.78 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |