Speak directly to the analyst to clarify any post sales queries you may have.

RECENT VENDOR ACTIVITIES

- In March 2024, Kerry Dairy launched a new range of oat and dairy-blended products, combining the nutritional benefits of both ingredients. This innovative product line aims to provide a more sustainable and inclusive option for consumers seeking plant-based alternatives without compromising on taste or texture. The oat-dairy blend is designed to offer a dairy experience with a plant-based twist, catering to diverse dietary preferences and enhancing product variety. This launch reflects Kerry Dairy’s commitment to sustainability, catering to evolving consumer demands for more versatile and eco-friendly food options.

- In February 2024, Fonterra Co-operative Group Ltd. announced its imminent plans to merge the organization’s dairy businesses in Australia and New Zealand (Fonterra Australia and Fonterra Brands New Zealand). This strategic integration initiative is expected to further strengthen the company’s position in this region.

KEY TAKEAWAYS

- By Product Type: In 2024, the powder segment accounts for the largest market share. The segment is growing due to its long shelf life and lower transportation costs.

- By Application: The food & beverage segment shows the highest growth, with a CAGR of 4.11%. The segment is growing as they are widely used in a variety of products including powdered milk, cheese powder, and creamers.

- By Geography: The APAC region dominates the global dairy blends market share. The driven by rising disposable income, dietary shifts, and urbanization.

- Growth Factor: The global dairy blends market is poised for growth, driven by the expansion of the food industry and the increasing health consciousness among consumers.

MARKET TRENDS

Rising Flavor Innovations

Manufacturers are introducing diverse and unique flavors to meet evolving consumer preferences. Popular trends include fruit-infused flavors (such as strawberry and mango), dessert-inspired options (like caramel and chocolate), and botanical flavors (such as lavender and matcha). Leading brands like Nestlé and Danone have launched flavored dairy blends with natural extracts to enhance consumer appeal. As demand for natural and organic flavoring grows, brands are increasingly using clean-label ingredients. Customized flavored dairy blends are gaining traction in yogurts, bakery products, and ready-to-drink beverages.Expansion of Dairy Blends into New Application Areas

Dairy blends are increasingly being incorporated into plant-based meat alternatives, functional foods, and pet nutrition. Their versatility enhances texture, improves flavor, and provides nutritional fortification across various food categories. High-protein dairy blends are gaining popularity in sports nutrition products and protein-enriched beverages. Additionally, the demand for savory dairy-infused snacks and ready-to-eat meals is rising, driven by shifting consumption habits. Leading companies such as FrieslandCampina and Kerry Group are investing in innovative dairy blend formulations for non-traditional applications.MARKET DRIVERS

Growth in the Food Industry

The expanding food and beverage industry is driving the demand for dairy blends, particularly in processed foods, bakery, and confectionery products. Fast-food chains such as McDonald's and Burger King utilize dairy blends in cheese-based products, sauces, and desserts, further fueling market growth. The rising demand for ready-to-eat meals in regions like North America and Europe is prompting manufacturers to incorporate dairy blends for extended shelf life and improved texture. Major food companies, including Nestlé and Mondelez, are adopting dairy blends as cost-effective alternatives to whole milk and cream in their products. Meanwhile, emerging economies such as India and Brazil are experiencing a surge in dairy consumption, driven by increasing urbanization and a growing middle-class population.Rise in Health Consciousness

Consumers are increasingly seeking nutritional benefits from dairy products, driving the growth of high-protein, low-fat dairy blends. Brands like Fairlife and Yoplait are introducing fortified dairy blends enriched with calcium, vitamins, and probiotics to support gut health. Lactose-intolerant consumers are fueling demand for low-lactose and lactose-free dairy blends, boosting the market for specialized dairy formulations. Additionally, the sports and fitness industry is accelerating the demand for protein-enriched dairy blends, with companies like Muscle Milk and Optimum Nutrition leading the segment. Health-conscious trends in the APAC region, particularly in Japan and South Korea, are further driving demand for functional dairy blends in meal replacements and beverages.INDUSTRY RESTRAINTS

Stringent Regulations

Countries like the U.S. (FDA) and EU (EFSA) impose strict hygiene, safety, and labeling requirements, such as Good Manufacturing Practices (GMPs) and Hazard Analysis and Critical Control Points (HACCP) making it mandatory for dairy blend manufacturers to undergo extensive testing. In the European Union, dairy blends must meet specific standards for fat content and composition, making it difficult for global brands to introduce uniform products. The Codex Alimentarius standards limit the use of certain stabilizers and emulsifiers in dairy blends, forcing manufacturers to reformulate their products. The Codex Alimentarius sets global food safety standards, limiting certain stabilizers and emulsifiers in dairy blends, and influencing regulations in the EU, U.S., and other major markets.SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT TYPE

The global dairy blends market by product type is segmented into liquid, powder, and others. In 2024, the powder segment dominates the market and holds the largest share. Milk powder products are designed for extended shelf life. By removing the majority of moisture, fluid milk is transformed into a shelf-stable, dry powder. Powdered dairy blends are dehydrated formulations used across various applications due to their extended easy transportation and convenient storage. Surplus milk powder can be reconstituted when fresh milk supplies are limited, ensuring consistent availability. Additionally, these blends help lower transportation costs compared to liquid dairy products, enhancing cost efficiency in global trade by reducing mass and volume. Powdered dairy blends are widely used in bakery, confectionery, and infant formula due to their ease of handling and versatile formulation.INSIGHTS BY APPLICATION

The global dairy blends market by application is categorized into the food & beverages sector and non-food & beverages sector. The food & beverages sector shows prominent growth, with the fastest-growing CAGR of 4.11% during the forecast period. Powdered dairy blends are widely used in various products, including powdered milk, cheese powder, and creamers. They are particularly popular in the food service, baking, and beverage industries. Additionally, these blends can be customized to meet specific dietary preferences, such as low-fat, lactose-free, or plant-based options, making them suitable for a diverse range of consumers. Dairy blends serve as cost-effective alternatives to whole milk and butter in bakery production. As versatile and functional food ingredients, they are used across multiple food industries, including bakery, confectionery, and beverages. The growing demand for convenience foods and ready-to-drink dairy beverages is driving the increased use of dairy blends. They are also incorporated into a wide range of food and beverage products, including ready-to-eat meals, infant formula, and functional ingredients.GEOGRAPHICAL ANALYSIS

The APAC region dominates and holds the largest global dairy blends market share. The APAC dairy blend market is in a growth phase, driven by rising disposable incomes, shifting dietary habits, and rapid urbanization. Countries such as China, India, and Japan are fueling demand for convenient, fortified, and value-added dairy blends, particularly in infant nutrition, bakery applications, and sports nutrition.China and India dominate the Asia-Pacific dairy blends market due to their large populations and strong cultural emphasis on dairy consumption. China's extensive dairy farming and processing capabilities, combined with India's traditional dairy practices and cooperative structures, position these countries as key contributors to market growth.

SEGMENTATION & FORECASTS

- By Product Type

- Liquid

- Powder

- Others

- By Application

- Food & Beverages Sector

- Non-food & Beverages Sector

- By Geography

- APAC

- China

- India

- Japan

- Indonesia

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Turkey

- Saudi Arabia

COMPETITIVE LANDSCAPE

The global dairy blends market report consists of exclusive data on 24 vendors. The market is highly competitive, with key players such as Fonterra Co-operative Group, Arla Foods, Lactalis, Agropur, FrieslandCampina, Kerry Group, Danone, Abbott Nutrition, Nestle, and Cargill actively expanding their market presence through product innovation, strategic partnerships, and geographic expansion. With increasing demand for clean-label and sustainable dairy solutions, these companies are investing in R&D and sustainable sourcing practices to align with consumer preferences and regulatory standards, intensifying competition in the global dairy blends market. These companies are taking advantage of the increasing consumer desire for health-centric performance drinks.Key Vendors

- Fonterra Co-operative Group

- Arla Foods

- Lactalis

- Agropur

- FrieslandCampina

- Kerry Group

- Danone

- Abbott Nutrition

- Nestle

- Cargill

Other Prominent Vendors

- AAK

- Bakels

- dsm-firmenich

- Dana Foods

- Cape Food Ingredients

- Galloway Company

- The Kraft Heinz Company

- GC Ingredients

- All American Foods

- Batory Foods

- Dairy Farmers of America

- Schreiber Foods

- Land O'Lakes

- Döhler

KEY QUESTIONS ANSWERED

1. Which Application provides more business opportunities in the global dairy blends market?2. How big is the global dairy blends market?

3. Which product type has the largest share in the global dairy blends market?

4. What are the latest trends in the global dairy blends?

5. Who are the key players in the global dairy blends market?

Table of Contents

Companies Mentioned

- Fonterra Co-operative Group

- Arla Foods

- Lactalis

- Agropur

- FrieslandCampina

- Kerry Group

- Danone

- Abbott Nutrition

- Nestle

- Cargill

- AAK

- Bakels

- dsm-firmenich

- Dana Foods

- Cape Food Ingredients

- Galloway Company

- The Kraft Heinz Company

- GC Ingredients

- All American Foods

- Batory Foods

- Dairy Farmers of America

- Schreiber Foods

- Land O'Lakes

- Döhler

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

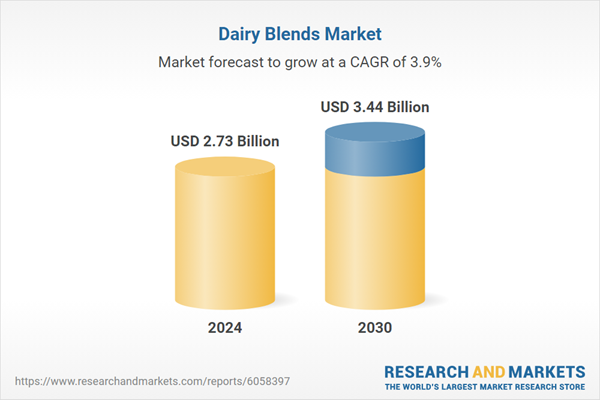

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.73 Billion |

| Forecasted Market Value ( USD | $ 3.44 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |