Speak directly to the analyst to clarify any post sales queries you may have.

The Fiber Optic Cables for Last Mile Market is undergoing rapid transformation as industry leaders adapt to new digital consumption and infrastructure demands. This report provides senior decision-makers with actionable insights into the evolving ecosystem, highlighting the critical strategic levers at play for business growth and competitiveness.

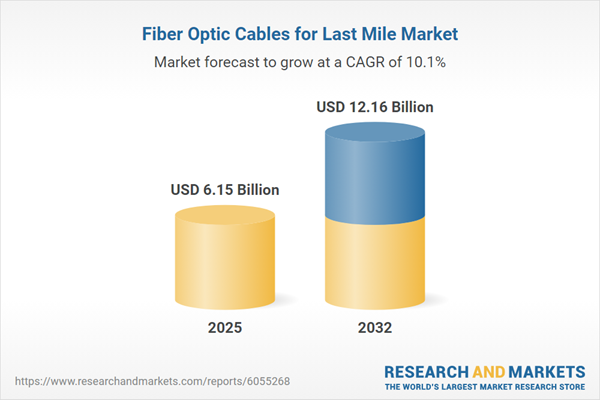

Market Snapshot: Fiber Optic Cables for Last Mile Market Growth

The Fiber Optic Cables for Last Mile Market grew from USD 5.62 billion in 2024 to USD 6.15 billion in 2025. It is projected to continue expanding at a CAGR of 10.10%, reaching USD 12.16 billion by 2032. This robust trajectory reflects intensifying demand for high-speed, low-latency network connectivity across diverse geographies and user profiles. Market growth is being shaped by advancements in next-generation networking, connectivity standards, and targeted government programs aiming to enhance digital access for enterprises and consumers.

Scope & Segmentation: Defining the Last Mile Fiber Optic Opportunity

This report delivers in-depth analysis and forecasts across substantial areas of the last mile fiber optic ecosystem, designed for strategic decision-making. Strategic segmentation—by product, geography, and leading players—enables tailored insights for actionable market positioning:

- Product Segments:

- Components & Accessories: including cable ties and anchors, fiber assemblies, fiber closures, fiber connectors, splitters, and couplers

- Fiber Optic Cables: covers conventional and advanced cable types for multiple use-cases

- Regional Coverage:

- Americas: United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru

- Europe, Middle East & Africa: United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya

- Asia-Pacific: China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan

- Key Companies Analyzed:

- Market landscape review includes Amphenol Corporation, Axon' Cable SAS, Belden Inc., Clearfield Inc., Coherent Corporation by II-VI, Collins Aerospace by RTX, CommScope Inc., Corning Incorporated, Fiberoptics Technology Incorporated, Finolex Cables Limited, Fujikura Ltd., Furukawa Electric Co. Ltd., Futong Group Import and Export, Guangzhou Jiqian Fiber Optic Cable, Hengtong Group, HFCL Ltd., Huihong Technologies, Lapp Group, LS Cable & System, Optical Cable Corporation, Proterial Cable America, Prysmian S.p.A, Radiall SA, Shenzhen Optico Communication, Sterlite Technologies, Sumitomo Electric Industries, TE Connectivity, W. L. Gore & Associates, WEINERT Industries, Yangtze Optical Fiber and Cable Joint Stock Company

Key Takeaways: Strategic Insights for Fiber Optic Cables for Last Mile Market

- Last mile fiber optic networks are mission-critical as organizations move toward digitally intensive operations and services.

- Emerging technologies, such as 5G and the Internet of Things, drive the deployment of advanced fiber architectures and increase network resilience requirements.

- Network operators are rapidly shifting away from legacy copper toward full-fiber builds, seeking efficiency and future-ready capacity.

- New installation techniques and materials are reducing deployment complexity, labor, and operational disruption.

- Sustainability factors are influencing product development, with greater emphasis on environmentally responsible cable designs and installation practices.

- Main industry players are forming alliances, adopting modular turnkey solutions, and leveraging analytics to enhance forecasting and fulfillment.

Tariff Impact and Supply Chain Resilience

The 2025 United States tariff regime has altered cost structures, especially for manufacturers and distributors sourcing specialized components internationally. In response, industry stakeholders are optimizing procurement, exploring nearshoring, and investing in automation. Collaboration across the value chain and the pursuit of standardized, scalable product lines help preserve margins and speed up deployment, even amid shifting trade dynamics. Ongoing public funding and regulatory support in key regions work to offset cost increases and foster continued infrastructure growth.

Methodology & Data Sources

This market intelligence is grounded in a multi-pronged research approach combining primary interviews with industry and regulatory leaders, as well as exhaustive secondary analysis of technical standards, funding programs, and verified financial disclosures. Robust quantitative modeling and data triangulation deliver reliability and actionable clarity for senior decision-makers.

Why This Report Matters

- Enables precise, market-based supply chain and investment planning in a complex, evolving landscape.

- Delivers competitive benchmarking to help companies identify partnership and innovation opportunities.

- Supports informed, strategic responses to policy and technology disruptions, strengthening market position and business resilience.

Conclusion

Unlocking value from last mile fiber optic networks requires agile adaptation to evolving technology, collaboration models, and regulatory shifts. Decision-makers equipped with robust market intelligence can capture new opportunities and build long-term connectivity leadership.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Fiber Optic Cables for Last Mile market report include:- Amphenol Corporation

- Axon' Cable SAS

- Belden Inc.

- Clearfield Inc.

- Coherent Corporation by II-VI Incorporated

- Collins Aerospace by RTX Corporation

- CommScope Inc.

- Corning Incorporated

- Fiberoptics Technology Incorporated

- Finolex Cables Limited

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Futong Group Import and Export Co., Ltd.

- Guangzhou Jiqian Fiber Optic Cable Co., Ltd.

- Hengtong Group Co. Ltd.

- HFCL Ltd.

- Huihong Technologies Limited

- Lapp Group

- LS Cable & System Ltd.

- Optical Cable Corporation

- Proterial Cable America, Inc.

- Prysmian S.p.A

- Radiall SA

- Shenzhen Optico Communication Co., Ltd

- Sterlite Technologies Limited

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- W. L. Gore & Associates, Inc.

- WEINERT Industries AG

- Yangtze Optical Fiber and Cable Joint Stock Limited Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 6.15 Billion |

| Forecasted Market Value ( USD | $ 12.16 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |