The shift toward durable automotive manufacturing has enhanced consumer confidence in pre-owned vehicles. Advanced engineering, stringent quality control, and routine maintenance enable vehicles to maintain reliability over extended periods, increasing demand in the secondary market. Inflation, rising raw material costs, stringent emission regulations, and the growing popularity of hybrid and electric powertrains are further propelling the market. The affordability of used cars remains a key factor for price-sensitive consumers, reinforcing their appeal across Europe.

In terms of vehicle type, SUVs accounted for more than 40% of the market in 2024 and are anticipated to surpass USD 292 billion by 2034. Their elevated driving position, spacious interiors, and adaptability to both urban and rural terrains continue to attract consumers. Improved fuel efficiency in modern SUVs, along with the introduction of hybrid and compact crossover models, has reduced previous concerns regarding fuel consumption and environmental impact. Compact SUVs, offering a balance between fuel efficiency and practicality, have gained popularity in European cities due to their maneuverability in tight urban spaces.

Based on end use, the market is segmented into personal and commercial, with the personal segment exceeding USD 630 billion in 2024. Rising living expenses and inflation have encouraged consumers to opt for used vehicles over new ones. Lower financing rates and flexible loan options have made personal vehicle ownership more accessible. While car-sharing and subscription models exist, the majority of consumers still prefer owning their vehicles for the flexibility and long-term financial benefits they offer.

Regarding fuel type, gasoline vehicles dominated the market with a 50% share in 2024. Stricter emission regulations have diminished the demand for diesel cars, particularly with the implementation of Low Emission Zones (LEZs) in urban areas. Gasoline vehicles remain preferable due to their lower maintenance costs and better performance in city driving conditions. Additionally, tax incentives and widespread availability contribute to their continued market dominance.

The market is divided by sales channels into peer-to-peer transactions, franchised dealerships, and independent dealers. Peer-to-peer sales are expected to expand at a CAGR of 5%, driven by the convenience of digital platforms that facilitate direct transactions without intermediaries. This method allows buyers to negotiate better deals while avoiding dealership-related expenses.

Western Europe leads the regional market, holding a 47% share in 2024. Strong domestic production, high vehicle turnover, and a well-established infrastructure for used car sales contribute to the region’s dominance. The presence of a structured leasing system ensures a steady influx of well-maintained vehicles into the secondary market, supporting sustained industry growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Europe Used Cars market report include:- Alphartis Deutschland

- AMAG Schweiz

- Autotorino Italien

- AVAG Holding Deutschland

- Avemo Deutschland

- Bernard Frankreich

- Bertel O. Steen Norwegen

- Bilia Schweden

- BPM Frankreich

- BymyCar Frankreich

- Car Avenue Frankreich

- Chopard Lallier Frankreich

- D’Ieteren Auto Belgien

- Eden Auto Frankreich

- Emil Frey Schweiz

- Fahrzeug-Werke Lueg Deutschland

- Feser

- Graf & Co. Deutschland

- GCA Groupe Frankreich

- Gottfried Schultz Deutschland

- Gueudet Frankreich

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | February 2025 |

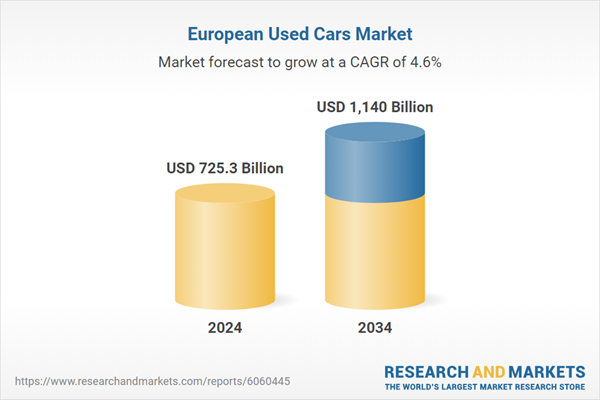

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 725.3 Billion |

| Forecasted Market Value ( USD | $ 1140 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 22 |