Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

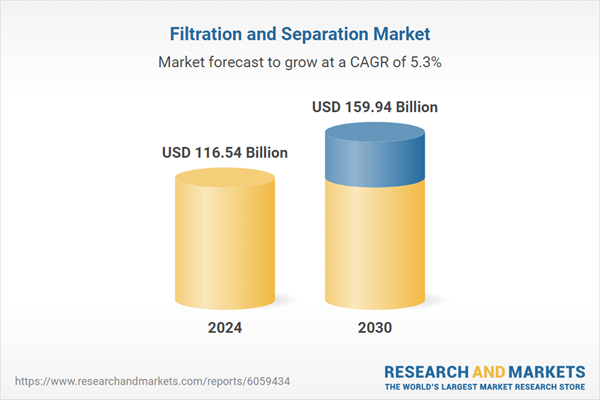

Filtration and separation technologies play a crucial role in various industries, including water and wastewater treatment, food and beverage, pharmaceuticals, oil and gas, chemicals, and power generation. With growing concerns over air and water pollution, industries are adopting advanced filtration solutions to ensure compliance with regulatory standards while improving operational efficiency. Additionally, rapid urbanization and population growth have heightened the need for effective water treatment systems, further propelling the market forward.

One of the key drivers of market expansion is the increasing need for clean and safe water. With depleting freshwater resources and rising contamination levels, governments and industries are investing in advanced membrane filtration technologies, such as reverse osmosis, ultrafiltration, and nanofiltration, to improve water quality. The wastewater treatment sector, particularly in developed nations, is witnessing rapid adoption of these technologies to meet sustainability goals. Furthermore, the growing demand for desalination plants, particularly in water-scarce regions like the Middle East and North Africa (MENA), is driving significant investments in filtration systems.

Key Market Drivers

Stringent Environmental Regulations and Sustainability Goals

The increasing enforcement of environmental regulations globally is a significant driver of the Filtration and Separation Market. Governments and regulatory bodies such as the Environmental Protection Agency (EPA), European Environment Agency (EEA), and China’s Ministry of Ecology and Environment are tightening laws on industrial emissions, wastewater discharge, and air quality. These regulations are compelling industries such as oil & gas, chemicals, pharmaceuticals, and power generation to adopt advanced filtration solutions to meet environmental compliance.One key area of focus is water pollution control, where industries are required to implement membrane filtration, activated carbon filters, and reverse osmosis systems to treat wastewater before discharge. For instance, the U.S. Clean Water Act and the European Union Water Framework Directive impose strict limits on the presence of contaminants in industrial wastewater, driving the demand for filtration technologies. Similarly, air pollution control regulations, such as the Clean Air Act in the U.S. and the European Industrial Emissions Directive (IED), are encouraging industries to install high-efficiency particulate air (HEPA) filters, electrostatic precipitators, and baghouse filters to reduce harmful emissions.

Additionally, corporate sustainability goals are playing a critical role in shaping the market. Many companies are striving to reduce their carbon footprint, optimize resource utilization, and minimize waste generation through improved filtration and separation processes. The integration of circular economy principles, such as wastewater reuse and air pollution control technologies, is leading to increased investments in eco-friendly filtration solutions. With industries adopting sustainable manufacturing practices, the demand for energy-efficient, recyclable, and long-lasting filtration products is rising. Filtration technologies used for water and wastewater treatment represent a significant portion of the market, with a value of around USD 20 billion in 2020. This segment is growing rapidly due to the increasing focus on clean water access and environmental regulations.

Key Market Challenges

High Initial Investment and Maintenance Costs

One of the significant challenges in the global filtration and separation market is the high initial investment required for advanced filtration systems. Industries such as water treatment, oil and gas, and pharmaceuticals require sophisticated filtration technologies, such as membrane filtration, nanofiltration, and electrostatic separation, which come with high capital costs. Additionally, the cost of installation, operation, and regular maintenance can be substantial. Many businesses, particularly small and medium-sized enterprises (SMEs), find it difficult to justify such expenses, leading to slower adoption of advanced filtration systems.Furthermore, regular filter replacement, membrane fouling, and system downtime contribute to ongoing operational costs, further deterring companies from making large-scale investments. In developing economies, financial constraints and limited government incentives for industrial filtration make it even more challenging for businesses to adopt high-end solutions. While cost-effective filtration alternatives exist, they often lack the efficiency and durability of advanced systems, creating a trade-off between affordability and performance.

Key Market Trends

Increasing Adoption of Air Filtration Systems for Industrial and Commercial Applications

With growing concerns over air pollution, workplace safety, and indoor air quality, the demand for advanced air filtration systems is witnessing significant growth. Industries such as automotive, manufacturing, oil and gas, pharmaceuticals, and electronics are investing in high-efficiency particulate air (HEPA) filters, activated carbon filters, and electrostatic precipitators to comply with stringent emission regulations and protect worker health.One of the primary drivers of this trend is the rising regulatory pressure on industrial emissions. Governments worldwide, particularly in North America and Europe, are enforcing strict air quality standards, compelling industries to install advanced filtration solutions. In sectors like power generation and cement production, electrostatic precipitators and baghouse filters are increasingly used to capture fine particulate matter (PM) and reduce pollution levels.

The commercial sector is also experiencing strong demand, fueled by heightened awareness of indoor air quality (IAQ) in public spaces, offices, and healthcare facilities. The COVID-19 pandemic further accelerated the adoption of air purifiers equipped with HEPA and UV-C filtration technologies to remove airborne pathogens and improve ventilation. The HVAC industry is integrating smart air filtration solutions, incorporating IoT and AI to monitor air quality in real time.

Additionally, the automotive industry is embracing advanced air filtration for vehicle cabins to enhance passenger safety. Electric vehicles (EVs) are particularly focusing on high-efficiency filters to combat urban pollution and improve air quality inside vehicles.

With rising industrialization, urbanization, and climate change concerns, the demand for air filtration solutions will continue to grow, making it a key driver in the Filtration and Separation Market.

Key Market Players

- Danaher Corporation

- Parker Hannifin Corporation

- MANN+HUMMEL International GmbH & Co. KG

- Donaldson Company, Inc.

- Eaton Corporation plc

- 3M Company

- Alfa Laval Corporate AB

- Pentair plc

- Porvair plc

- Cummins Inc.

Report Scope:

In this report, the Global Filtration and Separation Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Filtration and Separation Market, By Technology:

- Physical Filtration

- Chemical Filtration

- Biological Filtration

Filtration and Separation Market, By Product Type:

- Liquid Filtration Systems

- Air & Gas Filtration Systems

- Centrifugal Separators

- Magnetic Separators

Filtration and Separation Market, By Application:

- Water & Wastewater Treatment

- Food & Beverage Processing

- Pharmaceutical & Biotechnology

- Oil & Gas Industry

- Power Generation

- Others

Filtration and Separation Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Filtration and Separation Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Danaher Corporation

- Parker Hannifin Corporation

- MANN+HUMMEL International GmbH & Co. KG

- Donaldson Company, Inc.

- Eaton Corporation plc

- 3M Company

- Alfa Laval Corporate AB

- Pentair plc

- Porvair plc

- Cummins Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 116.54 Billion |

| Forecasted Market Value ( USD | $ 159.94 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |