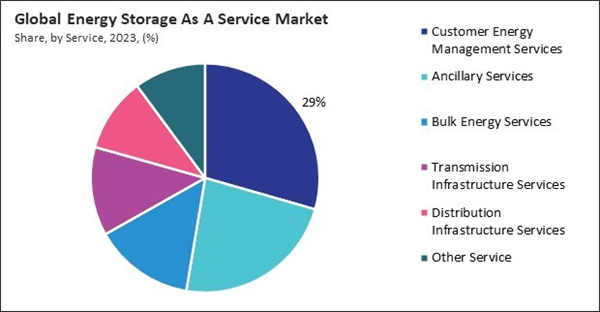

The rising penetration of renewable energy sources has increased the demand for fast-response energy storage solutions, such as battery energy storage systems (BESS), to provide grid-balancing services. Ancillary services are critical in maintaining grid stability, ensuring frequency regulation, voltage control, and spinning reserves. Therefore, the ancillary services segment procured 23% revenue share in the market in 2023. Additionally, regulatory policies promoting grid modernization and energy efficiency have further driven the growth of the ancillary services segment in the market.

With the growing adoption of renewable energy sources such as solar and wind, ESaaS plays a crucial role in maintaining grid stability. Renewable energy generation is often intermittent, making it essential to have energy storage solutions that can store excess energy and discharge it when needed. ESaaS providers offer energy storage systems that support grid reliability, enabling customers to optimize power usage while reducing dependency on traditional fossil-fuel-based backup systems. In addition, ESaaS supports the development of decentralized energy systems, such as microgrids and distributed energy resources (DERs). These systems allow communities, businesses, and industrial facilities to generate and store their own energy while reducing dependency on centralized power grids. By offering energy storage on a service-based model, ESaaS providers enable greater flexibility and resilience in energy management, fostering a more sustainable and self-sufficient energy ecosystem. Thus, rising demand for renewable energy integration and grid stability is driving the market's growth.

However, financing and investment risks associated with energy storage projects can deter investors from funding large-scale ESaaS initiatives. Long payback periods and uncertain returns on investment (ROI) may discourage financial institutions from supporting ESaaS providers, slowing the market’s expansion. Government incentives, subsidies, and innovative financing models are essential to overcome this restraint to make ESaaS solutions more financially viable. In conclusion, the high initial investment and capital expenditure required for energy storage deployment are propelling the market's growth.

Driving and Restraining Factors

Drivers

- Growing Need for Energy Resilience and Backup Power Solutions

- Increasing Energy Cost Volatility and Demand for Cost Savings

- Rising Demand for Renewable Energy Integration and Grid Stability

Restraints

- High Initial Investment and Capital Expenditure Required for Energy Storage Deployment

- Complexity of Energy Storage Integration with Existing Grid Infrastructure

Opportunities

- Rising Adoption of Electric Vehicles (EVs) and Vehicle-to-Grid (V2G) Technology

- Growing Investments in Smart Grid Technologies and Virtual Power Plants (VPPs)

Challenges

- Cybersecurity Threats and Data Privacy Concerns in Cloud-Based Energy Storage Management

- Shortage of Skilled Workforce for Energy Storage Deployment, Maintenance, and Optimization

Service Outlook

Based on service, the market is characterized into bulk energy services, ancillary services, transmission infrastructure services, distribution infrastructure services, customer energy management services, and others. The customer energy management services segment 29% revenue share in the market in 2023. This driven by the increasing need for optimized energy consumption, demand response solutions, and cost savings for businesses and residential consumers. This segment enables users to monitor, control, and store energy efficiently, reducing dependence on grid electricity during peak hours and lowering operational costs.End Use Outlook

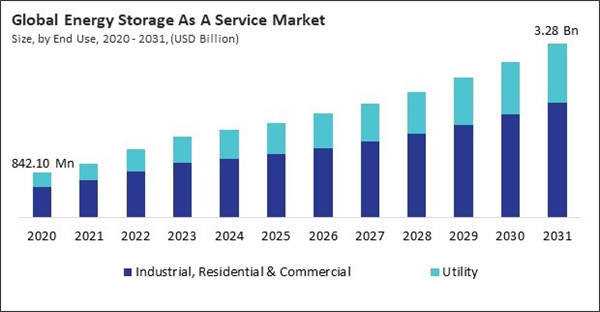

On the basis of end use, the market is classified into utility and industrial, commercial & residential. The utility segment acquired 32% revenue share in the market in 2023. Utilities are increasingly adopting energy storage solutions to enhance grid reliability, integrate renewable energy sources, and manage peak load demands efficiently. The rise of grid-scale battery storage and pumped hydro storage projects has further contributed to the segment's dominance. The growing need for grid stability and renewable energy integration drives demand for energy storage services, particularly bulk energy and ancillary services. Additionally, the rise in demand response programs supports the adoption of transmission and distribution infrastructure services.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed 34% revenue share in the market in 2023. This growth was fueled by rising electricity demand, rapid industrialization, and increasing renewable energy integration in countries like China, India, Japan, and South Korea. Government initiatives promoting energy storage and advancements in battery technologies further contributed to the expansion of ESaaS in the region.Recent Strategies Deployed in the Market

- Sep-2024: Honeywell deployed a Battery Energy Storage System (BESS) in India's Lakshadweep Islands to support renewable energy distribution. Partnering with SunSource Energy, the project reduces diesel reliance, lowers carbon emissions, and aligns with India’s net-zero goals through advanced microgrid energy management solutions.

- Jul-2024: NextEra Energy, Inc. and Entergy announced a joint agreement to develop up to 4.5 GW of solar and energy storage projects. This five-year partnership expands Entergy’s renewable portfolio and enhances grid reliability across Arkansas, Louisiana, Mississippi, and Texas.

- Jul-2024: Siemens and Boson Energy signed an MoU to convert non-recyclable waste into hydrogen, accelerating the green energy transition. Siemens will provide technology and expertise, while Boson Energy plans 300 plants by 2030, producing 1 million tons of hydrogen annually.

- Jun-2024: Generac Holdings, Inc. acquired PowerPlay Battery Energy Storage Systems from SunGrid Solutions to expand its commercial and industrial BESS offerings. The acquisition strengthens Generac’s energy storage portfolio, supporting resilient, efficient, and sustainable energy solutions amid growing demand for grid stability and electrification.

- May-2024: Veolia Environnement S.A. acquired MRC Consultants, enhancing its energy consulting expertise in decarbonization, renewables, and energy storage. The move aligns with Veolia’s GreenUp strategy, expanding services in smart grids, e-mobility, and waste-to-energy, strengthening its role in ecological transformation.

List of Key Companies Profiled

- Siemens Energy AG

- Veolia Environnement S.A.

- Honeywell International Inc.

- Tesla, Inc.

- NextEra Energy, Inc.

- Generac Holdings, Inc.

- Engie SA

- Customized Energy Solutions Ltd.

- SREIL Energy

- Hydrostor Inc.

Market Report Segmentation

By End Use

- Industrial, Residential & Commercial

- Utility

By Service

- Customer Energy Management Services

- Ancillary Services

- Bulk Energy Services

- Transmission Infrastructure Services

- Distribution Infrastructure Services

- Other Service

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Siemens Energy AG

- Veolia Environnement S.A.

- Honeywell International Inc.

- Tesla, Inc.

- NextEra Energy, Inc.

- Generac Holdings, Inc.

- Engie SA

- Customized Energy Solutions Ltd.

- SREIL Energy

- Hydrostor Inc.