The market is divided into total axial and peripheral DEXA bone densitometers. In 2024, the axial DEXA segment led the market, generating USD 355.2 million in revenue. This segment is favored for its high accuracy in diagnosing osteoporosis and assessing BMD in crucial skeletal regions like the hip and spine. Compared to peripheral systems, axial DEXA provides superior precision in detecting early signs of osteoporosis and monitoring treatment progress. Its extensive use in sports medicine and obesity management also contributes to its market dominance.

Another segmentation of the market is based on product type, which includes standalone and portable DEXA systems. The standalone segment accounted for 59.4% of the market share in 2024, with a projected value of USD 865.5 million by 2034. These systems are primarily installed in hospitals, diagnostic centers, and research institutions, where they offer high imaging strength and accuracy in bone density assessment. Their ability to provide precise diagnostics and support metabolic health evaluations makes them a preferred choice in medical facilities. Leading industry players are integrating low-dose radiation features to enhance patient safety without compromising diagnostic efficiency.

Regarding applications, the DEXA market encompasses osteoporosis diagnosis, body composition analysis, fracture management, bone densitometry, and other medical uses. The osteoporosis segment generated USD 238 million in 2024, maintaining a leading position due to the increasing prevalence of the disease. As bone health awareness grows, more patients and healthcare providers are prioritizing early detection and routine assessments.

Hospitals and clinics emerged as the top end-use segment, capturing 43.5% of the market share in 2024. These institutions serve as primary healthcare providers, conducting DEXA scans for accurate osteoporosis diagnosis and patient monitoring. The combination of advanced medical equipment and skilled professionals in these facilities contributes to the widespread adoption of these systems.

The U.S. market has seen substantial revenue growth, reaching USD 212.6 million in 2023, and is projected to hit USD 489.2 million by 2034. High osteoporosis prevalence and insurance coverage for bone density tests are key factors fueling market expansion.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Dual-energy X-ray Absorptiometry market report include:- Aurora Spine

- BeamMed

- DMS

- Fonar

- Fujifilm

- Furuno Electric

- GE Healthcare

- Hologic

- Medilink International

- Medonica

- Osteometer Meditech

- OSTEOSYS

- Scanflex Healthcare

- Shenzhen XRAY Electric

- Swissray Medical

- Xingaoyi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

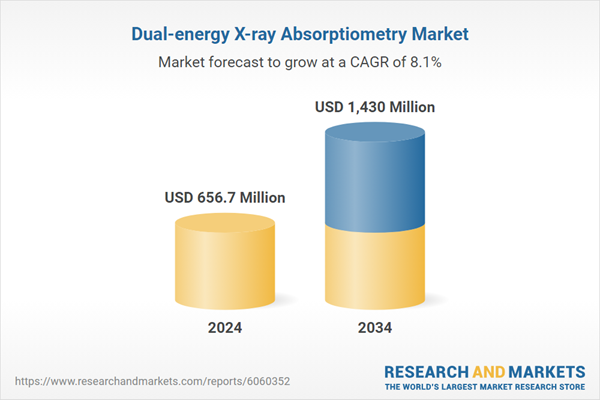

| Estimated Market Value ( USD | $ 656.7 Million |

| Forecasted Market Value ( USD | $ 1430 Million |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |