Reusable transport packaging includes handheld crates, pallets, dunnage and cargo protection, reusable plastic containers, unit-load-sized containers, tanks, drums, and barrels. The pallet market, valued at USD 68.3 billion in 2024, is undergoing innovations for improved shipment conditions. Handheld crates, expected to reach USD 25.6 billion by 2034, are widely adopted by retailers for efficient product handling. The dunnage and cargo protection segment, valued at USD 3.3 billion in 2024, is increasingly used for safeguarding fragile items. Unit-load-sized containers, estimated to reach USD 26.7 billion by 2034, are critical for space optimization and waste reduction. The reusable plastic container market is forecasted to reach USD 12.7 billion by 2034, with sensor integration enhancing real-time tracking. Tanks, drums, and barrels, projected to hit USD 6.2 billion by 2034, remain essential for industries transporting bulk liquids and hazardous materials.

By material type, the market is segmented into plastic, metal, and wood. In 2024, plastic held a 26.4% market share, driven by the demand for lightweight and durable solutions such as high-density polyethylene (HDPE) crates. The metal packaging market is expected to reach USD 26.1 billion by 2034, offering robust solutions for heavy-duty applications. Wood-based packaging, anticipated to reach USD 125.2 billion by 2034, remains a cost-effective and biodegradable option for transportation needs. Manufacturers are expanding their offerings with reusable materials to ensure sustainability and efficiency.

The market is further categorized by end-use industries, including food and beverages, consumer durables, automotive, and healthcare. The food and beverage sector, valued at USD 36.4 billion in 2024, is witnessing an increase in demand for reusable containers to prevent spoilage. The consumer durables segment is expected to grow at a CAGR of 6.3% as sustainable logistics solutions are increasingly adopted for electronics and home appliances. The automotive market is projected to reach USD 42.9 billion by 2034, with manufacturers relying on high-strength reusable pallets. The healthcare sector, forecasted to reach USD 21.4 billion by 2034, is shifting from single-use plastics to reusable containers for transporting delicate medical equipment.

North America’s reusable transport packaging market is expected to grow at a CAGR of 6.4% during the forecast period. The region is experiencing a surge in demand for sustainable packaging solutions, with businesses and consumers prioritizing eco-friendly logistics. Companies are adopting reusable transport packaging to lower costs while reducing environmental impact.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Reusable Transport Packaging (RTP) market report include:- Auer Packaging

- Borealis AG

- CABKA

- CDF Corporation

- DS Smith

- DW Reusables

- Georg Utz Holding AG

- Greif Inc.

- GWP Group

- IFCO SYSTEMS

- IPL Inc.

- Mauser Packaging Solutions

- Myers Industries

- Nefab Group

- ORBIS Corporation

- Rotovia Deventer bv

- Schoeller Allibert

- Schutz GmbH & Co. KGaA

- SSI SCHAEFER

- Werit

Table Information

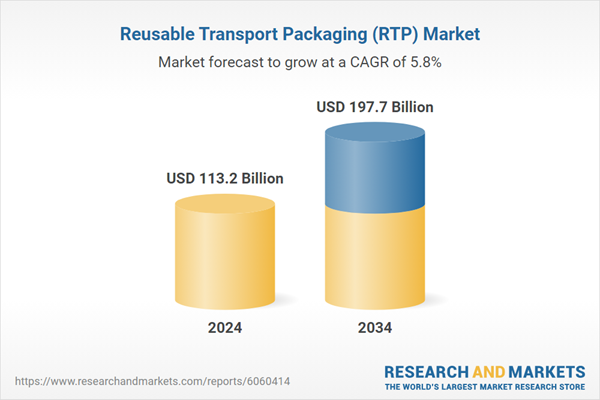

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 113.2 Billion |

| Forecasted Market Value ( USD | $ 197.7 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |