Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

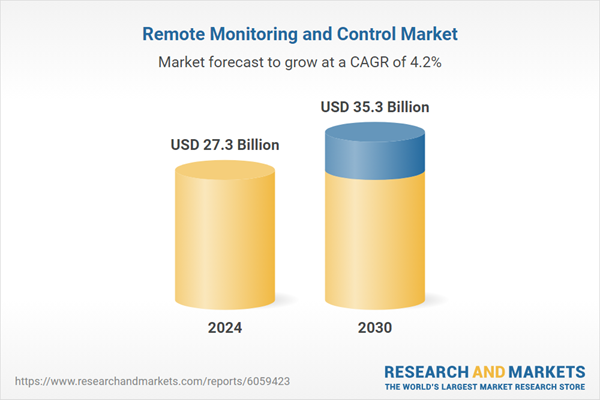

Additionally, the need for improved safety and risk management, especially in critical sectors such as oil and gas, drives demand for monitoring systems that ensure equipment reliability and safety. The shift towards remote operations, accelerated by the COVID-19 pandemic, has increased the reliance on such systems. Regulatory compliance in industries with strict safety standards also boosts the market, as remote monitoring ensures adherence. Furthermore, the rise of smart cities and infrastructure demands efficient management through remote systems, contributing to the market’s expansion. These combined factors are fueling the continued growth of the global remote monitoring and control market.

Key Market Drivers

Technological Advancements and Integration of IoT, AI, and Cloud Computing

Technological advancements play a pivotal role in the growth of the global remote monitoring and control market. The integration of Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing has revolutionized the way remote monitoring systems are deployed and operated across industries. IoT-enabled devices provide real-time data collection and seamless communication between assets and central control systems, enabling continuous monitoring and analysis of critical systems.AI algorithms further enhance the effectiveness of these solutions by enabling predictive maintenance, anomaly detection, and automated decision-making. For instance, AI can predict potential equipment failures by analyzing historical data and identifying patterns that humans may miss, thus reducing the risk of unplanned downtimes and costly repairs. Additionally, the adoption of cloud computing facilitates data storage and processing, allowing businesses to access remote monitoring insights anytime, anywhere, on any device, ensuring business continuity even when staff are not on-site.

These technological advancements also contribute to the scalability and flexibility of remote monitoring solutions. Businesses can now manage large, complex operations and assets across multiple locations with ease. For example, manufacturing plants can monitor machinery health across global facilities, energy grids can optimize power distribution in real-time, and healthcare providers can oversee patient vital signs remotely.

The increased interconnectivity brought by IoT, paired with the analytical power of AI, enables proactive and efficient control over operations, leading to cost savings and enhanced productivity. Additionally, cloud-based platforms offer businesses the ability to scale their remote monitoring solutions without significant upfront investments in infrastructure. These technological innovations are driving the adoption of remote monitoring and control systems, not just in traditional sectors like oil and gas, but also in emerging industries such as smart cities, healthcare, and agriculture, contributing to the overall growth of the market.

Key Market Challenges

Data Security and Privacy Concerns

One of the most significant challenges facing the global remote monitoring and control market is ensuring data security and privacy. As industries increasingly rely on IoT, cloud computing, and AI to manage operations remotely, they are simultaneously exposed to a higher risk of cyberattacks, data breaches, and unauthorized access to sensitive information. The vast amount of data generated by remote monitoring systems, such as operational metrics, employee information, and customer data, becomes an attractive target for cybercriminals. With remote monitoring systems being linked to cloud-based platforms and interconnected devices, businesses face the challenge of safeguarding this data from malicious entities, especially in sectors like healthcare, finance, and energy, where sensitive information is critical.Moreover, regulatory frameworks around data security and privacy are becoming more stringent, with laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. placing added pressure on companies to ensure the protection of personal and operational data. Failure to comply with these regulations can lead to heavy fines and reputational damage. Remote monitoring systems that store and process large volumes of data need robust encryption protocols, secure communication channels, and multi-factor authentication to protect against unauthorized access.

Additionally, vulnerabilities in the software or hardware of remote systems could leave organizations exposed to potential threats. The challenge, therefore, is not only in adopting secure technologies but also in educating stakeholders about cybersecurity risks and ensuring that the entire remote monitoring ecosystem is designed with data protection in mind. Addressing these security and privacy concerns is vital for organizations looking to leverage remote monitoring and control systems while safeguarding their operations and maintaining trust with customers.

Key Market Trends

Increasing Adoption of AI and Machine Learning for Predictive Maintenance

A significant trend in the global remote monitoring and control market is the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies, particularly for predictive maintenance. Traditionally, remote monitoring systems focused on real-time data collection and immediate reporting of issues. However, with the integration of AI and ML, these systems are becoming more advanced, offering the ability to predict potential equipment failures before they occur. By analyzing vast amounts of historical data and identifying patterns, AI algorithms can detect early warning signs of malfunctions, allowing operators to take proactive measures. This shift towards predictive maintenance helps industries reduce downtime, optimize resource allocation, and lower maintenance costs.For example, in industries such as manufacturing, oil and gas, and energy, predictive maintenance powered by AI and ML enables remote monitoring systems to analyze sensor data, detect anomalies, and schedule maintenance only when necessary, rather than relying on scheduled checks. This reduces unnecessary service calls and enhances asset lifespan. Additionally, AI can optimize system performance by adjusting operational parameters in real-time, further improving efficiency. As AI and ML continue to evolve, they will play a crucial role in the development of even more autonomous systems that can self-diagnose and perform corrective actions, minimizing human intervention and improving operational efficiency. The growing emphasis on predictive maintenance not only ensures smoother operations but also significantly impacts cost savings, making this trend a central driver for the remote monitoring and control market.

Key Market Players

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- General Electric Company

- ABB Ltd.

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser Group Services AG

Report Scope:

In this report, the Global Remote Monitoring and Control Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Remote Monitoring and Control Market, By Type:

- Solution

- Field Instruments

Remote Monitoring and Control Market, By End-User Industry:

- Oil and Gas

- Power Generation

- Chemical

- Metals & Mining

- Water and Wastewater

- Food & Beverages

- Pharmaceuticals

- Pulp & Paper

- Others

Remote Monitoring and Control Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Remote Monitoring and Control Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- General Electric Company

- ABB Ltd.

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser Group Services AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.3 Billion |

| Forecasted Market Value ( USD | $ 35.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |