Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces a substantial obstacle in the form of high interest rates, which raise borrowing costs and suppress investment activities. This financial strain restricts the capital available for new developments and lessens affordability for potential buyers, resulting in friction within transaction volumes. According to the European Public Real Estate Association, the estimated value of commercial real estate across the global markets included in their 2024 report exceeded USD 39.4 trillion.

Market Drivers

The growth of e-commerce and the strategic reorganization of global supply chains are the main forces driving the industrial real estate sector forward. As retailers and third-party logistics providers race to satisfy consumer demands for faster delivery, the need for modern distribution centers and last-mile warehousing has significantly increased, a trend further strengthened by manufacturing onshoring where companies move production closer to end markets for better resilience. According to a CBRE report from October 2025 titled 'Industrial Vacancy Stabilizes Amid Robust Leasing,' year-to-date industrial leasing activity in the U.S. rose by 9.8% year-over-year to reach 682 million square feet, demonstrating continued momentum in this segment.Concurrently, rising global populations and accelerated urbanization remain the fundamental pillars supporting the residential market. The concentration of economic opportunities in cities drives consistent housing requirements, pushing property values higher and necessitating significant development to bridge supply gaps. According to Savills' 'World's Residential Real Estate Value' report from July 2025, the total value of global residential property stood at approximately USD 286.9 trillion by the end of 2024, reflecting substantial capital appreciation over five years, while JLL noted in 2025 that global real estate investment volumes for the full year 2024 reached USD 703 billion, marking a 14% increase from the previous year.

Market Challenges

High interest rates currently act as a significant barrier to the growth of the Global Real Estate Market by fundamentally altering the cost of capital. This tightening of financial conditions directly increases the expense of debt financing, which is crucial for the majority of real estate acquisitions and development projects, causing net yield spreads to compress and often rendering previously viable deals financially unfeasible. Consequently, both institutional and private investors have adopted a more cautious stance, leading to a marked slowdown in capital deployment and transaction velocity, while the disconnect between buyers seeking discounts and sellers resisting devaluation further exacerbates liquidity issues and stalls momentum.This subdued market atmosphere is clearly reflected in recent quantitative metrics. According to the Royal Institution of Chartered Surveyors (RICS), the Global Commercial Property Sentiment Index recorded a reading of -7 in the third quarter of 2024. This negative figure highlights the prevailing pessimism and restricted activity levels across major global markets, confirming that the high-interest-rate environment continues to actively suppress the sector's expansion potential by weighing down investment confidence.

Market Trends

The mainstream adoption of net-zero and ESG-compliant developments is fundamentally reshaping investment strategies, as regulatory frameworks and tenant requirements increasingly penalize assets that do not comply. Investors are swiftly pivoting from passive ownership to active value creation through sustainability upgrades, driven by the risks of asset obsolescence and the potential for valuation premiums on green-certified buildings. Highlighting this shift, Knight Frank’s June 2025 'Key findings from ESG Property Investor Survey 2025' indicates that 76% of global investors now prioritize retrofitting existing assets as their primary ESG strategy, reflecting a decisive industry-wide move toward extending the lifecycle of current inventories.Simultaneously, accelerated investment in data center real estate has emerged as a critical growth vector, distinct from traditional industrial logistics and powered by the exponential rise of artificial intelligence and high-performance cloud computing. This surge has decoupled digital infrastructure from broader commercial property cycles, creating a unique asset class defined by massive power needs and high technical entry barriers. Demand in this sector significantly outpaces supply in major hubs, leading to historically low availability; according to CBRE’s 'Global Data Center Trends 2025' report from June 2025, the global weighted average data center vacancy rate fell by 2.1 percentage points year-over-year to 6.6% in the first quarter of 2025, underscoring the acute scarcity of capacity during this digital boom.

Key Players Profiled in the Real Estate Market

- Brookfield Asset Management Inc.

- ATC IP LLC

- Prologis, Inc.

- SIMON PROPERTY GROUP, L.P.

- Coldwell Banker Real Estate LLC

- RE/MAX, LLC

- Keller Williams Realty, Inc.

- CBRE Group, Inc.

- Sotheby's International Realty Affiliates LLC

- Colliers International Group Inc.

Report Scope

In this report, the Global Real Estate Market has been segmented into the following categories:Real Estate Market, by Type:

- Residential

- Commercial

- Industrial

- Land

Real Estate Market, by Booking Mode:

- Sales

- Rental

- Lease

Real Estate Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Real Estate Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Real Estate market report include:- Brookfield Asset Management Inc.

- ATC IP LLC

- Prologis, Inc.

- SIMON PROPERTY GROUP, L.P.

- Coldwell Banker Real Estate LLC

- RE/MAX, LLC

- Keller Williams Realty, Inc.

- CBRE Group, Inc.

- Sotheby's International Realty Affiliates LLC

- Colliers International Group Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

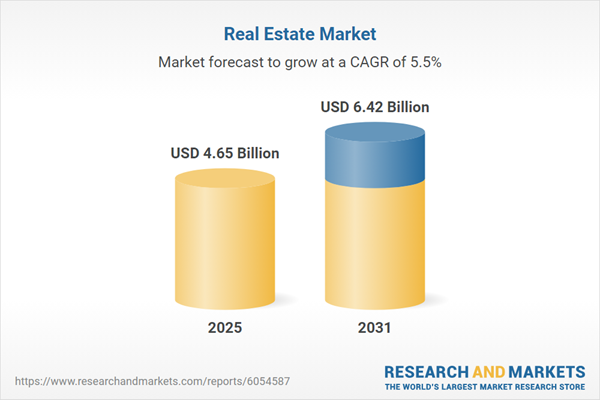

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.65 Billion |

| Forecasted Market Value ( USD | $ 6.42 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |