Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Global Sodium Methyl Paraben Market has experienced consistent growth driven by its widespread application as a preservative in various industries, notably in cosmetics, pharmaceuticals, food and beverages. Sodium methyl paraben, a derivative of para-hydroxybenzoic acid, is primarily used for its antimicrobial properties, helping to extend the shelf life of products by preventing the growth of bacteria, mold, and yeast. The market is characterized by rising demand in the personal care industry, where it is incorporated in products such as creams, lotions, shampoos, and deodorants. As consumers increasingly demand safer and more effective preservatives, the need for sodium methyl paraben remains high, particularly due to its stability and efficiency compared to other preservatives.

The pharmaceutical sector also contributes to the market's growth, as sodium methyl paraben is utilized in the formulation of ointments, injections, and oral medicines. Furthermore, its use in food and beverages, although less common than in other sectors, is driven by the growing demand for preservatives that extend product freshness without compromising safety. Increasing consumer awareness and the shift toward natural ingredients, however, have led to some scrutiny over parabens, with some preferring alternatives.

Despite this, sodium methyl paraben continues to dominate due to its effectiveness, low cost, and regulatory acceptance in many markets. Geographically, the market is expanding across regions such as North America, Europe, and Asia-Pacific, where regulatory standards are more aligned, encouraging market penetration. The rise of sustainable and green chemistry initiatives is expected to influence the market's trajectory, driving further innovations in preservative formulations. Overall, the Global Sodium Methyl Paraben Market remains an essential component in the preservation and stabilization of various consumer products.

Key Market Drivers

Growing Demand in Personal Care Products

The increasing demand for personal care products, especially in emerging markets, has significantly boosted the global sodium methyl paraben market. As consumers place a higher priority on hygiene and beauty, the demand for cosmetics and skincare items continues to rise. This surge in demand is particularly notable in regions like Asia-Pacific, where the middle-class population is growing and there is a heightened focus on personal grooming. Sodium methyl paraben is a preferred preservative in the personal care industry due to its broad spectrum antimicrobial activity, which helps to prevent the growth of bacteria, mold, and yeast.These properties extend the shelf life of products, ensuring that they remain safe and effective for longer periods. Health, Residential, and Personal Care Services encompass expenditures for medical services typically provided in non-traditional settings, such as schools, community centers, workplaces, as well as by ambulance services and residential mental health and substance abuse facilities. Spending in this category increased by 9.7% in 2022, reaching $246.5 billion, a rise from the 6.7% growth in 2021. The accelerated growth in 2022 was mainly attributed to a significant rise in spending for Medicaid home and community-based waivers.

Additionally, it is compatible with a wide range of pH levels and formulations, making it suitable for inclusion in diverse beauty products, such as moisturizers, shampoos, deodorants, and makeup. With consumer preferences shifting towards longer-lasting and safe products, sodium methyl paraben provides an ideal solution for maintaining the stability of these formulations.

Moreover, consumers are increasingly cautious about the ingredients in their personal care items, seeking those that balance safety and effectiveness. As a result, sodium methyl paraben, which is generally considered a safe and non-toxic preservative when used in recommended concentrations, has gained trust in the personal care market. Its ability to enhance product longevity without compromising the quality of the formulation has made it a key ingredient in cosmetic and skincare formulations. As global beauty standards evolve and consumer purchasing power rises, the demand for sodium methyl paraben as an essential preservative in personal care products is expected to continue its upward trajectory.

Rising Demand for Shelf-Life Extension in Pharmaceuticals

The pharmaceutical industry is one of the key drivers of the global sodium methyl paraben market. With an expanding global population and increasing healthcare needs, the demand for medicines is at an all-time high, leading to the need for effective preservation solutions. Sodium methyl paraben is used in the preservation of pharmaceutical formulations such as syrups, ointments, creams, and injections. The primary role of sodium methyl paraben in pharmaceuticals is to prevent microbial contamination, ensuring that products remain safe and effective throughout their shelf life.Pharmaceutical products are often subjected to stringent regulatory standards regarding preservation, and sodium methyl paraben meets these standards by offering reliable, low-cost preservation without compromising the integrity of the active ingredients. According to IBEF data, India boasts the largest number of USFDA-compliant pharmaceutical plants outside the United States and more than 2,000 WHO-GMP certified facilities. These facilities cater to demand from over 150 countries globally, with a total of more than 10,500 manufacturing sites.

Additionally, as new drugs are developed and new formulations are introduced, the pharmaceutical industry continues to explore ways to extend the shelf life of medications while minimizing the risk of contamination. Sodium methyl paraben, with its broad antimicrobial spectrum and compatibility with various formulations, becomes an ideal preservative in such applications. Furthermore, as global health awareness increases, more consumers are opting for over-the-counter pharmaceutical products, which are often preserved with sodium methyl paraben to ensure their longevity and efficacy. The regulatory approval and acceptance of sodium methyl paraben as a safe preservative in pharmaceutical products further contribute to its growing use.

According to EFPIA 2023 data, emerging economies such as Brazil, China, and India have experienced rapid growth in both market and research activities. This has contributed to a gradual shift of economic and research operations from Europe to these high-growth markets. Between 2017 and 2022, the Brazilian, Chinese, and Indian markets expanded by 13.0%, 5.3%, and 11.0%, respectively, compared to an average market growth of 6.6% in the top five European Union markets and 7.1% in the United States. Also, in regions with high pharmaceutical manufacturing activity, such as North America and Europe, sodium methyl paraben has become a go-to solution for enhancing the safety and stability of medications. This demand is expected to rise as the pharmaceutical industry continues to innovate and expand its offerings to meet the growing health needs worldwide.

Increase in Consumer Awareness for Safe Preservatives

The rise of consumer awareness regarding the ingredients in personal care products, food, and pharmaceuticals has played a significant role in boosting the demand for sodium methyl paraben. Consumers are increasingly becoming educated about the potential harmful effects of certain chemicals, such as parabens, in their daily products. However, sodium methyl paraben, often regarded as a safer alternative to other forms of parabens, has gained popularity due to its lower toxicity and reduced risk of skin irritation. The heightened awareness of consumer safety has driven manufacturers to seek preservatives that are not only effective but also recognized as safe.Sodium methyl paraben fits into this growing trend, as it is commonly used in lower concentrations and has a long history of safe usage in cosmetics and pharmaceutical products. This safety profile has made it an appealing choice for manufacturers who aim to align with the increasing consumer demand for gentle and non-irritating preservatives. Furthermore, the growing movement towards clean and natural beauty products has placed added pressure on companies to disclose their ingredient lists and avoid potentially harmful chemicals. As such, sodium methyl paraben’s positive reputation as a mild preservative has helped it gain a stronger foothold in the market. The consumer push for safe ingredients has also led to the development of new formulations that incorporate sodium methyl paraben, alongside other skin-friendly ingredients, to create effective yet safe products. As the consumer preference for transparency and safety continues to grow, sodium methyl paraben is expected to maintain its position as a trusted preservative, making it a key player in the market for personal care, food, and pharmaceutical products.

Key Market Challenges

Rising Demand for Natural and Organic Alternatives

One of the most significant challenges for the Global Sodium Methyl Paraben Market is the rising demand for natural and organic alternatives. As consumers become more health-conscious and environmentally aware, the shift towards organic, paraben-free, and sustainably sourced products has intensified. Natural preservatives such as essential oils, vitamin E, and other plant-derived ingredients are increasingly preferred over synthetic chemicals like sodium methyl paraben. This trend is especially strong in the cosmetic and personal care industries, where consumers are looking for products that align with their wellness and eco-conscious values.The growing popularity of natural and organic beauty and skincare products has led to an increased adoption of labels such as "paraben-free" and "chemical-free," creating pressure for manufacturers to reformulate products. This shift has significant implications for the sodium methyl paraben market, as traditional preservative suppliers face dwindling demand.

Moreover, the cost of sourcing natural preservatives and formulating products with them can be higher compared to using synthetics, which places additional financial strain on companies. For businesses that rely heavily on sodium methyl paraben as a preservative, this trend poses a threat to profitability. Additionally, the competition from newer and more innovative preservation methods such as microbial inhibition and fermentation-derived ingredients only adds to the pressure. The rise of the clean beauty movement has accelerated the shift toward natural alternatives, forcing the sodium methyl paraben market to reassess its product offerings and invest in research to develop safer and more consumer-friendly preservatives.

Market Volatility and Price Fluctuations

The Global Sodium Methyl Paraben Market is also susceptible to market volatility and price fluctuations, which can affect both supply and demand dynamics. The primary raw materials used in the production of sodium methyl paraben, such as methanol and p-hydroxybenzoic acid, are sourced from petrochemical industries. These materials are subject to fluctuations in global oil prices and supply chain disruptions, which can result in increased production costs. Additionally, geopolitical instability, natural disasters, and pandemics can lead to supply shortages, further driving up prices and impacting the cost structure for manufacturers.These market uncertainties make it difficult for businesses to maintain stable pricing models and predict future profitability. Fluctuations in raw material prices also directly affect the cost of the end product, which can influence consumer behavior. In times of economic uncertainty, businesses may reduce the use of non-essential ingredients, including preservatives like sodium methyl paraben, to reduce costs.

Furthermore, competition from substitute preservatives or the emergence of new technologies in food and cosmetic preservation can also cause shifts in demand, contributing to further market instability. In response, sodium methyl paraben manufacturers may be forced to invest in alternative sourcing strategies or adjust their pricing models to remain competitive. However, such adaptations require substantial financial investment, adding to the challenges faced by companies operating in this sector.

Key Market Trends

Emerging Demand from the Food and Beverage Sector

While sodium methyl paraben has been more commonly used in cosmetics and pharmaceuticals, its use in the food and beverage industry is emerging as a key growth driver. As the global population grows, especially in urban areas, the demand for processed, packaged, and ready-to-eat food products has surged. These products require preservatives that can help extend their shelf life while maintaining safety and taste. According to the Global Organic Trade Guide, the market for organic packaged food and beverages in the United Arab Emirates grew by 5.8% in 2021, reaching a value of USD 32.6 million.Sodium methyl paraben, with its effective antimicrobial properties, is increasingly being used in food and beverage applications to prevent microbial contamination and spoilage. This is particularly important in products such as sauces, jams, jellies, and salad dressings, where a longer shelf life is desired. Sodium methyl paraben provides a safe and cost-effective preservation option compared to other preservatives, which is a major advantage in the competitive food industry. As food manufacturers continue to focus on providing consumers with high-quality products that are safe, fresh, and long-lasting, sodium methyl paraben presents an appealing option due to its efficiency at lower concentrations.

Additionally, as global trade and distribution networks expand, ensuring the stability of food products during transport and storage becomes more critical. Sodium methyl paraben helps to address these concerns, further driving its adoption in the food and beverage sector. Although its use in food is still regulated and subject to limits in various countries, the growing demand for convenient, ready-to-eat meals and snacks is likely to spur the use of sodium methyl paraben as a trusted preservative. As food safety concerns continue to rise, sodium methyl paraben's ability to prevent contamination and ensure product quality will make it an essential preservative in this sector.

Shift Toward Sustainable and Green Chemistry

The trend toward sustainability and green chemistry is reshaping various industries, including the preservatives market, and this is benefiting the global sodium methyl paraben market. As the demand for eco-friendly and sustainable products grows, consumers and manufacturers alike are seeking alternatives to traditional synthetic chemicals that may have harmful environmental impacts. Sodium methyl paraben, derived from para-hydroxybenzoic acid, offers a more sustainable option compared to other preservatives that may have a higher environmental footprint.Unlike some synthetic preservatives, sodium methyl paraben is biodegradable and does not persist in the environment, which aligns with the increasing emphasis on sustainability in manufacturing processes. Furthermore, its relatively low toxicity means it has less impact on ecosystems and wildlife when disposed of, making it a safer choice for both consumers and the planet. Manufacturers are responding to this shift by incorporating preservatives like sodium methyl paraben into their formulations, as it offers both environmental and functional benefits.

Green chemistry principles emphasize the development of chemicals and processes that are not only safer for human health but also have a minimal environmental impact. By utilizing sodium methyl paraben, companies are able to meet consumer demand for more sustainable and green products without compromising on the performance and shelf-life stability of their goods. As sustainability becomes a central theme in production across various industries, sodium methyl paraben’s eco-friendly characteristics position it as a key player in the future of preservative solutions, especially within the personal care, food, and pharmaceutical industries.

Segmental Insights

Type Insights

Based on the Type, Pharma Grade segment was dominating the Global Sodium Methyl Paraben Market. This is primarily driven by its widespread use in pharmaceutical applications, where the highest standards of product safety and stability are required. Sodium methyl paraben, with its effective antimicrobial properties, is widely used in the formulation of pharmaceutical products such as oral medicines, injectable drugs, and topical creams. In the pharmaceutical industry, preservatives are essential to maintain the safety, potency, and shelf life of medications, particularly in products that need to be stored for extended periods.Pharma-grade sodium methyl paraben is subject to stringent regulatory standards, ensuring that it meets the required purity and safety criteria. This level of quality control makes it a preferred choice in the highly regulated pharmaceutical industry. Additionally, as the global pharmaceutical industry continues to expand, particularly in developing markets, the demand for high-quality preservatives like pharma-grade sodium methyl paraben is expected to grow significantly. Furthermore, the increasing prevalence of chronic diseases, the aging population, and the growing need for over-the-counter medications contribute to the expansion of the pharma-grade segment. While sodium methyl paraben is also used in food and cosmetics, the strict regulatory requirements and the higher demand for preservatives in the pharmaceutical industry ensure that the pharma-grade segment remains the dominant force in the sodium methyl paraben market.

Regional Insights

Asia Pacific region was the most dominating region in the Global Sodium Methyl Paraben Market. This is driven by rapid industrialization, a growing population, and the expanding demand for consumer goods, particularly in the food and beverage, cosmetics, and pharmaceutical sectors. Countries like China, India, and Japan are key contributors to the market’s growth, with significant demand for preservatives in various industries.The rising disposable income in these regions has led to increased consumption of packaged foods, personal care products, and pharmaceuticals, all of which utilize sodium methyl paraben as an effective preservative. In particular, India and China’s large and diverse consumer bases drive the demand for sodium methyl paraben in the food and beverage industry, where the need for longer shelf life and protection from contamination is paramount. Similarly, the rapidly expanding pharmaceutical and cosmetic industries in Asia Pacific further bolster the demand for preservatives in formulations. Moreover, Asia Pacific has become a manufacturing hub for many global pharmaceutical and cosmetic companies, resulting in a heightened demand for raw materials such as sodium methyl paraben. The region’s lenient regulatory environment, compared to Western markets, also facilitates the continued use of sodium methyl paraben in various applications.

Key Market Players

- Shanghai Bichain Industrial Chemical.

- Hefei TNJ Chemical Industry Co.,Ltd

- Ueno Fine Chemicals Industry,Ltd.

- Qzuhou Ebright Chemicals Co.,Ltd

- NBS Biologicals Ltd.

- Alta Laboratories Ltd

- Sharon Group

Report Scope:

In this report, the Global Sodium Methyl Paraben Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Sodium Methyl Paraben Market, By End-Use Industry:

- Chemical & Petrochemical

- Oil & Gas

- Energy & Power

- Automotive

- Food & Beverages

- Healthcare

- Others

Sodium Methyl Paraben Market, By Type:

- Food Grade

- Cosmetic Grade

- Pharma Grade

- Others

Sodium Methyl Paraben Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sodium Methyl Paraben Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Shanghai Bichain Industrial Chemical.

- Hefei TNJ Chemical Industry Co.,Ltd

- Ueno Fine Chemicals Industry,Ltd.

- Qzuhou Ebright Chemicals Co.,Ltd

- NBS Biologicals Ltd.

- Alta Laboratories Ltd

- Sharon Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2025 |

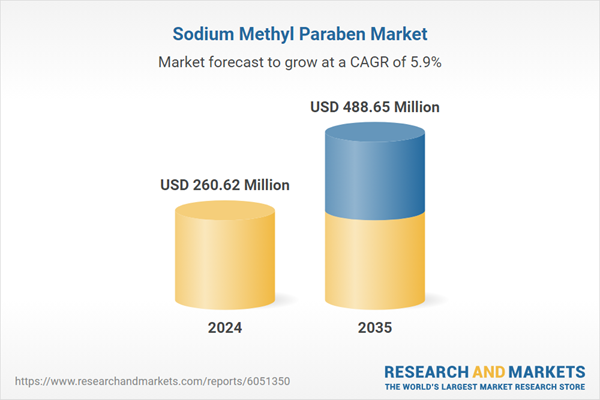

| Forecast Period | 2024 - 2035 |

| Estimated Market Value ( USD | $ 260.62 Million |

| Forecasted Market Value ( USD | $ 488.65 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |