The rising emphasis on infrastructure development, particularly in emerging economies, is a key catalyst for market expansion. As cities modernize and industries adopt automation, the need for efficient power transmission solutions is escalating. Countries across Asia-Pacific, the Middle East, and Latin America are prioritizing electrification projects to support growing populations and economic activities. Additionally, stringent energy regulations and sustainability initiatives are prompting a shift toward environmentally friendly, high-efficiency cabling systems. Smart buildings, IoT integration, and electric vehicle charging networks further contribute to the increasing adoption of low voltage cables.

Market segmentation highlights the diverse applications of low voltage wires and cables. Among the various product types, power, communication, and control cables hold a significant share. Signal and control cables accounted for 13% of the market in 2024, largely due to their expanding role in intelligent building systems. The growing demand for automation in residential and commercial spaces, particularly for HVAC, lighting, and security applications, is propelling the adoption of these products. Builders and developers are integrating advanced cabling systems into modern infrastructure, ensuring seamless connectivity and operational efficiency.

Utility applications held a 27% market share in 2024, with robust growth anticipated over the next decade. The ongoing transition to renewable energy sources is amplifying the need for high-performance power cables to facilitate the integration of solar and wind energy into existing grids. As governments worldwide push for increased renewable energy adoption, grid stability and efficiency remain critical concerns. Reliable low voltage wiring solutions are essential for ensuring uninterrupted power distribution and enhancing the resilience of modern energy infrastructure.

U.S. low voltage wire and cable industry was valued at USD 15 billion in 2024, with North America witnessing continuous investments in upgrading aging electrical infrastructure. The U.S. government allocated over USD 2 billion in 2024 to modernize grid systems and accommodate rising energy demands. This funding is driving substantial improvements in power transmission and distribution networks, accelerating the need for advanced low voltage cables. As the energy sector continues to evolve, sustained investments in electrification and infrastructure upgrades are expected to support long-term market expansion across the region.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Low Voltage Wire and cable market report include:- alfanar Group

- Bahra Cables

- BELDEN

- Brugg Kabel AG

- Ducab

- Elsewedy Electric

- Federal Cables

- Fujikura

- HELUKABEL MiddleEast

- Jeddah Cables

- KEI Industries

- Midal Cables

- Naficon

- Nexans

- NIBE Industrier AB

- NKT A/S

- Power Plus Cables

- Prysmian Group

- Riyadh Cables

- Saudi Cable Company

- Sumitomo Electric Industries

- ZTT

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

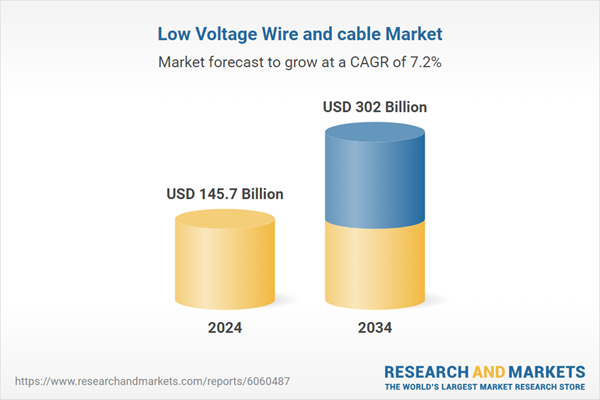

| Estimated Market Value ( USD | $ 145.7 Billion |

| Forecasted Market Value ( USD | $ 302 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |