Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Disposable Incomes and Economic Development

One of the most prominent drivers of growth in the Asia Pacific Life and Annuity Insurance market is the rising disposable income levels in many countries within the region. The growing economic development, particularly in emerging markets such as China, India, and Southeast Asia, has contributed to an expanding middle class. As household incomes increase, individuals have more discretionary income to invest in financial security products like life and annuity insurance. According to the study, the Chinese life insurance industry is projected to grow at a compound annual growth rate (CAGR) of 9% from 2024 to 2028, with direct written premiums (DWP) anticipated to rise from USD 597.1 billion in 2024. This growth is driven by key factors such as an aging population, increasing disposable incomes, and heightened awareness of financial security and retirement planning among consumers.Key Market Challenges

Low Insurance Penetration in Emerging Markets

While the Asia Pacific region is home to some of the fastest-growing economies, insurance penetration remains relatively low in many emerging markets. Countries such as India, Indonesia, and the Philippines have a significant portion of their populations uninsured, despite increasing awareness of the need for financial protection. A large number of individuals in these markets still rely on traditional savings methods or family support systems instead of insurance products.The lack of financial literacy and understanding of life and annuity insurance is a critical barrier. Many consumers in these regions may not fully understand the benefits of life insurance or annuities, especially in rural areas where access to information and education is limited. Furthermore, some insurance products may appear too complex or too expensive, deterring potential customers from investing in them.

Key Market Trends

Rising Demand for Retirement and Income Protection Products

As the Asia Pacific region's populations age, the demand for retirement and income protection products such as life insurance and annuities is increasing. Many countries in the region, including Japan, South Korea, and China, are facing demographic shifts where the proportion of elderly individuals is growing rapidly. This trend has led to an increasing focus on financial products that provide security in retirement, especially as public pension systems struggle to keep up with the rising number of retirees.Key Market Players

- AIA Group Limited

- Nippon Life Insurance Company

- Aviva Ltd.

- Life Insurance Corporation of India (LIC)

- Muang Thai Life Assurance Public Company Limited

- AMP Limited

- Hong Leong Assurance Berhad

- China Life Insurance (Overseas) Company Limited

- Ping An Insurance (Group) Company of China, Ltd

- HDFC Life Insurance Company Limited

Report Scope:

In this report, the Asia Pacific Life and Annuity Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Life and Annuity Insurance Market, By Insurance Type:

- Individual Insurance

- Annuity Insurance

- Endowment Insurance

- Juvenile Insurance

- Whole Life Insurance

- Medical Insurance

- Other

Asia Pacific Life and Annuity Insurance Market, By Distribution Channel:

- Direct

- Banks

- Agents

- Others

Asia Pacific Life and Annuity Insurance Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Singapore

- Vietnam

- Malaysia

- Thailand

- Rest of Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Life and Annuity Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AIA Group Limited

- Nippon Life Insurance Company

- Aviva Ltd.

- Life Insurance Corporation of India (LIC)

- Muang Thai Life Assurance Public Company Limited

- AMP Limited

- Hong Leong Assurance Berhad

- China Life Insurance (Overseas) Company Limited

- Ping An Insurance (Group) Company of China, Ltd

- HDFC Life Insurance Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | February 2025 |

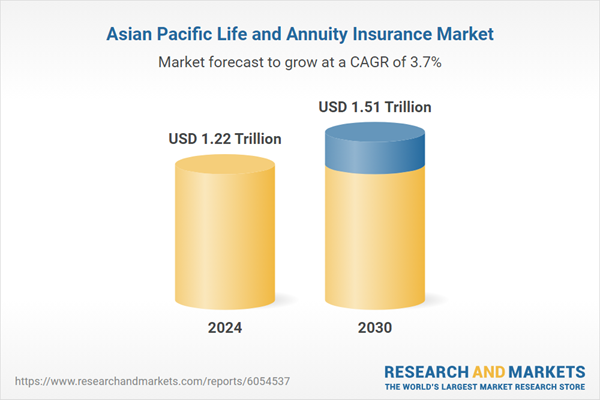

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.22 Trillion |

| Forecasted Market Value ( USD | $ 1.51 Trillion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |