Speak directly to the analyst to clarify any post sales queries you may have.

Special Boiling Point solvents are increasingly central to streamlined, compliant manufacturing and process innovation. Senior executives now rely on up-to-date market intelligence to align operations, manage risk, and seize opportunities as the sector evolves.

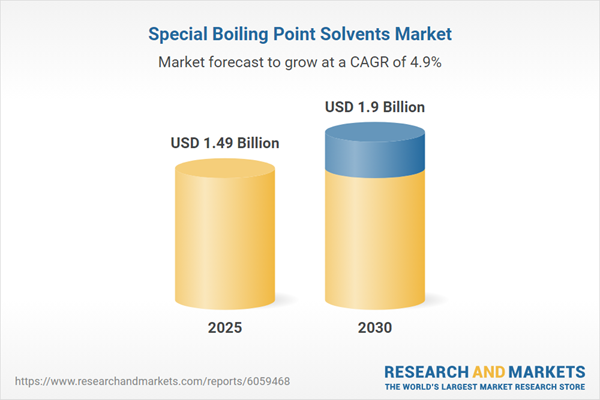

Market Snapshot: Special Boiling Point Solvents Market

The Special Boiling Point Solvents Market advanced from USD 1.42 billion in 2024 to USD 1.49 billion in 2025 and is forecast to maintain a CAGR of 4.94%, attaining USD 1.90 billion by 2030.

Market momentum is supported by evolving regulatory frameworks, technological progress, and sustained demand for specialized, high-value end uses. Adoption continues to expand across pharmaceuticals, coatings, cleaning, and sophisticated manufacturing. Organizations are recalibrating investment in agile supply chains and adherence to rising international standards. Shifting trends point to the necessity of dynamic procurement strategies as formulation techniques and regulatory requirements redefine competitive advantage.Scope & Market Segmentation

This report delivers thorough analysis for senior decision-makers seeking practical guidance on strategy, investment, and compliance in the Special Boiling Point Solvents Market. The segmentation structure covers critical areas of opportunity and risk management:

- Type: Heptane-Based SBP Solvents, Hexane-Based SBP Solvents, Naphtha-Based SBP Solvents, Petroleum Ether

- Boiling Range Type: SBP 100/140, SBP 140/170, SBP 170, SBP 40/60, SBP 60/95, SBP 80/100

- Grade: Food Grade, Laboratory Grade, Pharmaceutical Grade, Technical Grade

- Application: Adhesives & Sealants, Agrochemicals & Pesticides, Cleaning & Degreasing, Paints & Coatings, Pharmaceuticals & Extraction, Printing Inks, Rubber Processing

- Distribution Channel: Offline (Direct Sales, Distributor), Online (Brand Websites, E-commerce Platforms)

- Regional Coverage: Americas (USA, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (UK, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, UAE, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Company Analysis: Arkema SA, Asahi Kasei Corporation, BASF SE, Celanese Corporation, Chevron Phillips Chemical Company LLC, Clariant AG, Covestro AG, DHC Solvent Chemie GmbH, Dow Inc., DuPont de Nemours, Inc., Exxon Mobil Corporation, Saudi Basic Industries Corporation, Shell plc, TotalEnergies SE, Sumitomo Chemical Co., Ltd., UBE Corporation, Equilex B.V, Bharat Petroleum Corporation Limited, Idemitsu Kosan Co.,Ltd., Neste Oyj, Sasol Limited, Reliance Industries Limited, Haltermann Carless Group GmbH, Mitsubishi Chemical Holdings Corporation, INEOS AG

Each market segment is defined by specific technical requirements that influence both supply chain resilience and growth potential. Regional market dynamics are shaped by regulatory differentiation and the emergence of new application sectors. Accelerating product development cycles and advances in digital distribution are meeting industry needs for increased quality and reliability, creating more responsive and competitive offerings across global markets.

Key Takeaways for Senior Decision-Makers

- Advances in material science are improving solvent reliability and enabling more streamlined, compliant production for key industries.

- Digital transformation in quality management and analytics is enhancing process efficiency and supporting proactive regulatory alignment.

- Sustainability mandates and tighter standards are prompting manufacturers to prioritize bio-based, low volatility, and specialty solvent blends.

- Synergies among producers, technology partners, and end-users are accelerating adoption of customized solutions in pharmaceuticals, advanced coatings, and cleaning applications.

- Expansion of online and offline distribution is bolstering supply chain flexibility and increasing market access for both standard and tailored formulations.

- Investment in facility upgrades and strategic partnerships positions leading companies to manage disruptions in supply and policy environments with increased agility.

Tariff Policy Impact

United States tariff adjustments adopted in 2025 are reshaping pricing structures for imported Special Boiling Point solvents, impacting both intermediate and finished goods. Industry participants are revisiting sourcing and distribution models by seeking suppliers from exempt regions or scaling domestic production. These measures introduce new logistical and operational demands, requiring scenario planning and enhanced collaboration. Enterprises showing adaptability in their supply frameworks can maintain margins and service levels despite variable trade conditions.

Methodology & Data Sources

The research applies a structured, multi-step approach. Insights are gathered from primary interviews with industry and procurement leaders, and substantiated by secondary research drawn from regulatory documents, patent libraries, and reputable journals. Data integrity is fortified by peer validation and technical review.

Why This Report Matters

- Empowers executive teams to synchronize growth and operational strategies with changes in supply, technology, and compliance requirements.

- Equips decision-makers with actionable, region-and segment-level analysis for procurement, investment, and product development decisions.

- Helps organizations navigate technological changes and global tariff challenges by reducing the uncertainty in supply chain and distribution networks.

Conclusion

This report enables leaders to anticipate shifts in the Special Boiling Point Solvents Market, supporting robust operational strategies and resilient long-term growth. Leverage its findings to foster informed, forward-looking decision-making.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Special Boiling Point Solvents market report include:- Arkema SA

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Covestro AG

- DHC Solvent Chemie GmbH

- Dow Inc.

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- Saudi Basic Industries Corporation

- Shell PLC

- TotalEnergies SE

- Sumitomo Chemical Co., Ltd.

- UBE Corporation

- Equilex B.V

- Bharat Petroleum Corporation Limited

- Idemitsu Kosan Co.,Ltd.

- Neste Oyj

- Sasol Limited

- Reliance Industries Limited

- Haltermann Carless Group GmbH

- Mitsubishi Chemical Holdings Corporation

- INEOS AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.49 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |