Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Disposable Incomes and Urbanization

Vietnam's robust economic development over the past decade has significantly boosted consumer purchasing power, especially in urban areas. Vietnam's economy is projected to expand by 6% in 2024, followed by 6.5% growth in both 2025 and 2026, marking a 5% increase compared to the previous year. The country’s growing middle class is now more willing to spend on dining out and exploring diverse cuisines, making food service a fast-expanding sector. Rapid urbanization has also played a pivotal role, with more people moving into cities where access to a wide range of dining options, from street food vendors to upscale restaurants, is readily available.As lifestyles become more fast-paced, the urban population increasingly values convenience, ambiance, and experiential dining, which has resulted in the proliferation of cafés, fast-food chains, food courts, and casual dining establishments. The demographic shift has created a vibrant market for food services that cater to the tastes and budgets of various consumer segments, particularly young professionals and dual-income households. With over 37% of the population living in urban areas as of 2024 and expected to rise further, the demand for diverse and convenient food service formats continues to surge.

Key Market Challenges

Fragmented Market and Intense Competition

One of the major challenges in Vietnam’s food service market is its fragmented structure, marked by a large number of small, independent players competing alongside international and domestic chains. While this fragmentation offers variety to consumers, it creates significant hurdles for businesses attempting to scale operations or establish a loyal customer base. The low barrier to entry means that new establishments constantly enter the market, increasing saturation and making differentiation difficult.Many independent outlets struggle with inconsistent food quality, poor service standards, or limited marketing capabilities, which reduces their long-term competitiveness. At the same time, major players such as KFC, McDonald’s, Lotteria, and Highlands Coffee invest heavily in brand-building, customer experience, and technology, making it difficult for smaller competitors to keep up. This disparity creates an uneven playing field and contributes to high business turnover, especially in urban centers where rents and operational costs are higher.

Key Market Trends

Emergence of Cloud Kitchens and Virtual Brands

One of the most transformative trends in Vietnam’s food service market is the rise of cloud kitchens and virtual brands, which are revolutionizing how food is prepared and delivered. These delivery-only kitchen models eliminate the need for physical dine-in space, significantly reducing overhead costs such as rent and utilities. With the rapid growth of online food delivery platforms like GrabFood, Baemin, ShopeeFood, and Gojek, cloud kitchens allow brands to tap into high-demand areas without the expense of opening a full-service restaurant.This trend is particularly appealing to startups and existing brands looking to scale quickly and test new menus or cuisines with minimal risk. Virtual brands - created solely for online platforms - are also gaining popularity, especially among young, tech-savvy consumers who value convenience and fast service. These models provide data-driven insights into customer preferences, allowing operators to rapidly iterate and optimize offerings. As digital infrastructure and e-commerce ecosystems continue to mature in Vietnam, cloud kitchens are expected to become a mainstream operating model, transforming the future of the country’s food service industry.

Key Market Players

- Lotteria Vietnam Co., Ltd

- Golden Gate Group Joint Stock Company

- Imex Pan Pacific Group

- Jollibee Vietnam Co., Ltd.

- Lotte GRS Co.,Ltd

- Mesa Asia Pacific Trading Services Company Ltd

- Restaurant Brands International, Inc.

- Starbucks Corporation

- AFG Vietnam

- Yum! International Restaurant Group

Report Scope:

In this report, the Vietnam Food Service Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Food Service Market, By Type:

- Dining Service

- PBCL

- QSR

- Café

- Others

Vietnam Food Service Market, By Ownership:

- Standalone Outlets

- Chained Outlets

Vietnam Food Service Market, By Brands:

- Domestic

- International

Vietnam Food Service Market, By Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Food Service Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Lotteria Vietnam Co., Ltd

- Golden Gate Group Joint Stock Company

- Imex Pan Pacific Group

- Jollibee Vietnam Co., Ltd.

- Lotte GRS Co.,Ltd

- Mesa Asia Pacific Trading Services Company Ltd

- Restaurant Brands International, Inc.

- Starbucks Corporation

- AFG Vietnam

- Yum! International Restaurant Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

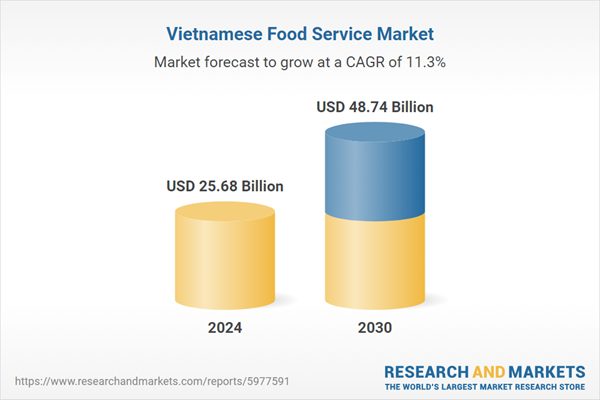

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.68 Billion |

| Forecasted Market Value ( USD | $ 48.74 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |