The North America region witnessed 36% revenue share in the market in 2023. The region’s leadership can be attributed to the rapid adoption of smart grid technologies, increasing investment in renewable energy integration, and the presence of major technology providers. The U.S. and Canada have been at the forefront of digital transformation in the energy sector, leveraging advanced ANM solutions to optimize grid efficiency, reduce operational costs, and enhance power reliability.

Smart grid technology transforms energy systems by allowing for real-time monitoring, advanced analytics, and automated decision-making. These capabilities make the grid more efficient, reliable, and capable of integrating renewable energy sources. For utilities, transitioning to a smart grid enables better demand-side management and more efficient energy distribution. Active network management systems work with smart grids to offer enhanced load balancing, fault detection, and improved outage management, driving the adoption of ANM systems. Therefore, the increasing adoption of smart grid technology drives the market's growth.

Additionally, the growing shift towards renewable energy sources like solar, wind, and hydropower is reshaping the global energy landscape. These energy sources are intermittent, meaning their output varies depending on weather conditions, which can cause grid instability. Active network management systems help address this challenge by enabling real-time adjustments to energy flows, balancing supply and demand, and incorporating storage systems that can store excess energy for later use. In conclusion, the rising integration of renewable energy sources drives the market's growth.

However, One of the major barriers to the widespread adoption of ANM systems is the high initial investment required. Utilities must upgrade their existing infrastructure to accommodate ANM systems, which often involves significant capital expenditure. This includes the costs of installing new sensors, smart meters, communication networks, and advanced software platforms. For many utilities, especially those in developing regions or with limited budgets, these upfront costs can be prohibitive. Hence, high initial investment costs and infrastructure upgrade expenses impede the market's growth.

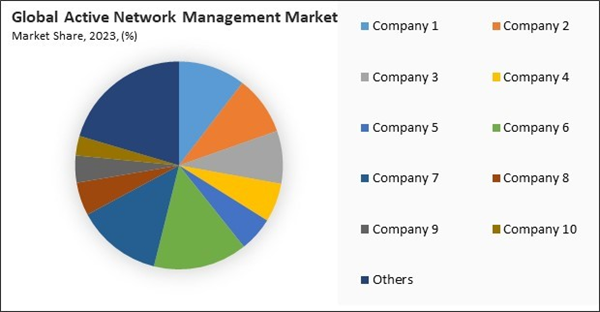

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increasing Adoption Of Smart Grid Technology

- Rising Integration Of Renewable Energy Sources

- Growing Investments In Modernizing Power Infrastructure

Restraints

- High Initial Investment Costs And Infrastructure Upgrade Expenses

- Cybersecurity Risks And Data Privacy Concerns

Opportunities

- Growing Demand For Electric Vehicles (Evs)

- Expansion Of Smart Cities And Urbanization Worldwide

Challenges

- Data Overload And Management Complexities With Real-Time Grid Monitoring

- Integration Challenges With Existing Legacy Systems

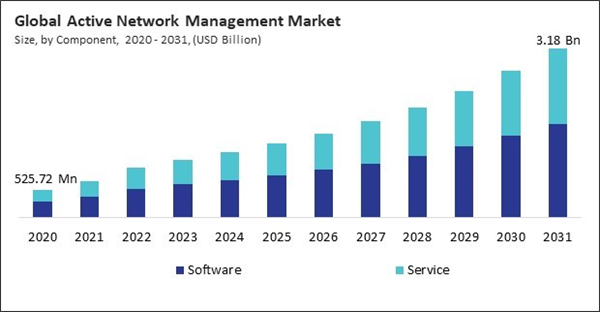

Component Outlook

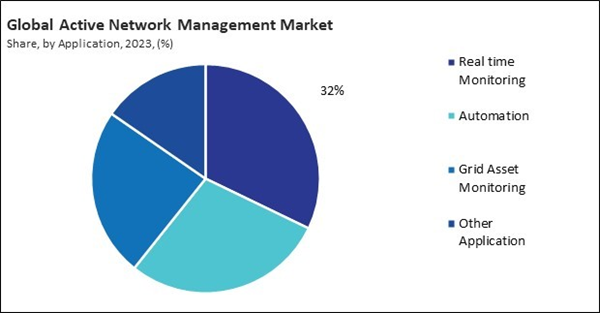

Based on component, the market is divided into software and service. The service segment held 42% revenue share in the market in 2023. As enterprises and utility providers embrace digital transformation, the demand for consulting, implementation, and maintenance services has increased. These services are essential for successfully deploying and operating active network management systems, ensuring optimal performance and compliance with evolving energy regulations.Application Outlook

By application, the market is divided into grid asset monitoring, real-time monitoring, and automation. In 2023, the grid asset monitoring segment registered 24% revenue share in the market. The increasing complexity of power grids and the integration of renewable energy sources have heightened the need for efficient asset monitoring solutions. Grid asset monitoring enables utilities to track the performance of transformers, substations, and power lines in real-time, helping to minimize downtime and optimize maintenance schedules.Enterprise Size Outlook

On the basis of enterprise size, the market is segmented into SMEs and large enterprises. In 2023, the SMEs segment attained 30% revenue share in the market. With increasing digitization and adopting cloud-based solutions, SMEs are gradually integrating active network management to enhance their operational efficiency and reduce energy costs. The growing availability of cost-effective, scalable network management solutions tailored for SMEs has contributed to the segment’s growth.Industries Outlook

Based on industries, the market is categorized into transportation, energy & utilities, government, and others. The transportation segment witnessed 28% revenue share in the market in 2023. The need for improved traffic management, real-time monitoring, and optimized energy consumption in smart transportation systems drives the adoption of active network management solutions in transportation.Regional Outlook

Recent Strategies Deployed in the Market

- Aug-2024: ABB Ltd. launched ADAM, a cloud-based power distribution management solution, in Vietnam, enhancing grid stability and operational efficiency. The platform integrates with the SSC600 to provide predictive fault analysis, supporting the country's energy modernization and renewable integration goals.

- Jul-2024: Cisco Systems, Inc. and Optus expanded their partnership to enhance network security for businesses with hybrid workforces. The collaboration introduces secure managed services, including firewalls, Secure Service Edge, and 24/7 monitoring, leveraging Cisco’s technology to simplify complex security challenges and optimize network performance.

- May-2024: ABB Ltd. (ABB Canada) came into partnership with Powrmatic Canada to provide smart electrical distribution solutions, including energy-efficient products for residential and commercial buildings, enhancing energy distribution, efficiency, and grid reliability through advanced electrification technologies, supporting Active Network Management.

- Feb-2024: General Electric Company launched GridOS® Data Fabric, a grid-specific data management software, to help utilities orchestrate smarter, more resilient energy grids. Collaborating with Itron, it integrates decentralized data for better real-time decisions, aiding electrification and grid modernization.

- Feb-2023: Schneider Electric, Capgemini, and Qualcomm have partnered to create a 5G-enabled automated hoisting solution for industrial sites. This collaboration aims to replace wired connections, simplify network complexity, and enhance productivity and safety with low latency 5G private networks.

List of Key Companies Profiled

- ABB Ltd.

- Cisco Systems, Inc.

- General Electric Company

- IBM Corporation

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

- Hitachi, Ltd. (Hitachi Energy Ltd.)

- Itron, Inc.

- KELVATEK LTD.

Market Report Segmentation

By Component

- Software

- Service

By Application

- Real time Monitoring

- Automation

- Grid Asset Monitoring

- Other Application

By Enterprise Size

- Large Enterprises

- SMEs

By Industries

- Energy & Utility

- Transportation

- Government

- Other Industries

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ABB Ltd.

- Cisco Systems, Inc.

- General Electric Company

- IBM Corporation

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

- Hitachi, Ltd. (Hitachi Energy Ltd.)

- Itron, Inc.

- KELVATEK LTD.