Veterinary pain management includes drugs and devices used to relieve acute and chronic pain in animals. In 2021, the market was valued at USD 1.9 billion, followed by USD 2 billion in 2022 and USD 2.1 billion in 2023. In terms of products, the drugs segment accounted for 85.4% of the total market share in 2024. It is further categorized by type, route of administration, and distribution channel. By type, the segment includes NSAIDs, opioids, anesthetics, and alpha-2 agonists.

The route of administration is divided into oral, parenteral, and topical, while the distribution channel includes veterinary hospital pharmacies, retail pharmacies, and online pharmacies. The dominance of drugs in the market is attributed to their easy availability and effectiveness in managing pain and inflammation. NSAIDs and opioids are widely used due to their well-established efficacy. The demand for pain management drugs continues to rise due to the increasing prevalence of chronic diseases such as osteoarthritis, joint disorders, and cancer. Advancements in drug formulations have improved efficacy, reduced dosage frequency, and enhanced palatability, making them more widely accepted.

The veterinary pain management market is also segmented by application, with joint pain holding the largest share of 53.7% in 2024. This segment was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.1 billion by 2034 at a CAGR of 6.3%. Joint pain includes conditions such as osteoarthritis and musculoskeletal disorders. The availability of advanced treatments, including anti-inflammatory drugs and disease-modifying osteoarthritis drugs, has contributed to the expansion of this segment.

By animal type, the market is classified into companion animals and livestock animals. The companion animals segment led the market in 2024 and is expected to grow at a 6.4% CAGR during the forecast period. This category includes dogs, cats, horses, and other companion animals. The increasing adoption of pets and their longer lifespan have heightened the demand for veterinary pain management solutions. As pets age, they become more susceptible to chronic conditions, necessitating effective pain relief measures. The growth of pet insurance and rising veterinary expenditures have further supported the expansion of this segment.

North America dominated the global veterinary pain management market in 2024, holding a 43.9% share. The well-developed veterinary healthcare infrastructure, high pet adoption rates, and substantial livestock population contribute to the region’s market strength. The U.S. market, which was valued at USD 785.5 million in 2021, grew to USD 817.5 million in 2022 and USD 853.6 million in 2023, further solidifying its position as the leading contributor to market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Veterinary Pain Management market report include:- Alivira Animal Health

- Boehringer Ingelheim

- Ceva Santé Animale

- Chanelle Pharma

- Dechra Pharmaceuticals

- Elanco Animal Health

- K-Laser USA

- Merck

- Multi Radiance Medical

- Norbrook

- Vetoquinol

- Zoetis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

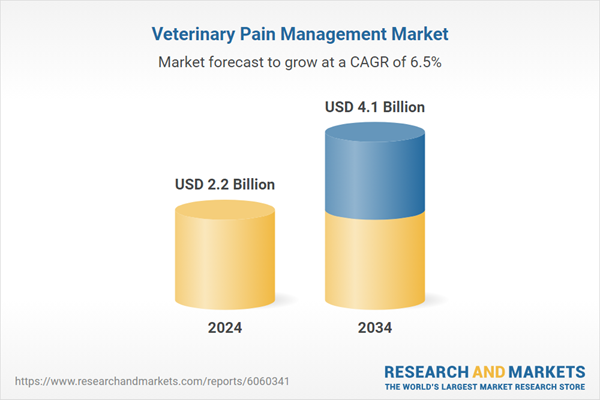

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |