Gas turbines remain a preferred choice in power generation due to their efficiency and rapid response time. These systems convert the chemical energy of fuel into mechanical energy, which is then transformed into electricity. The integration of renewable energy sources, advancements in turbine designs, and the growing deployment of hydrogen-blend turbines are enhancing market prospects. The expansion of distributed power systems, especially in off-grid and remote locations, is driving demand for small and medium-sized gas turbines. Increased focus on achieving net-zero emissions is further boosting the adoption of next-generation turbines, which are being developed to operate on alternative fuels.

The market is categorized based on capacity into turbines ranging from ≤ 30 MW to 70 MW, > 70 MW to 200 MW, and > 200 MW. Systems within the ≤ 30 MW to 70 MW range accounted for over 10% of the market in 2024, favored for their efficiency, cost-effectiveness, and widespread application in combined cycle and gasification plants. The continuous evolution of turbine components, including airfoils and coatings, is enhancing operational performance and reliability.

By design, the industry is divided into aeroderivative and heavy-duty gas turbines. The heavy-duty segment held a USD 5 billion share in 2024, driven by extensive use in combined cycle gas turbine (CCGT) plants and the ability to complement renewable energy. The aeroderivative segment, valued at USD 1 billion in 2024, is gaining traction due to its efficiency in regions with limited grid access. The growth of data centers, with their substantial power requirements, is also fueling demand for aeroderivative turbines.

The market further differentiates into open cycle and combined cycle systems. While combined cycle turbines accounted for over USD 5 billion in 2024, open cycle turbines are expected to grow at a CAGR of 5% through 2034. Open cycle turbines are favored for their quick startup, versatility, and lower cooling requirements. The combined cycle segment is projected to witness a CAGR of over 5.5% through 2034, driven by industrial growth, energy efficiency mandates, and government policies aimed at reducing emissions.

The U.S. market is expected to surpass USD 700 million by 2034, supported by increased investment in hydrogen combustion technologies and low-carbon energy sources. North America's gas turbine industry is projected to expand at a CAGR of 5.5% through 2034, benefiting from an abundant natural gas supply and advancements in extraction technologies. The continued development of combined cycle power plants and improvements in gas turbine efficiency will play a significant role in driving the industry's expansion.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Power Generation Gas Turbine market report include:- Ansaldo Energia

- Bharat Heavy Electricals Limited (BHEL)

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Opra Turbines

- Rolls Royce

- Siemens

- Solar Turbines

- TotalEnergies

- Wartsila

- Zorya-Mashproekt

Table Information

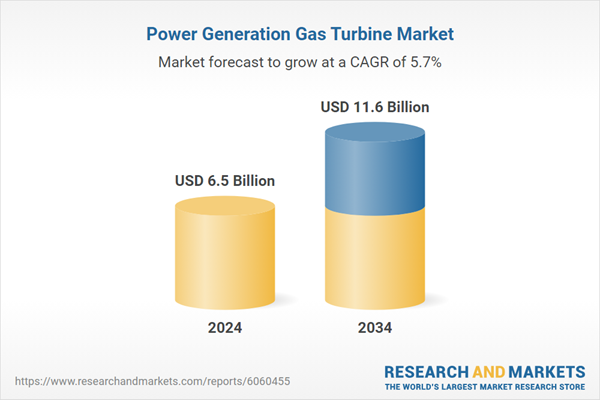

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 11.6 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |