The Asia-Pacific segment acquired 44% revenue share in the market in 2023. Countries such as China, Japan, South Korea, and India are leading contributors to this growth, with significant investments in automotive production, consumer electronics, and metal processing industries. China, in particular, dominates the fiber laser market due to its large-scale industrial base, strong presence of fiber laser manufacturers, and government support for advanced manufacturing technologies.

High precision and accuracy have become critical requirements across multiple industries in the modern manufacturing era. The increasing need for miniaturization, intricate designs, and complex geometries has driven manufacturers to seek advanced laser technologies that offer unparalleled precision and efficiency. Fiber lasers have become the preferred option for high-precision manufacturing owing to their exceptional beam quality, stability, and precise control, which allow manufacturers to attain intricate detailing while minimizing material waste. Hence, as industries continue to advance toward high-precision and high-efficiency manufacturing, the fiber laser market is poised for rapid expansion.

Additionally, Advancements in fiber laser technology have significantly enhanced efficiency, reliability, and precision in industrial applications. The introduction of ultrafast fiber lasers, which operate in femtosecond or picosecond pulses, has revolutionized micro-machining, semiconductor fabrication, and biomedical research. Meanwhile, high-power fiber lasers have enabled faster and more efficient cutting, welding, and deep material penetration, making them ideal for automotive, aerospace, and heavy manufacturing industries. Thus, as laser technology advances, the fiber laser market is poised for unprecedented growth.

However, Fiber laser systems require a substantial upfront investment, including the laser source and auxiliary components such as cooling systems, beam delivery mechanisms, and automation integration. This makes fiber lasers a relatively expensive option compared to traditional laser technologies. As a result, many businesses, particularly small and medium-sized enterprises (SMEs), struggle to justify the high capital expenditure required to adopt this advanced laser technology. Hence, the high upfront cost will continue to be a major growth inhibitor for the fiber laser market.

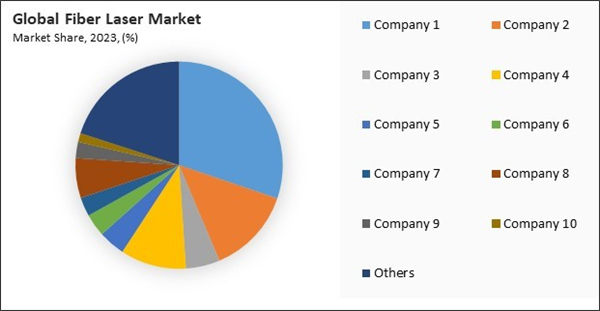

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Rising Demand For High-Precision Manufacturing

- Advancements In Laser Technology

- Rapid Expansion Of The Automotive Industry

- Requirement Of High Initial Cost

- Complex Maintenance And Repair Costs

- Rising Demand For Cost-Effectiveness And Low Maintenance Products

- Growth Of Additive Manufacturing (3D Printing)

- Prevalent Technological Limitations

- Competition From Alternative Technologies

Power Output Outlook

On the basis of power output, the market is divided into low power (up to 100W), medium power (100W-2kW), and high power (above 2kW). The medium power (100W-2kW) segment recorded 43% revenue share in the market in 2023. The segment is growing due to its versatility in sheet metal cutting, precision welding, and laser marking applications. These lasers balance power efficiency and affordability, making them popular in electronics, medical devices, and small-scale industrial manufacturing.Application Outlook

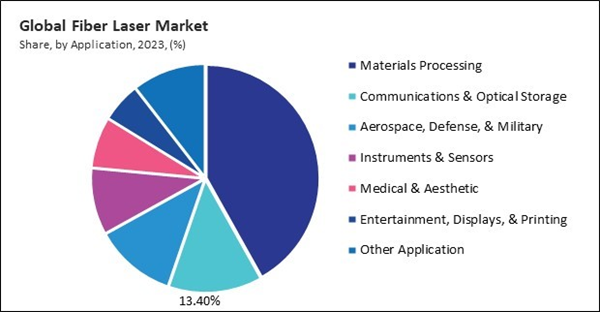

By application, the market is segmented into medical & aesthetic, instruments & sensors, aerospace, defense, & military, materials processing, communications & optical storage, entertainment, displays, & printing, and others. The communications & optical storage segment garnered 13% revenue share in the market in 2023. Fiber lasers are crucial for contemporary telecommunications, broadband networks, and cloud computing infrastructure because they are involved in optical signal amplification, wavelength conversion, and fiber-optic data transmission.Type Outlook

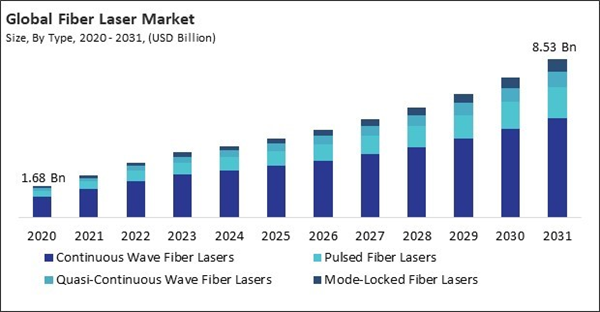

Based on type, the market is classified into continuous wave fiber lasers, pulsed fiber lasers, quasi-continuous wave fiber lasers, and mode-locked fiber lasers. The pulsed fiber lasers segment procured 19% revenue share in the market in 2023. Pulsed fiber lasers operate in short bursts of energy, making them suitable for fine and precise material processing without excessive heat buildup. These lasers are widely utilized in industries such as electronics, semiconductor manufacturing, and medical devices, where precision is crucial.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America segment recorded 27% revenue share in the market in 2023. The region is home to leading fiber laser manufacturers and research institutions, which continuously drive innovation in laser technology. The U.S. defense sector has invested heavily in laser-based weaponry, anti-drone systems, and advanced surveillance technologies, further propelling fiber laser demand.Recent Strategies Deployed in the Market

- Nov-2024: IPG Photonics Corporation unveiled advanced dual-beam fiber lasers for additive manufacturing, offering independent core and ring beam control for enhanced precision and efficiency. The YLR-AMB series delivers faster build rates, optimized heat distribution, and versatile processing. These lasers redefine productivity in aerospace, medical, and tooling applications.

- Oct-2024: Coherent Corp. unveiled the EDGE FL high-power fiber laser series, designed for machine tool cutting applications. With power options from 1.5 kW to 20 kW, the series offers industry-leading performance, energy efficiency, and superior beam quality at an affordable price. It also includes integrated cutting packages for added value.

- Sep-2024: TRUMPF SE + Co. KG unveiled the TruMatic 5000 to North America, featuring automated laser cutting, punching, and forming. The new SheetMaster enables fully automated material flow, enhancing efficiency. Equipped with a 6kW fiber laser and Delta Drive, it boosts productivity while reducing energy use.

- Nov-2023: IPG Photonics Corporation teamed up with Miller Electric Mfg. to advance handheld laser welding technology, combining IPG’s fiber laser expertise with Miller’s welding industry knowledge. This collaboration aims to enhance precision, speed, and ease of use, delivering innovative, reliable solutions for welders.

- Jun-2022: TRUMPF SE + Co. KG unveiled the TruFiber 2000 P, a 2kW fiber laser for cutting, welding, and additive manufacturing. Featuring Automatic Laser Power Control for stability and TruControl for managing 1,000 programs, it ensures easy integration across industries like e-mobility and medical tech, offering high flexibility, efficiency, and long-term reliability.

List of Key Companies Profiled

- IPG Photonics Corporation

- TRUMPF SE + Co. KG

- Furukawa Electric Co., Ltd.

- Coherent Corp.

- FANUC Corporation

- Fujikura Ltd.

- Lumentum Holdings, Inc.

- Jenoptik AG

- Epilog Laser Corporation

- Amonics Ltd.

Market Report Segmentation

By Type- Continuous Wave Fiber Lasers

- Pulsed Fiber Lasers

- Quasi-Continuous Wave Fiber Lasers

- Mode-Locked Fiber Lasers

- High Power (Above 2kW)

- Medium Power (100W-2kW)

- Low Power (Up to 100W)

- Materials Processing

- Communications & Optical Storage

- Aerospace, Defense, & Military

- Instruments & Sensors

- Medical & Aesthetic

- Entertainment, Displays, & Printing

- Other Application

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- IPG Photonics Corporation

- TRUMPF SE + Co. KG

- Furukawa Electric Co., Ltd.

- Coherent Corp.

- FANUC Corporation

- Fujikura Ltd.

- Lumentum Holdings, Inc.

- Jenoptik AG

- Epilog Laser Corporation

- Amonics Ltd.