This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The automotive plastic bumper market is experiencing significant growth, driven by increasing vehicle production, advancements in material technology, and rising demand for lightweight components. As automakers strive to enhance fuel efficiency and comply with stringent emission regulations, plastic bumpers have emerged as a preferred choice due to their lightweight nature and cost-effectiveness. A key factor fueling market growth is the rising popularity of electric vehicles (EVs). As EV manufacturers focus on optimizing battery performance and extending driving range, the adoption of lightweight plastic components, including bumpers, has increased significantly.

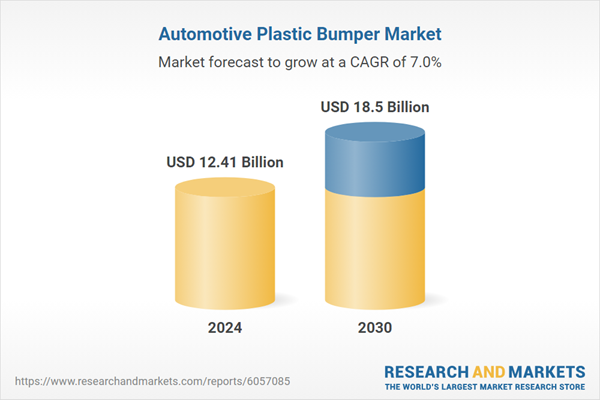

According to the research report “Global Automotive Plastic Bumper Market Outlook, 2030” the global market is projected to reach market size of USD 180.06 Billion by 2030 increasing from USD 118.65 in 2024, growing with 7.35% CAGR by 2025-30. The push for sustainability has also influenced the market, with companies investing in recyclable and bio-based plastics to align with global environmental goals. This shift is particularly evident in regions like Europe and North America, where governments have introduced strict regulations on vehicle emissions and material recyclability.

The Asia-Pacific region dominates the automotive plastic bumper market, primarily due to the high production of vehicles in countries like China, Japan, and India. The region's strong automotive manufacturing base, coupled with increasing consumer demand for fuel-efficient and stylish vehicles, has propelled the growth of plastic bumpers. Additionally, emerging markets in Latin America and Africa are witnessing gradual adoption, fueled by urbanization, rising disposable incomes, and expanding automotive infrastructure. Technological advancements in manufacturing processes, such as 3D printing and automated injection molding, have further boosted the production efficiency of plastic bumpers.

Leading manufacturers are focusing on integrating smart technologies into bumpers, such as sensors for collision detection and pedestrian safety, creating new growth opportunities in the industry. As automotive design continues to evolve, the demand for innovative and sustainable plastic bumpers is expected to drive substantial market expansion in the coming years.

Market Drivers

- Advancement in Autonomous and Connected Vehicles: The rise of autonomous and connected vehicles is significantly driving the demand for advanced plastic bumpers. Modern bumpers are no longer just protective components; they are now designed to integrate sensors, cameras, and radar systems that support Advanced Driver Assistance Systems (ADAS). As self-driving technology progresses, bumpers will play a crucial role in housing and protecting these high-tech components while maintaining durability and lightweight properties.

- Rise in Shared Mobility and Fleet Vehicles: The growing trend of ride-sharing, car rentals, and fleet-based transportation services is accelerating the need for durable and cost-efficient plastic bumpers. Vehicles used for shared mobility experience higher wear and tear, leading to frequent maintenance and replacement needs. Plastic bumpers, being lightweight and easy to repair or replace, are preferred by fleet operators looking to reduce operational costs and downtime.

Market Challenges

- Plastic Waste Management and Recycling Concerns: While plastic bumpers contribute to lightweight and fuel-efficient vehicles, they also pose significant environmental challenges. Disposing of and recycling end-of-life vehicle (ELV) bumpers remains a critical issue, as not all plastics used in bumpers are easily recyclable. Governments and industry stakeholders are under pressure to develop sustainable solutions, such as bio-based plastics and closed-loop recycling systems, to mitigate plastic waste concerns.

- Supply Chain Disruptions and Raw Material Volatility: The automotive industry has faced persistent supply chain disruptions, particularly in the wake of global events like the COVID-19 pandemic and geopolitical tensions. Shortages of key raw materials, such as polypropylene (PP) and ABS, have led to price fluctuations and production delays. Additionally, dependence on a limited number of suppliers for high-quality automotive-grade plastics has increased vulnerability in the market, impacting production timelines and overall costs.

Market Trends

- Integration of Smart and Active Safety Bumpers: The future of plastic bumpers is shifting towards smart bumpers equipped with sensors, impact detection systems, and self-healing materials. These bumpers will not only enhance vehicle safety but also support collision mitigation technologies by providing real-time feedback to onboard safety systems. Some manufacturers are exploring the use of self-repairing polymers that can heal minor scratches and dents automatically, reducing maintenance costs.

- Adoption of 3D Printing in Bumper Manufacturing: 3D printing technology is revolutionizing bumper production by enabling rapid prototyping, lightweight design customization, and cost-efficient mass production. Automotive manufacturers are increasingly using additive manufacturing to create complex bumper shapes with optimized strength and weight. This technology also facilitates on-demand production, reducing waste and inventory costs, making it a game-changer for both OEMs and aftermarket parts manufacturers.

Polypropylene dominates the automotive plastic bumper industry primarily because of its low density, which significantly reduces vehicle weight and improves fuel efficiency - a critical factor in modern automotive design, especially with the rise of electric and fuel-efficient vehicles. It is also highly cost-effective, making it a preferred choice for large-scale production. Unlike other polymers, PP offers an excellent balance of impact resistance and flexibility, allowing bumpers to absorb and dissipate energy effectively during collisions, thereby enhancing passenger and pedestrian safety.

Furthermore, its high moldability and ease of processing enable manufacturers to create complex bumper designs with integrated features like aerodynamic contours and sensor housing for advanced driver assistance systems (ADAS). Additionally, PP exhibits good chemical and weather resistance, ensuring durability against exposure to extreme temperatures, UV radiation, and road chemicals, reducing long-term maintenance costs.

Sustainability is another key factor, as polypropylene is recyclable, aligning with the global push toward environmentally friendly automotive manufacturing. With advancements in reinforced PP composites, the material continues to evolve, offering even greater strength and performance while maintaining its lightweight benefits. These factors collectively make polypropylene the undisputed leader in the automotive plastic bumper market.

The passenger vehicle segment leads the automotive plastic bumper market due to its high production volume, increasing consumer demand for lightweight and fuel-efficient vehicles, and stringent safety and design regulations.

Passenger vehicles, including sedans, hatchbacks, SUVs, and crossover vehicles, dominate the automotive plastic bumper market primarily because of their mass production and widespread consumer preference. With global vehicle ownership on the rise, especially in developing economies like China, India, and Brazil, the demand for cost-effective, durable, and aesthetically appealing bumpers has surged. Automakers are continuously focusing on reducing vehicle weight to improve fuel efficiency and meet stringent emission norms, which has further accelerated the adoption of lightweight plastic bumpers in passenger cars.

Additionally, safety regulations and crash test requirements enforced by government bodies like Euro NCAP, NHTSA, and IIHS mandate the use of impact-resistant, energy-absorbing bumpers, making plastic the ideal material due to its superior flexibility and shock absorption properties. Moreover, modern passenger vehicles integrate advanced driver assistance systems (ADAS) and aerodynamic bumper designs for improved performance and efficiency, both of which are easier to achieve with plastic materials.

The growing trend of electric vehicles (EVs) and hybrid cars has further boosted the demand for plastic bumpers, as EV manufacturers emphasize lightweight components to extend battery range. With continuous innovations in recyclable plastics and smart bumper technology, the passenger vehicle segment remains the primary driver of growth in the automotive plastic bumper market.

The front bumper leads the automotive plastic bumper market because it plays a critical role in vehicle safety, aerodynamics, and aesthetics, while also being more prone to impact, requiring frequent replacements and advanced design integration.

The front bumper dominates the automotive plastic bumper market due to its primary function in absorbing impact during collisions, ensuring pedestrian safety, and minimizing damage to the vehicle’s essential components like the engine, radiator, and headlights. As the first line of defense in frontal crashes, front bumpers must comply with stringent safety regulations and crash test standards enforced by organizations like Euro NCAP, NHTSA, and IIHS, leading manufacturers to continuously improve their design, durability, and material composition.

Additionally, front bumpers play a significant role in aerodynamics, influencing fuel efficiency and high-speed stability, especially in modern electric and fuel-efficient vehicles where drag reduction is a key design priority. The rise of Advanced Driver Assistance Systems (ADAS) has further increased the complexity and importance of front bumpers, as they now integrate radars, cameras, and sensors for features like adaptive cruise control, collision avoidance, and automatic emergency braking.

Moreover, because of frequent exposure to road debris, minor accidents, and parking collisions, front bumpers require more replacements than rear bumpers, driving higher demand in the aftermarket sector. With evolving lightweight material innovations, smart bumper technologies, and enhanced aesthetic customizations, the front bumper remains the most significant and rapidly advancing component in the automotive plastic bumper industry.

Injection molding leads the automotive plastic bumper market because it enables mass production of high-quality, lightweight, and complex bumper designs with superior precision, cost efficiency, and material flexibility.

Injection molding is the dominant manufacturing process for automotive plastic bumpers due to its ability to produce intricate and customized designs with high repeatability and minimal material waste. The technique involves injecting molten plastic, typically polypropylene (PP), ABS, or thermoplastic olefins (TPO), into a mold under high pressure, allowing for the creation of durable, lightweight, and impact-resistant bumpers that meet strict safety and aesthetic standards. One of the biggest advantages of injection molding is its high production efficiency, making it ideal for the automotive industry, where large volumes of bumpers are required to meet global vehicle demand.

This method also offers design flexibility, enabling automakers to incorporate complex aerodynamic shapes, integrated sensor housings for ADAS, and aesthetic enhancements without compromising on strength or weight. Furthermore, cost-effectiveness is a key driver, as injection molding allows for lower labor costs, reduced production time, and optimized material utilization, which helps automakers maintain competitive pricing.

Additionally, advancements in multi-material injection molding and recyclable polymer composites have made the process more sustainable, aligning with the industry's increasing focus on eco-friendly manufacturing practices. With continuous improvements in automation, precision engineering, and material science, injection molding remains the preferred choice for producing high-performance, lightweight, and cost-effective plastic bumpers in the automotive industry.

The Asia-Pacific (APAC) region leads the automotive plastic bumper market due to its high vehicle production, rapidly growing automotive industry, cost-effective manufacturing, and increasing demand for lightweight and fuel-efficient vehicles.

The APAC region dominates the automotive plastic bumper market primarily because it is home to some of the world’s largest automobile manufacturing hubs, including China, Japan, India, and South Korea. These countries account for a significant share of global vehicle production, driven by high domestic demand, export activities, and strong investments in automotive infrastructure. China, in particular, is the largest automotive market in the world, with a strong presence of both domestic and international automakers, fueling the demand for cost-effective and lightweight plastic bumpers.

Additionally, the availability of low-cost raw materials, affordable labor, and advanced manufacturing technologies has made APAC a preferred destination for automotive component production, including plastic bumpers. The rise in electric vehicles (EVs) and hybrid cars, especially in China and Japan, has further increased the demand for lightweight plastic bumpers, as manufacturers focus on improving battery efficiency and reducing vehicle weight. Moreover, government regulations promoting fuel efficiency, emission reduction, and vehicle safety have pushed automakers in APAC to adopt advanced bumper materials and designs, driving innovation in the market.

The growing middle-class population, rising disposable incomes, and increasing urbanization have also contributed to higher vehicle sales in emerging markets like India, Indonesia, and Thailand, further strengthening APAC’s leadership in the automotive plastic bumper industry. With continuous advancements in automotive manufacturing, supply chain efficiency, and sustainability initiatives, the APAC region is expected to maintain its dominance in the market for years to come.

- In April 2024, the fourth-generation Maruti Suzuki Swift is set to launch, with an expected release in May. The design will largely match the international model, with modifications tailored for the Indian market. The new Swift will feature a redesigned exterior with LED headlamps integrated into an L-shaped daytime running light (DRL). In India, most variants will include a chrome grille surround. The interior will closely resemble the European model, with a right-side steering wheel and control buttons. Although no official interior images have been released, Maruti will add stylish touches, including a touch of color on the dashboard.

- In February 2024, MBA Polymers UK Ltd. launched a recycling program to repurpose broken or obsolete car bumpers into high-quality polymers for the automotive sector. The company now collects bumpers from authorized treatment facilities (ATFs) at two UK sites. This initiative reduces landfill waste, lowers carbon emissions, supports automakers in meeting recycling targets, and promotes a circular economy. By recycling bumpers directly, MBA Polymers UK can produce enhanced automotive-grade polymers without relying on post-shredding recovery.

- In April 2022, Novitec introduced a carbon fiber body kit for the Ferrari 458 Speciale. The kit includes a trunk-lid side panel with double fins, an air-intake louvre, taillight covers, a front spoiler lip, and flaps for the front air guide.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Automotive Plastic Bumpers Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Type

- Front Bumper

- Rear Bumper

By Sales Channel

- OEM

- Aftermarket

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Magna International Inc.

- Hyundai Mobis

- Toyota Motor Corporation

- Samvardhana Motherson International Limited

- AD Plastik

- Plasman Group

- Opmobility

- NTF (India) Pvt. Ltd.

- Fab Fours, Inc

- Rehau Group

- Yanfeng International Automotive Technology Co. Ltd.

- Seoyon E-Hwa Co., Ltd

- KIRCHHOFF Automotive

- Tong Yang Industry Co., Ltd.

- HUAYU Automotive Systems Co Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.41 Billion |

| Forecasted Market Value ( USD | $ 18.5 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |