Introduction of Lightweight Rooftop Solar PV Market

The lightweight rooftop solar PV market has been experiencing significant growth, driven by advancements in materials technology, sustainability initiatives, and global incentives for renewable energy adoption. Unlike traditional solar panels, lightweight photovoltaic (PV) systems are designed with innovative materials such as thin-film technology and polymer-based substrates, making them 30-60% lighter while maintaining efficiency. These panels are particularly beneficial for commercial and industrial buildings with structural limitations, enabling wider adoption across urban environments. The increasing adoption of building-integrated photovoltaics (BIPV), financial incentives such as tax credits, and supportive policies such as the Inflation Reduction Act (IRA) in the U.S. and the European Green Deal further boost market expansion. While challenges such as lower efficiency and durability concerns remain in the lightweight rooftop solar PV market, ongoing innovations are improving performance, making lightweight rooftop solar PV a crucial solution for enhancing distributed renewable energy generation worldwide.Market Introduction

The lightweight rooftop solar PV market has been witnessing rapid growth, driven by advancements in durable, lightweight materials and the increasing adoption of building-integrated photovoltaics (BIPV). The lightweight rooftop solar PV market has been gaining traction due to the growing emphasis on sustainability, energy efficiency, and government incentives promoting solar energy adoption. Key trends include the shift toward thin-film and frameless solar panels, reducing installation constraints on commercial and industrial rooftops with limited load-bearing capacity. Additionally, emerging technologies such as ventilated BIPV systems are enhancing efficiency by lowering operating temperatures. The lightweight rooftop solar PV market is expected to expand significantly, with North America, Europe, and the Rest-of-the-World projected to see substantial gigawatt capacity growth from 2024 to 2034.Industrial Impact

The industrial impact of the lightweight rooftop solar PV market is substantial, driven by increasing adoption in commercial and industrial sectors due to advancements in lightweight materials, regulatory incentives, and sustainability initiatives. The shift toward lightweight photovoltaic (PV) solutions enables industries to install solar panels on rooftops that previously could not support conventional systems, thus expanding the market reach. Key industries in the lightweight rooftop solar PV market, including manufacturing, logistics, retail, and real estate, are leveraging these innovations to reduce operational energy costs and carbon footprints, aligning with global net-zero emission targets. The growing preference for building-integrated photovoltaics (BIPV) in urban development further enhances the sector's integration into industrial infrastructure. Additionally, financial incentives such as tax credits, subsidies, and investment grants in regions such as North America and Europe have accelerated market penetration, fostering competition and innovation among key players. However, challenges such as lower efficiency compared to traditional panels and concerns over durability remain, prompting ongoing research and development efforts to improve panel performance. Overall, the industrial sector is set for significant transformation, as lightweight solar PV technology supports sustainable energy solutions while unlocking new business opportunities in decentralized energy generation.Market Segmentation:

Segmentation 1: by Type

- Rigid

- Flexible

Rigid Segment to Dominate the Lightweight Rooftop Solar PV Market (by Type)

The leading segment in the lightweight rooftop solar PV market is the commercial and industrial (C&I) sector, driven by increasing adoption among businesses aiming to reduce energy costs and meet sustainability targets. Within this, rigid, lightweight solar panels dominate due to their balance of durability, efficiency, and cost-effectiveness compared to flexible panels. The building-integrated photovoltaics (BIPV) segment is also witnessing rapid growth, particularly in urban environments where integrating building materials enhances functionality and aesthetics.Segmentation 2: by Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, Italy, Belgium, Greece, U.K., Netherlands, Poland, Romania, Bulgaria, Austria, Switzerland, Hungary, and Rest-of-Europe)

- Rest-of-the-World (Japan and Others of Rest-of-the-World)

Europe to Dominate the Lightweight Rooftop Solar PV Market (by Region)

Europe leads the lightweight rooftop solar PV market, driven by strong government incentives, sustainability commitments, and widespread adoption in industrial and commercial buildings. Countries such as Germany, France, and the Netherlands are at the forefront due to favorable policies such as feed-in tariffs and subsidies for lightweight solar technologies. North America, particularly the U.S., follows closely with financial incentives such as the Investment Tax Credit (ITC) under the Inflation Reduction Act (IRA), which significantly boosts installations. The Asia-Pacific region, led by China, Japan, and India, is also expanding rapidly due to increasing industrialization and energy demand, alongside innovations in lightweight solar PV manufacturing.Recent Developments in the Lightweight Rooftop Solar PV Market

- In June 2024, GAF Energy, a division of Standard Industries and one of the leading providers of solar roofing solutions in North America, announced plans to establish a cutting-edge testing facility for solar roofing. This new initiative, supported in part by a U.S. Department of Energy (DOE) investment, will focus on advancing building integrated photovoltaics (BIPV). The project aims to develop, evaluate, and refine a range of optical, thermal, and energy models for roof-integrated solar shingles to enhance understanding of how these shingles impact home heating and cooling efficiency. The facility will feature comprehensive monitoring systems for weather, photovoltaic performance, and temperature.

- In September 2024, researchers from Nanjing University of Science and Technology introduced a ventilated building-integrated photovoltaic (VL-BIPV) system designed for rooftops with load capacities under 15 kg/m². This innovative system features flexible solar modules weighing only 6 kg/m² and incorporates an airflow channel to lower operating temperatures and enhance power yield. The modules, utilizing a polymer front layer instead of heavy glass, weigh approximately 3 kg/m² and are 1.8 mm thick, offering a PV efficiency of 21.04%. The VL-BIPV system's combination of lightweight materials and effective thermal management provides significant efficiency, stability, and cost advantages, making it a promising solution for practical applications.

- In December 2023, AGC Inc., based in Tokyo, Japan, exemplified the growing trend of Building-Integrated Photovoltaics (BIPV) with its Sunjoule BIPV glass installation at Shizuoka Station's North Exit Square bicycle parking facility. This project, executed by TOKAI Cable Network Corporation, highlights the increasing adoption of BIPV systems that seamlessly integrate solar technology into building structures. The Sunjoule system, which will generate up to 3.7 kW of solar power, represents a significant step toward incorporating renewable energy solutions directly into building materials.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Rising Focus on Renewable Energy Targets and Sustainability Driving the Adoption of Efficient Solar System

The rising focus on renewable energy targets and sustainability is a key driver in the adoption of lightweight rooftop solar PV systems. Governments and organizations worldwide are implementing aggressive renewable energy policies and sustainability goals to reduce carbon emissions and transition to cleaner energy sources. Lightweight solar panels offer a practical solution for buildings with structural load limitations, allowing a broader range of structures to comply with sustainability mandates without the need for major renovations. This focus on meeting renewable energy targets while reducing environmental impact is accelerating the demand for efficient, easy-to-install solar PV systems in both industrial and commercial buildings.Market Challenges: Durability and Longevity Issues with Lightweight Materials

A significant challenge in the lightweight rooftop solar PV market is the durability and longevity of the materials used. Lightweight panels, often made from advanced polymers, thin films, or flexible substrates, are more prone to wear and tear than traditional solar panels, typically encased in durable glass and framed with aluminum. The reduced structural strength in lightweight panels can lead to faster degradation, particularly in harsh environmental conditions such as extreme heat, high winds, heavy snow, or hail. This can impact the overall lifespan of the solar system, reducing its efficiency over time and increasing the frequency of maintenance or replacement, which can be a financial burden for consumers. Additionally, despite their flexibility and reduced weight, thin-film technologies such as CIGS and CdTe solar panels degrade more quickly than their crystalline counterparts. These panels often come with shorter warranties, reflecting concerns about their long-term reliability and performance under challenging environmental conditions.Market Opportunities: Off-Grid and Mobile Applications

Off-grid and mobile applications present a convincing opportunity in the lightweight rooftop solar PV market, driven by the increasing demand for portable, flexible, and reliable energy solutions. Unlike traditional solar panels, which can be heavy and difficult to transport, lightweight solar PV systems are designed to offer mobility and ease of installation, making them ideal for remote areas, mobile homes, boats, and off-grid living. As more consumers and businesses look for sustainable and autonomous energy solutions, lightweight solar panels provide an opportunity to expand into sectors where traditional grid access is either impractical or unavailable. This opens new markets for manufacturers, including rural communities, mobile applications, and disaster relief operations.Several industry players in the lightweight rooftop solar PV market are already capitalizing on this opportunity. For instance, FlexSolar's FlexWatt lightweight flexible solar panel and FlexSolar F Series Solar Panel have been designed specifically for portable and off-grid applications, offering flexibility, durability, and efficiency in powering RVs, boats, and remote cabins.

How can this report add value to an organization?

This report adds value to an organization by providing comprehensive insights into the evolving lightweight rooftop solar PV market, enabling data-driven decision-making and strategic planning for sustainable growth. It highlights key market trends, technological advancements, and competitive dynamics, helping businesses identify emerging opportunities in sectors such as commercial and industrial buildings, real estate, logistics, and urban infrastructure. The report’s detailed segmentation by type and region allows organizations to target specific markets, optimize product offerings, and refine business strategies. Additionally, its coverage of government incentives, regulatory frameworks, and sustainability policies ensures companies remain compliant with evolving energy regulations. By leveraging this report, organizations can make informed investment decisions in lightweight solar technology, enhance operational efficiency, and gain a competitive edge in the rapidly expanding renewable energy sector, ensuring long-term growth and leadership in the market.Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the lightweight rooftop solar PV market.The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the lightweight rooftop solar PV market in Asia-Pacific and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.Secondary research was done to obtain crucial information about the industry’s value chain, revenue models, the market’s monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

This product will be delivered within 3-5 business days.

Table of Contents

Table Information

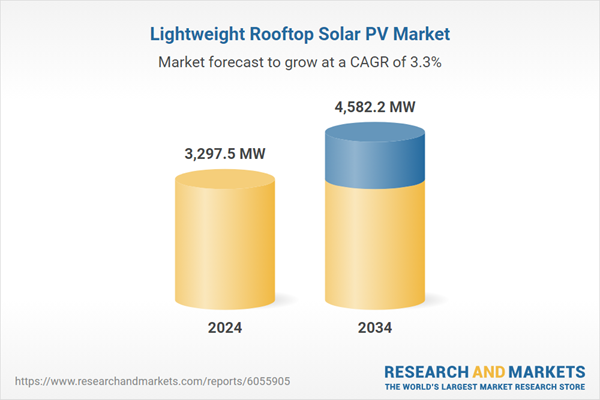

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value in 2024 | 3297.5 MW |

| Forecasted Market Value by 2034 | 4582.2 MW |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |