Growing awareness and early medical interventions have increased the demand for insulin therapy, which remains essential for diabetes management. Advances in insulin formulations, including ultra-rapid-acting, long-acting, and biosimilar insulins, have improved treatment adherence and patient outcomes. Additionally, increased government and NGO investments in developing regions have expanded insulin access, further strengthening the market. Favorable reimbursement policies in developed economies have also contributed to market expansion.

Insulin is essential in regulating blood glucose levels, ensuring efficient energy utilization. The market includes various insulin formulations, including rapid-acting, short-acting, intermediate-acting, long-acting, and premixed options, as well as biosimilars.

The market is segmented into human insulin and insulin analogs. Insulin analogs dominated the market, accounting for USD 22.3 billion in 2024. Their widespread adoption stems from superior efficacy, lower risk of hypoglycemia, and better patient adherence compared to traditional human insulin. Insulin analogs provide greater dosing flexibility, reduce postprandial glucose spikes, and offer a more predictable response. Long-acting insulin analogs, such as insulin detemir, also minimize weight gain compared to regular insulin. The availability of biosimilar insulin analogs has further expanded accessibility and affordability.

By product type, the market is divided into long-acting insulin, rapid-acting insulin, combination insulin, biosimilars, and other products. Long-acting insulin held the largest share at 45.4% in 2024. Its slow-release mechanism ensures stable insulin levels, reducing the frequency of injections and enhancing patient adherence. These formulations effectively mimic basal insulin secretion, lowering the risk of hypoglycemia. The development of advanced long-acting insulin products and improvements in insulin delivery devices continue to support market dominance.

The market is categorized by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 1 diabetes accounted for 75.2% of the market in 2024 and is expected to grow at a CAGR of 3.6%. Patients with type 1 diabetes rely on daily insulin injections to maintain blood glucose levels. Unlike type 2 diabetes, where lifestyle modifications and oral medications may be effective, type 1 diabetes necessitates consistent insulin administration.

In terms of distribution channels, hospital pharmacies led the market in 2024, projected to reach USD 22.4 billion by 2034. High diabetes-related hospital admissions, access to a wide range of insulin products, and advanced healthcare systems contribute to this segment's dominance.

Regionally, North America led the market with a 40.3% share in 2023. The US market grew from USD 9.6 billion in 2022 to USD 10.2 billion in 2023. The country’s high diabetes prevalence, robust healthcare infrastructure, and strong investments in insulin research and development continue to drive market growth. The presence of leading insulin manufacturers further supports market expansion.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Insulin market report include:- Adocia

- Biocon

- Boehringer Ingelheim International

- Eli Lilly and Company

- Gan & Lee Pharmaceuticals

- Gland Pharma

- Julphar

- MannKind Corporation

- Novo Nordisk

- Pfizer

- Sanofi

- Shanghai Fosun Pharmaceutical

- Tonghua Dongbao Pharmaceutical

- United Laboratories International

- Wockhardt

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | February 2025 |

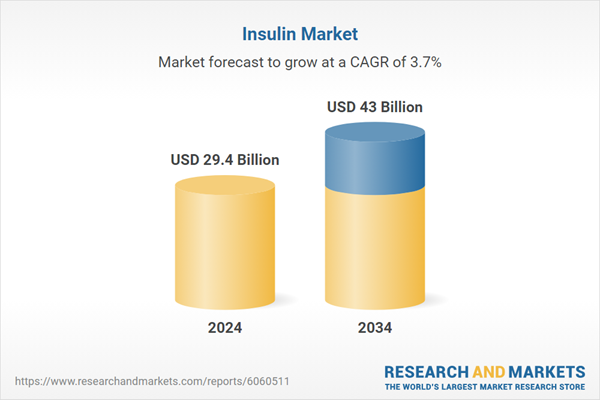

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 29.4 Billion |

| Forecasted Market Value ( USD | $ 43 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |