Thermal energy storage is a key enabler of grid stability, particularly as renewable energy adoption accelerates. Molten salt-based systems are becoming the preferred choice in energy storage due to their ability to provide consistent electricity output. Advancements in phase change materials, thermochemical storage, and molten salt solutions are further improving efficiency and storage capacity. Governments worldwide are implementing stringent energy efficiency regulations, directing significant investments into the sector. In 2023, Europe allocated over USD 105 billion toward renewable energy projects, reinforcing the demand for thermal storage solutions.

The molten salt segment is expected to surpass USD 94 billion by 2034, driven by the growing emphasis on renewable energy integration. Sensible heat storage accounted for over 98% of the market share in 2024 and is projected to expand further, supported by increasing global energy consumption, industrialization, and urbanization. These factors continue to drive the need for efficient storage technologies worldwide.

Asia Pacific thermal energy storage market witnessed substantial growth, with valuations reaching USD 9.1 billion in 2022, USD 18.7 billion in 2023, and USD 25.1 billion in 2024. Rapid urbanization and industrial growth in developing countries are generating high electricity demand, bolstering the need for energy storage. Government policies and financial incentives are further accelerating thermal storage adoption as part of broader sustainability initiatives. Global commitments to carbon reduction and renewable energy expansion necessitate the deployment of large-scale storage systems, ensuring long-term market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Thermal Energy Storage Systems market report include:- Abengoa S.A.

- Baltimore Aircoil Company

- Burns & McDonnell

- Caldwell Energy Company

- CALMAC

- Deepchill Solutions Inc.

- DN Tanks

- Dunham-Bush Limited

- EVAPCO Inc.

- FAFCO Inc.

- Goss Engineering Inc.

- McDermott

- New BrightSource Ltd.

- Siemens Gamesa Renewable Energy

- S.A.

- Steffes LLC

Table Information

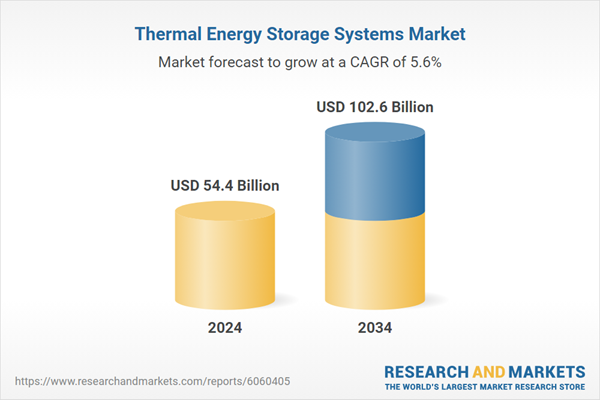

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 54.4 Billion |

| Forecasted Market Value ( USD | $ 102.6 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |