Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The growing consumer electronics industry, with increasing sales of smartphones, laptops, and wearables, is another major driver, as manufacturers seek batteries with improved energy density and charging capabilities. Moreover, significant investments in battery manufacturing by companies like Tesla, CATL, and LG Energy Solution have increased the production capacity of lithium-ion batteries, further driving electrolyte consumption. Stringent environmental regulations on conventional lead-acid batteries are shifting focus toward lithium-ion and sustainable alternatives. Additionally, the demand for high-performance electrolytes with better thermal stability, enhanced conductivity, and improved safety features continues to grow. Innovations in fluorine-free and non-flammable electrolytes are gaining traction, ensuring safer and more efficient battery operations across industries.

Key Market Drivers

Surging Demand for Electric Vehicles (EVs) and Energy Storage Systems (ESS)

The rapid expansion of the electric vehicle (EV) industry is one of the most significant drivers of the Global Battery Electrolyte Market. Governments worldwide are implementing stringent emission regulations, incentivizing EV adoption through subsidies, tax rebates, and infrastructure development. This shift toward sustainable transportation has fueled the demand for high-performance lithium-ion batteries, which rely heavily on advanced electrolytes for improved efficiency, thermal stability, and cycle life. Major automotive companies, including Tesla, BYD, Volkswagen, and General Motors, are increasing their EV production capacities, further accelerating electrolyte consumption. Additionally, the growing need for energy storage systems (ESS) in renewable power projects, such as solar and wind farms, has amplified the requirement for long-lasting and high-energy-density batteries.The intermittent nature of renewable energy sources necessitates efficient battery storage solutions, leading to innovations in liquid, gel, and solid-state electrolytes that enhance battery safety and longevity. As countries aim to reduce their reliance on fossil fuels and transition to clean energy solutions, the market for battery electrolytes is witnessing a steady rise, with manufacturers investing in next-generation electrolyte formulations to meet the evolving demands of EVs and ESS applications. By 2030, it is expected that electric vehicles will account for over 50% of total vehicle sales globally, driven by stricter emissions regulations and a push for sustainability.

Key Market Challenges

Raw Material Price Volatility and Supply Chain Disruptions

One of the most significant challenges facing the Global Battery Electrolyte Market is the volatile pricing and limited availability of raw materials used in electrolyte production. Essential components such as lithium salts (e.g., lithium hexafluorophosphate - LiPF₆), solvents (ethylene carbonate, dimethyl carbonate), and additives are subject to frequent price fluctuations due to geopolitical tensions, trade restrictions, and supply-demand imbalances. The rising global demand for electric vehicle (EV) batteries, consumer electronics, and energy storage systems (ESS) has placed immense pressure on raw material supplies, leading to periodic shortages and increased production costs. Additionally, the dominance of China in lithium-ion battery supply chains, including the manufacturing of electrolytes and lithium salts, makes other regions, such as North America and Europe, highly dependent on imports, exposing them to potential trade risks.Supply chain disruptions caused by COVID-19, geopolitical conflicts, and logistical bottlenecks have further intensified challenges for battery electrolyte manufacturers. Shipping delays, transportation restrictions, and labor shortages have impacted raw material procurement, leading to production slowdowns and cost overruns. To mitigate these risks, battery manufacturers and electrolyte producers are exploring alternative raw materials, securing long-term supply contracts, and expanding local production capacities. However, these strategies require significant investment, regulatory approvals, and time, making supply chain instability a persistent challenge for the Global Battery Electrolyte Market in the near term.

Key Market Trends

Rising Adoption of Solid-State and Advanced Electrolytes

A significant trend shaping the Global Battery Electrolyte Market is the shift toward solid-state electrolytes (SSEs) and advanced liquid electrolyte formulations. Traditional liquid electrolytes, which are widely used in lithium-ion batteries (LiBs), pose flammability and thermal stability risks, making safety a top concern for industries such as electric vehicles (EVs), consumer electronics, and energy storage systems (ESS). As a result, companies are investing heavily in solid-state battery (SSB) technology, which replaces liquid electrolytes with ceramic, polymer, or sulfide-based solid electrolytes, eliminating risks of leakage, fire, and thermal runaway. Major battery manufacturers, including Toyota, QuantumScape, and Solid Power, are actively developing solid-state batteries, aiming for higher energy density, longer lifespan, and enhanced safety.Beyond solid-state electrolytes, high-performance liquid and gel-based electrolytes are also gaining traction. Innovations such as high-voltage electrolytes for next-generation lithium-ion batteries, fluorine-free electrolyte solutions, and lithium-sulfur battery electrolytes are being explored to improve battery performance. Additionally, ionic liquid-based and water-based electrolytes are emerging as safer and environmentally friendly alternatives to conventional LiPF₆-based formulations. As demand for faster-charging, long-lasting, and more durable batteries increases, electrolyte manufacturers are prioritizing research and development (R&D) to bring new, high-efficiency electrolyte solutions to the market.

Key Market Players

- 3M Company

- UBE Corporation

- Guangzhou Tinci Materials Technology Co. Ltd

- Mitsubishi Chemical Holdings Corporation

- Targray Industries Inc

- NOHMs Technologies Inc.

- Shenzhen Capchem Technology Co. Ltd

- Mitsui Chemicals Inc.

Report Scope:

In this report, the Global Battery Electrolyte Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Battery Electrolyte Market, By Battery Type:

- Lead-Acid

- Lithium-Ion

Battery Electrolyte Market, By Electrolyte Type:

- Liquid

- Gel

- Solid

Battery Electrolyte Market, By End-Use:

- EV

- Consumer Electronics

- Energy Storage

- Others

Battery Electrolyte Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Battery Electrolyte Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- UBE Corporation

- Guangzhou Tinci Materials Technology Co. Ltd

- Mitsubishi Chemical Holdings Corporation

- Targray Industries Inc

- NOHMs Technologies Inc.

- Shenzhen Capchem Technology Co. Ltd

- Mitsui Chemicals Inc.

Table Information

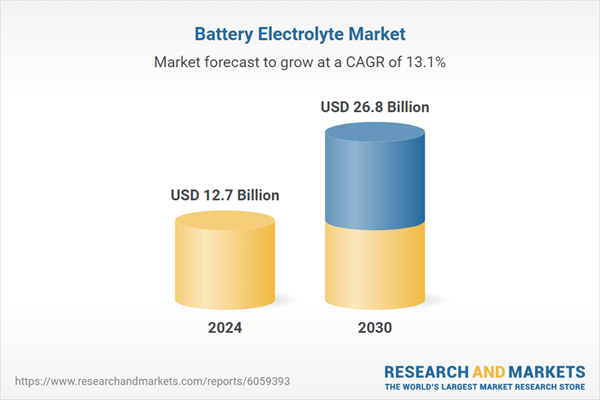

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.7 Billion |

| Forecasted Market Value ( USD | $ 26.8 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |