The increasing demand for high-speed data transmission within data centers, telecommunications, and artificial intelligence-driven computation serves as the principal catalyst for this sector. The widespread adoption of 400G and 800G optical transceivers to support increasing network bandwidth, coupled with the rise of 5G deployments, cloud computing, and hyperscale data centers, is fueling market growth. Thus, the optical transceivers segment garnered 28% revenue share in the market in 2023. Additionally, advancements in co-packaged optics (CPO) and silicon photonics-based transceivers enhance performance while reducing power consumption, further accelerating adoption.

Leading technology companies, including Google, NVIDIA, Microsoft, and Tesla, invest heavily in silicon photonics and optical communication technologies to enhance AI processing speeds. The introduction of co-packaged optics (CPO) and on-chip optical interconnects further revolutionizes AI hardware by integrating optical transmission directly into AI accelerators, minimizing latency and maximizing computing efficiency. Moreover, the incorporation of optical interconnects within 5G infrastructure facilitates the advancement of emerging technologies, including network slicing and edge computing. Network slicing allows operators to create virtual networks tailored to specific applications, improving efficiency and resource allocation. Optical solutions enable fast, scalable, and low-power data transmission between edge devices and cloud data centers, optimizing network responsiveness for applications like real-time AI processing, remote healthcare, and industrial automation. Thus, as 5G adoption accelerates globally, the reliance on optical fiber-based interconnects will continue to grow, shaping the future of high-speed, intelligent, and ultra-connected digital ecosystems.

However, the cost of maintaining and upgrading optical networks further adds to the financial burden. Unlike conventional systems that can be repaired or replaced relatively easily, optical networks require specialized tools and expertise for troubleshooting and maintenance. This increases the total ownership cost, discouraging businesses from transitioning to optical solutions. The financial constraints are particularly challenging for small and medium-sized enterprises (SMEs), which may lack the budget to invest in high-end optical infrastructure. Hence, without cost-effective solutions, SMEs are often forced to rely on slower, less efficient interconnect technologies, limiting the overall growth of the optical interconnect market.

Driving and Restraining Factors

Drivers

- Rapid Expansion of Data Centers

- Rising Adoption of 5G Networks

- Growth of Artificial Intelligence and Machine Learning

Restraints

- High Initial Investment & Deployment Costs

- Technical Challenges & Compatibility Issues

Opportunities

- Advances in Photonic Integration and Silicon Photonics

- Growing Demand in Telecommunications and Enterprise Networks

Challenges

- Power Consumption & Heat Dissipation Concerns

- Complexity in Manufacturing & Fabrication

Product Type Outlook

Based on product type, the market is classified into cable assemblies, connectors, optical transceivers, silicon photonics, optical engines, PIC-based interconnects, and others. The connectors segment acquired 20% revenue share in the market in 2023. The demand for high-performance fiber optic connectors is rising due to the need for low-loss, high-speed connectivity in data centers, telecom infrastructure, and enterprise networking. The adoption of MPO/MTP connectors, LC connectors, and high-density fiber optic patch panels is driven by the need for scalable, high-bandwidth solutions that ensure network reliability. Additionally, the increasing deployment of edge computing and 5G infrastructure is creating a surge in demand for high-speed optical interconnect solutions, further boosting this segment.Interconnect Level Outlook

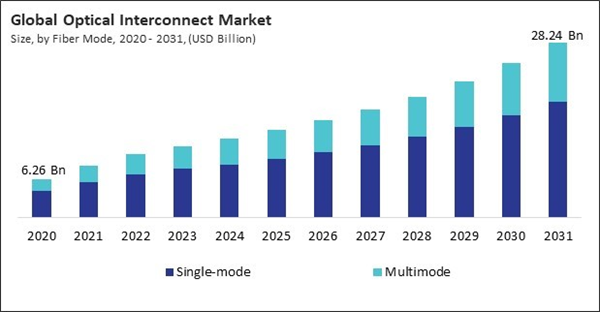

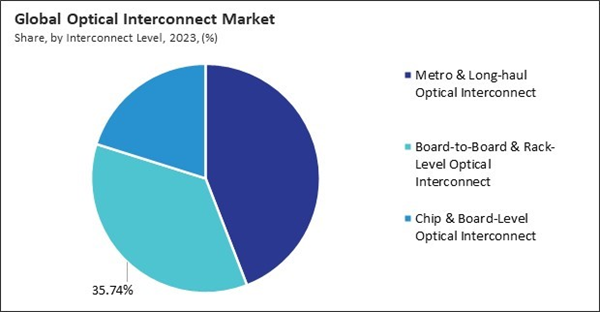

On the basis of interconnect level, the market is divided into metro & long-haul optical interconnect, board-to-board & rack-level optical interconnect, and chip & board-level optical interconnect. The metro & long-haul optical interconnect segment witnessed 44% revenue share in the market in 2023. The increasing deployment of fiber-optic communication networks to support 5G expansion, hyperscale data centers, and broadband connectivity is the primary driver for this segment. The rising demand for high-speed internet, video streaming, and cloud-based services has led to significant investments in the metro and long-haul optical networks. Governments and telecommunications operators are making substantial investments in fiber-to-the-home (FTTH) projects and national broadband initiatives, thereby significantly contributing to growth. The need for low-latency, high-bandwidth communication in finance, healthcare, and smart cities is fueling the demand for long-distance optical interconnect solutions.Fiber Mode Outlook

By fiber mode, the market is bifurcated into single-mode and multimode. The multimode segment acquired 32% revenue share in the market in 2023. The growing need for cost-effective, high-speed connectivity in short-range applications drives the demand for multimode fiber. This segment is widely used in enterprise networks, data centers, and AI-driven computing environments, where short-distance, high-bandwidth data transmission is crucial. The increasing deployment of rack-to-rack and board-to-board optical interconnects in hyperscale data centers and high-performance computing (HPC) systems further accelerates market growth. Advancements in VCSEL-based multimode transceivers, high-speed multimode fiber optics, and parallel fiber solutions enhance data transmission efficiency, making multimode fiber a key enabler for short-range optical communication networks.Data Rates Outlook

Based on data rates, the market is segmented into less than 10 Gbps, 10-50 Gbps, 50-100 Gbps, and more than 100 Gbps. The 10-50 Gbps segment witnessed 26% revenue share in the market in 2023. The widespread adoption of enterprise networking, metro optical transport, and mid-scale cloud data centers drives the demand for 10-50 Gbps optical interconnect solutions. This segment is crucial in supporting corporate LANs, broadband networks, and telecommunications infrastructure, where moderate bandwidth and cost-effective optical solutions are needed. The increasing adoption of edge computing, 5G small cells, and high-speed fiber-to-the-home (FTTH) services has further boosted demand in this category. Additionally, advancements in DWDM, optical transceivers, and Ethernet-based optical interconnects continue to enhance the efficiency of 10-50 Gbps network deployments.Distance Outlook

On the basis of distance, the market is classified into less than 10 km, 11-100 km, and more than 100 km. The more than 100 km segment procured 27% revenue share in the market in 2023. The growing demand for high-speed, long-haul optical communication networks is driving the adoption of more than 100 km optical interconnect solutions. This segment is crucial for submarine communication cables, intercontinental data transmission, and telecom backbone networks, where ultra-high bandwidth and low latency are essential. The rapid deployment of 5G infrastructure, national broadband networks, and international fiber-optic connectivity projects has further fueled market growth.Application Outlook

By application, the market is divided into data communication, telecommunications, and military & defense. The data communication segment acquired 54% revenue share in the market in 2023. The primary reason for the growth of this segment is the increasing demand for high-speed, low-latency data transfer in hyperscale data centers, cloud computing, and AI-driven workloads. As big data analytics, machine learning, and edge computing expand, enterprises require ultra-fast optical interconnect solutions to handle massive data volumes efficiently. Additionally, data center interconnect (DCI) solutions and intra-rack optical connections are becoming essential to support AI-driven networking and high-performance computing (HPC) environments.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed 37% revenue share in the market in 2023. The rapid expansion of hyperscale data centers, AI-driven computing, and 5G network deployments is the primary driver for the North American optical interconnect market. The region is home to leading cloud service providers, telecom giants, and tech companies investing heavily in fiber-optic infrastructure and next-generation networking solutions. Additionally, government initiatives supporting broadband expansion, digital transformation, and sustainable data center technologies drive significant demand for high-speed optical interconnect solutions.Recent Strategies Deployed in the Market

- Jan-2025: Nvidia has partnered with TSMC to develop silicon photonics technology for improving data center bandwidth and server connectivity. This collaboration aligns with the growing optical interconnect market, using silicon instead of glass for more efficient photonic circuits.

- Aug-2024: Corning Incorporated and Lumen Technologies have entered a partnership, with Corning reserving 10% of its global fiber capacity for Lumen. This collaboration will strengthen Lumen’s intercity fiber network to meet the increasing AI and high bandwidth demands of data centers.

- Mar-2024: Broadcom, Inc. has launched the 51.2-Tbps co-packaged optics (CPO) Ethernet switch, a groundbreaking product that enhances power efficiency, bandwidth, and cost-effectiveness for AI clusters and data centers. This launch marks a significant advancement in optical interconnect technology, benefiting the market.

- Mar-2024: Coherent Corp. introduced new optical communication innovations at OFC 2024, featuring advancements in VCSELs, high-power laser modules, 200G optics, and optical circuit switches. These products are designed to enhance next-gen optical interconnects, AI networks, and high-speed communication systems.

- Sep-2021: Molex, LLC showcased 400G-DR4 optical modules, utilizing its Telluride PAM4 DSPs, at the CIOE. These modules, developed with Molex, support high-performance cloud-scale networks and hyperscale data centers, driving advancements in the optical interconnect market for high-speed data transfer.

List of Key Companies Profiled

- Broadcom, Inc.

- Coherent Corp.

- Fujitsu Limited

- Corning Incorporated

- Molex, LLC (Koch Industries, Inc.)

- NVIDIA Corporation

- Sumitomo Electric Industries, Ltd.

- Infinera Corporation

- Juniper Networks, Inc.

- TE Connectivity Ltd.

Market Report Segmentation

By Fiber Mode

- Single-mode

- Multimode

By Interconnect Level

- Metro & Long-haul Optical Interconnect

- Board-to-Board & Rack-Level Optical Interconnect

- Chip & Board-Level Optical Interconnect

By Distance

- Less than 10 Km

- 11-100 Km

- More than 100 Km

By Application

- Data Communication

- Telecommunications

- Military & Defense

By Data Rates

- 50-100 Gbps

- 10-50 Gbps

- More than 100 Gbps

- Less than 10 Gbps

By Product Type

- Optical Transceivers

- Connectors

- Cable Assemblies

- Silicon Photonics

- Optical Engines

- PIC-based Interconnects

- Other Product Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Broadcom, Inc.

- Coherent Corp.

- Fujitsu Limited

- Corning Incorporated

- Molex, LLC (Koch Industries, Inc.)

- NVIDIA Corporation

- Sumitomo Electric Industries, Ltd.

- Infinera Corporation

- Juniper Networks, Inc.

- TE Connectivity Ltd.