This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The ability of steel to withstand high loads and extreme weather conditions makes it an ideal choice for infrastructure projects such as bridges and railway tracks. Additionally, its recyclability makes it an environmentally friendly option, contributing to sustainability efforts in the construction industry. Innovation has significantly improved the efficiency and quality of structural steel production. Advanced manufacturing processes such as automated welding, 3D modeling, and computer-aided design (CAD) have streamlined fabrication and assembly.

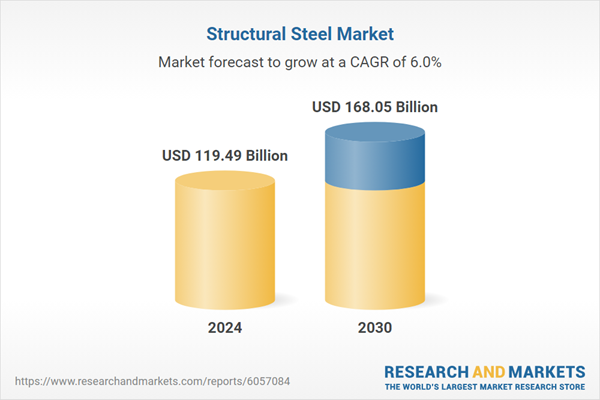

According to the research report “Global Structural Steel Market Outlook, 2030” the global market is projected to reach market size of USD 168.05 Billion by 2030 increasing from USD 119.49 in 2024, growing with 8.55% CAGR by 2025-30. High-strength steel variants have been developed to reduce weight while maintaining structural integrity, allowing for more efficient and cost-effective designs. The use of Building Information Modeling (BIM) has also revolutionized the industry, enabled better project planning and reducing material waste. Despite its many advantages, the structural steel industry faces several challenges.

Fluctuations in raw material prices, particularly iron ore and scrap metal, can impact production costs. Additionally, supply chain disruptions, labour shortages, and environmental regulations add to the complexities of steel manufacturing. Competition from alternative building materials such as reinforced concrete and composite structures also poses a challenge. However, industry leaders continue to invest in research and innovation to address these issues. Sustainability is a major focus for the structural steel industry.

Efforts to reduce carbon emissions in steel production are gaining momentum, with companies investing in cleaner technologies such as hydrogen-based steelmaking and electric arc furnaces. The circular economy approach, where steel is recycled and reused, further enhances the industry's eco-friendly profile. As governments worldwide push for greener construction practices, structural steel is expected to play a key role in sustainable development.

Market Drivers

- Urbanization and Infrastructure Development: Rapid urbanization, particularly in developing economies, is a significant driver of the structural steel industry. As cities expand, there is a growing demand for high-rise buildings, transportation networks, bridges, and industrial complexes - all of which rely heavily on structural steel. Government initiatives for smart cities, infrastructure modernization, and large-scale public projects are fueling the demand for steel in construction.

- Technological Advancements in Steel Production: Innovations in steel manufacturing, such as automation, artificial intelligence (AI), and advanced metallurgical techniques, are improving production efficiency and reducing costs. High-performance steel alloys, enhanced corrosion resistance, and lightweight structural steel solutions are enabling stronger and more sustainable construction projects. The integration of digital tools like Building Information Modeling (BIM) is also streamlining design and fabrication, further driving industry growth.

Market Challenges

- Volatility in Raw Material Prices: The structural steel industry is highly dependent on raw materials like iron ore, coking coal, and scrap metal. Price fluctuations due to global supply chain disruptions, geopolitical tensions, and changing trade policies can significantly impact production costs. This volatility makes it challenging for steel manufacturers to maintain consistent pricing and profitability.

- Decarbonization and Environmental Regulations: As governments and industries push for carbon neutrality, the steel sector faces increasing pressure to reduce its carbon footprint. Traditional steelmaking processes are energy-intensive and contribute to high CO₂ emissions. Compliance with strict environmental regulations and the need for green technologies, such as hydrogen-based steel production, pose significant cost and operational challenges for steel manufacturers.

Market Trends

- Rise of Green and Recycled Steel: Sustainability is shaping the future of the steel industry, with a growing emphasis on recycled and low-emission steel production. Companies are investing in electric arc furnaces (EAFs), which use scrap metal instead of raw iron ore, significantly reducing energy consumption and emissions. Additionally, innovations like carbon capture and storage (CCS) and hydrogen-based steelmaking are gaining traction to create more environmentally friendly steel.

- Modular and Prefabricated Steel Structures: The shift toward modular construction and prefabricated steel components is revolutionizing the industry. Pre-engineered steel buildings, modular bridge structures, and factory-fabricated steel components are improving construction speed, reducing labor costs, and minimizing material waste. This trend is particularly significant in commercial and residential construction, where faster project timelines are crucial.

Their high strength-to-weight ratio allows for efficient load distribution, reducing the need for excessive materials while maintaining structural integrity. Beams come in various shapes, such as I-beams, H-beams, and T-beams, each designed for specific applications to maximize efficiency and stability. Their ability to resist bending and shear forces makes them ideal for frameworks, floor joists, and roof structures. Additionally, beams are widely used in modular and prefabricated construction, further enhancing their demand due to ease of assembly and cost savings in labor and materials.

With advancements in steel fabrication, high-strength beams are being developed to improve performance while reducing weight, making them even more appealing for modern construction projects. Their compatibility with welding, bolting, and riveting also adds to their popularity, as they can be seamlessly integrated into different structural designs. Furthermore, with the global push for sustainable construction, steel beams - being 100% recyclable - align with green building initiatives, further reinforcing their leadership in the structural steel market.

Infrastructure leads the structural steel market due to the increasing need for durable, large-scale construction projects such as bridges, highways, airports, railways, and power plants, all of which rely heavily on steel for strength and longevity.

Governments worldwide are investing in infrastructure expansion and modernization to support economic growth, urbanization, and industrialization, further driving demand for structural steel. Steel's ability to withstand heavy loads, extreme weather conditions, and seismic activity makes it the preferred material for critical infrastructure projects. Its high tensile strength, flexibility, and resistance to corrosion ensure that structures remain safe and functional for decades. Additionally, steel allows for faster construction compared to traditional materials like concrete, reducing project timelines and overall costs.

The growing adoption of prefabricated and modular steel components in infrastructure projects enhances efficiency and minimizes on-site labor requirements. Moreover, the push for sustainable development has led to the incorporation of recycled and low-emission steel in infrastructure projects, making steel a key player in the global transition toward eco-friendly construction. With continuous technological advancements and increasing public and private sector investments, infrastructure remains the dominant segment in the structural steel market, reinforcing its long-term growth potential.

Welded structures are leading in the structural steel market due to their superior strength, seamless design integration, and cost-effective assembly, making them the preferred choice for a wide range of construction and industrial applications.

Welding allows for strong, continuous connections between steel components, eliminating the need for bolts or rivets that could weaken over time, resulting in highly durable and stable structures. This process enhances load-bearing capacity, making welded steel frameworks ideal for high-rise buildings, bridges, pipelines, offshore platforms, and heavy machinery.

The flexibility of welding enables intricate and customized designs that meet specific engineering requirements, allowing architects and engineers to create innovative and complex structures with greater precision. Additionally, welded structures minimize material waste and reduce the need for additional reinforcements, leading to cost savings in both raw materials and labor.

Advances in automated welding technologies, such as robotic welding and laser welding, have further improved efficiency, precision, and consistency, ensuring high-quality construction with minimal errors. Moreover, as industries prioritize sustainability, welded steel structures contribute to environmental goals by supporting the use of high-strength, lightweight steel that reduces overall material consumption and enhances energy efficiency. With rapid urbanization, growing industrial activities, and increasing demand for sustainable construction, welded structures continue to dominate the structural steel market, reinforcing their importance in modern infrastructure and engineering.

Carbon steel is leading the structural steel market because it offers an ideal combination of high strength, cost-effectiveness, and adaptability, making it the preferred choice for a vast range of construction and industrial applications.

As one of the most widely used steel types, carbon steel provides excellent structural integrity, allowing it to support heavy loads in buildings, bridges, pipelines, and transportation infrastructure. Its high tensile strength ensures durability and resistance to deformation under stress, making it suitable for both static and dynamic structures. Additionally, carbon steel is significantly more affordable compared to alloy or stainless steel, making it an economical option for large-scale projects where cost efficiency is a priority. The material's versatility allows it to be easily welded, machined, and fabricated into various structural components, including beams, columns, plates, and reinforcing bars.

Furthermore, carbon steel’s availability in different grades, such as low, medium, and high carbon steel, enables engineers to select the right balance between strength, flexibility, and toughness based on project requirements. Advances in coatings and treatments, such as galvanization and corrosion-resistant finishes, have further improved carbon steel's longevity, making it suitable for both indoor and outdoor applications. With rapid urbanization, infrastructure expansion, and industrial growth, the demand for durable, cost-efficient, and high-performance materials continues to rise, ensuring carbon steel remains the dominant choice in the structural steel market.

The Asia-Pacific (APAC) region is leading the structural steel market due to its unprecedented pace of urbanization, large-scale industrialization, and massive infrastructure development driven by economic growth and government investments.

Countries like China, India, Japan, and South Korea are at the forefront of this expansion, with booming construction activities in residential, commercial, and industrial sectors. China, the world’s largest steel producer and consumer, plays a pivotal role in shaping the structural steel market, with its vast manufacturing capabilities and extensive infrastructure projects, such as high-speed rail networks, bridges, and skyscrapers. India is also experiencing significant demand for structural steel, fueled by government initiatives like "Make in India" and large public infrastructure projects, including smart cities, highways, and metro rail systems.

The rapid expansion of industries such as automotive, energy, and shipbuilding further strengthens the need for structural steel across APAC. Additionally, the region benefits from abundant raw material availability, lower production costs, and strong domestic consumption, making it a dominant force in the global steel market. As environmental regulations push for greener steel production, APAC countries are also investing in sustainable technologies, such as electric arc furnaces and hydrogen-based steelmaking, ensuring long-term growth and competitiveness. With continuous urban expansion, rising foreign investments, and increasing construction demand, APAC remains the driving force behind the structural steel industry’s global dominance.

- In August 2023, Hybar LLC, a metal scrap recycling company commenced the construction of its steel rebar mill project in Arkansas, U.S. Machinery is being supplied by SMS group GmbH, and will utilize steel scrap as feedstock.

- In March 2023, JSPL announced its plans to produce the first-ever fire-resistant steel structures in India at its facility located in Raigarh, Chhattisgarh, India.

- In March 2023, Nippon Steel & Sumitomo Metal Corporation, Japan's largest steelmaker, announced plans to invest USD 1.5 billion in its structural steel business. The investment will be used to expand production capacity and develop new products.

- In February 2023, China Steel Corporation, Taiwan's largest steelmaker, announced plans to invest USD 2.5 billion in its structural steel business. The investment will be used to expand production capacity and upgrade technology.

- In January 2023, ArcelorMittal, the world's largest steelmaker, announced plans to invest USD 1 billion in its structural steel business. The investment will be used to expand production capacity and develop new products.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Structural Steel Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product

- Beams

- Angles

- Channels

- Steel Plates & Sheet

- Squares Tubes

- Others

By Application

- Residential Construction

- Commercial Construction

- Industrial Structures

- Infrastructure

- Energy & Power

By Connection Type

- Bolted Structures

- Welded Structures

- Riveted Structures

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ArcelorMittal S.A.

- Nippon Steel Corporation

- POSCO

- JFE Holdings, Inc.

- Nucor Corporation

- Voestalpine AG

- China Baowu Steel Group

- ThyssenKrupp AG

- Gerdau S.A.

- Hyundai Steel Co., Ltd.

- Anshan Iron and Steel Group Corporation

- Tata Steel Ltd.

- EVRAZ plc

- Steel Authority of India Limited

- SSAB AB

- British Steel Limited

- JSW Steel Limited

- OJSC Novolipetsk Steel

- Kobe Steel Ltd.

- Delong Steel

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 219 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 119.49 Billion |

| Forecasted Market Value ( USD | $ 168.05 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |