The shift toward software-defined networking (SDN) and network function virtualization (NFV) is reshaping the market landscape, enabling organizations to achieve greater flexibility, automation, and cost efficiency in managing their networks. Cybersecurity threats and regulatory compliance requirements are also pushing enterprises to upgrade their networking frameworks with robust security measures, ensuring data integrity and resilience. Additionally, the proliferation of smart cities, autonomous vehicles, and edge computing solutions is amplifying the demand for next-generation networking systems that can support complex, data-intensive applications.

The market is segmented into hardware, software, and services, with hardware accounting for the largest share. In 2024, the hardware segment held a 40% market share and is expected to reach USD 25 billion by 2034. Essential networking components such as routers, switches, servers, and network processors play a pivotal role in enabling high-performance infrastructure, particularly with the deployment of 5G, SDN, and NFV technologies. Businesses are prioritizing investments in scalable, high-speed networking equipment to meet evolving demands in cloud computing, enterprise data centers, and telecommunication networks.

Enterprise size also plays a significant role in market dynamics, with large enterprises leading adoption. In 2024, large enterprises dominated the next-generation networking market with a 71% share, leveraging their financial capabilities to implement advanced, secure networking solutions. These organizations rely on high-performance networks to support large-scale operations, workforce collaboration, and data-driven decision-making. Meanwhile, small and medium-sized enterprises (SME) are gradually increasing their investments in next-generation networking technologies, recognizing the need for scalable, cost-effective solutions to stay competitive.

North America held a 34% share of the global next-generation networking market in 2024, with the United States contributing USD 5.6 billion to the regional valuation. The presence of major telecom players, coupled with aggressive investments in 5G deployment and digital transformation initiatives, has positioned the region as a frontrunner in network innovation. The increasing demand for high-speed, low-latency connectivity across industries, including healthcare, finance, and manufacturing, continues to drive market growth. With a strong focus on next-gen wireless infrastructure and emerging networking technologies, North America is set to remain a key player in shaping the future of global networking solutions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Next Generation Networking market report include:- A10 Networks

- Adtran

- AT&T

- Check Point Software Technologies

- Ciena Corporation

- Cisco

- Commverge Solutions

- Ericsson

- Forcepoint

- Fortinet

- Huawei

- IBM

- Juniper Networks

- Keysight Technologies

- NEC

- Nokia

- Samsung

- TelcoBridges

- VMware (Broadcom)

- ZTE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | February 2025 |

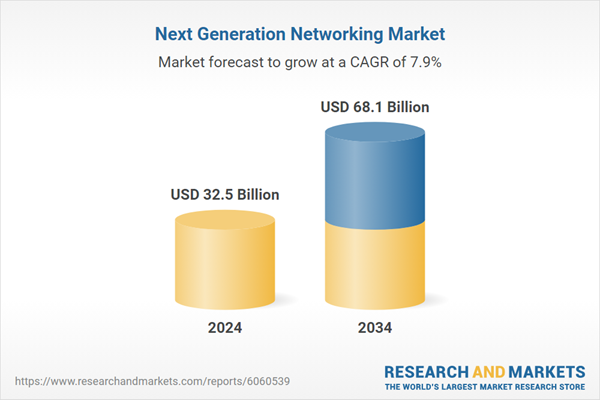

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 32.5 Billion |

| Forecasted Market Value ( USD | $ 68.1 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |