This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The key advantage of this method is its ability to produce lightweight yet durable materials with excellent thermal and acoustic insulation properties. Unlike traditional foaming processes that rely on chemical blowing agents, thermo compression foaming often uses physical foaming techniques, making it more environmentally friendly. Recent advancements in material science and manufacturing technologies are further shaping the future of thermo compression foaming. The development of bio-based polymers, nanocomposite foams, and smart foamed materials with enhanced properties is opening new possibilities across industries. Researchers are also exploring additive manufacturing (3D printing) in combination with thermo compression foaming to create customized, high-performance components.

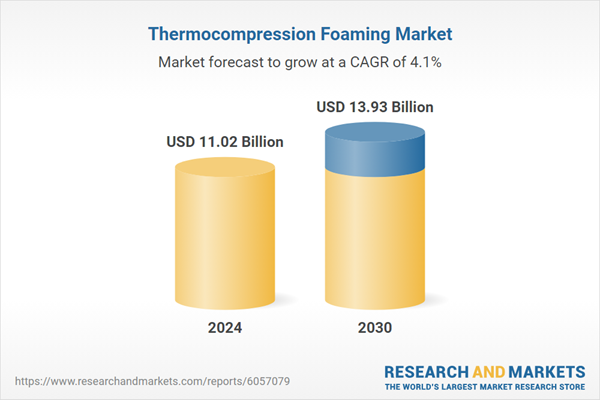

According to the research report “Global Thermo Compression Foaming Market Outlook, 2030” the global market is projected to reach market size of USD 13.93 Billion by 2030 increasing from USD 11.02 Billion in 2024, growing with 4.06% CAGR by 2025-30. One of the primary industries benefiting from thermo compression foaming is automotive manufacturing. Automakers use foamed materials for interior components such as dashboards, door panels, and seating structures to reduce vehicle weight and improve fuel efficiency. The process enables the production of parts with high impact resistance and sound absorption capabilities, contributing to enhanced safety and comfort for passengers.

Moreover, the use of recyclable thermoplastic foams aligns with the growing emphasis on sustainability in the automotive sector. The packaging industry is another major player in the adoption of thermo compression foaming. Lightweight foamed materials are used to create protective packaging solutions that offer superior shock absorption and insulation.

Compared to conventional plastic packaging, foamed polymers reduce material usage while maintaining strength, making them an ideal choice for eco-conscious companies. In the consumer goods sector, this technology is widely used in the production of shoe soles, sporting goods, and cushioning materials due to its ability to enhance comfort and durability.

In the construction industry, thermo compression foamed materials are utilized for insulation panels, flooring underlays, and acoustic barriers. These materials provide excellent thermal resistance, reducing energy consumption in buildings. Additionally, their soundproofing capabilities contribute to creating quieter indoor environments. With the increasing focus on sustainable construction, the industry is exploring bio-based and recycled materials to develop eco-friendly foamed solutions that meet modern building regulations.

Market Drivers

- Lightweight and High-Performance Materials Demand: Industries such as automotive, aerospace, and packaging are increasingly adopting lightweight materials to enhance fuel efficiency, reduce emissions, and improve product performance. Thermo compression foaming produces low-density yet structurally robust materials, making it a preferred choice for these sectors. The need for materials that combine strength, durability, and weight reduction continues to drive the growth of this industry.

- Sustainability and Circular Economy Initiatives: With stricter environmental regulations and growing consumer awareness, industries are shifting towards eco-friendly materials and processes. Thermo compression foaming enables the production of recyclable and bio-based foamed materials, reducing plastic waste and carbon footprint. Companies are investing in sustainable alternatives such as biodegradable polymers and recycled materials to align with global sustainability goals.

Market Challenges

- High Initial Investment and Processing Complexity: Setting up thermo compression foaming facilities requires advanced equipment, high-temperature molds, and specialized expertise, leading to significant capital investment. The process also demands precise control of temperature, pressure, and material properties, making it challenging for smaller manufacturers to adopt this technology cost-effectively.

- Material Compatibility and Process Limitations: Not all polymers or composites are suitable for thermo compression foaming. The industry faces challenges in finding the right material formulations that offer desired properties such as thermal stability, mechanical strength, and foam uniformity. Additionally, some bio-based and recycled polymers struggle with consistent performance, limiting their widespread adoption in demanding applications.

Market Trends

- Integration of Smart and Functional Foams: The industry is witnessing advancements in smart foams with self-healing, shape-memory, and conductive properties. These innovative materials are being explored for applications in electronics, medical devices, and wearable technology, where foams can provide enhanced functionality beyond traditional insulation and cushioning roles.

- Hybrid Manufacturing and 3D Printing Technologies: The combination of additive manufacturing (3D printing) with thermo compression foaming is opening new possibilities for customized, high-performance foamed structures. This hybrid approach allows for the design of complex geometries with controlled porosity, reducing material waste and optimizing performance in sectors such as biomedical, aerospace, and high-end consumer goods.

Unlike thermosetting foams, which undergo irreversible chemical crosslinking, thermoplastic foams can be reheated, reshaped, and recycled, significantly reducing material waste and production costs. Their ability to be molded into complex shapes with precise control over density and mechanical properties makes them ideal for industries such as automotive, packaging, construction, and consumer goods. Additionally, thermoplastic foams offer excellent impact resistance, flexibility, and durability, ensuring long-term performance in demanding applications.

Advances in material science have led to the development of high-performance thermoplastic foams with enhanced thermal insulation, acoustic damping, and lightweight properties, further driving their adoption. With the global push towards sustainability and circular economy initiatives, manufacturers are increasingly investing in bio-based and recycled thermoplastic foams, reinforcing their dominance in the thermo compression foaming market.

The automotive industry is leading the thermo compression foaming market primarily due to its continuous demand for lightweight, high-performance materials that enhance fuel efficiency, reduce emissions, and improve vehicle safety.

With stringent global regulations pushing for lower carbon footprints and better energy efficiency, automakers are increasingly replacing traditional metal and solid plastic components with lightweight foamed materials that maintain strength while reducing vehicle weight. Thermo compression foaming enables the production of durable, impact-resistant, and sound-absorbing foamed parts, making it ideal for interior components such as dashboards, door panels, headliners, and seating structures. Additionally, these foamed materials contribute to better crash absorption, thermal insulation, and noise reduction, significantly enhancing passenger comfort and safety.

The ability to use recyclable thermoplastic foams aligns with the automotive industry's shift toward sustainable and eco-friendly manufacturing, further solidifying its dominance in this market. As electric vehicles (EVs) gain traction, the need for lightweight yet strong materials becomes even more critical to optimize battery efficiency and extend driving range, ensuring that the automotive sector continues to drive innovation and adoption in the thermo compression foaming market.

North America is leading the thermo compression foaming market primarily due to its well-established industrial base, strong R&D capabilities, and high adoption of advanced manufacturing technologies across key sectors such as automotive, aerospace, packaging, and construction.

The region is home to major automotive manufacturers and suppliers who are actively integrating lightweight foamed materials to enhance vehicle fuel efficiency and meet stringent emission regulations. Additionally, North America has a robust focus on sustainable and eco-friendly materials, driving the demand for recyclable and bio-based thermoplastic foams. The presence of leading aerospace companies further accelerates the market, as the industry relies on high-performance, lightweight foams for insulation and structural applications.

Moreover, the region’s strong investment in technological advancements, automation, and material innovation enables faster adoption of thermo compression foaming techniques, improving cost efficiency and product quality. Government regulations promoting energy-efficient buildings and sustainable packaging solutions also contribute to the widespread use of thermo compression foamed materials in construction and consumer goods. With continuous advancements in manufacturing processes, research collaborations, and sustainability initiatives, North America remains at the forefront of growth and innovation in the thermo compression foaming market.

- In July 2024, FLEXTECH partnered with Sun Path Products, Inc. to design and select materials for Spyn System foam components in skydiving equipment.

- In February 2024, Janco, Inc. launched Janco Medical, a division specializing in cleanroom manufacturing and medical packaging, with ISO 13485 and FDA registrations.

- In July 2023, Toray Advanced Composites expanded its Morgan Hill plant by 74,000 sq. ft. to meet the rising demand for aerospace, defense, and industrial composites.

- In October 2021, Intertech Products, Inc. acquired Oji Intertech, Inc. to strengthen its presence in automotive, transportation, and industrial packaging.

- In January 2021, Tooling Tech Group (TTG) opened a 72,000 sq. ft. facility in La Vergne, Tennessee, consolidating its Automation division to enhance manufacturing for multiple industries.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Thermocompression foaming Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Foam Type

- Thermoplastic Foams

- Needle-Punch Nonwovens

- Lightweight Glass Mat Thermoplastic

By End-Use Industry

- Automotive

- Aerospace

- Medical

- Construction

- Electrical & Electronics

- Other End-Use Industries

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- UFP Technologies, Inc.

- Teijin Limited

- SGL Carbon SE

- Toray Industries, Inc.

- Mitsubishi Chemical Group

- Saudi Basic Industries Corporation

- Ensinger GmbH

- Trocellen

- Hexcel Corporation

- Huntsman Corporation

- Core Molding Technologies, Inc

- Janco, Inc.

- Armacell International S.A.

- Ray Products, Inc.

- RCO Engineering

- Sonfarrel Aerospace LLC

- Tech Plaastic Industrie Pvt Ltd

- AP&T AB

- Klaus Kunststofftechnik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.02 Billion |

| Forecasted Market Value ( USD | $ 13.93 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |