The opioid industry is undergoing significant transformation, shaped by both regulatory shifts and evolving healthcare policies. Governments and healthcare providers are balancing the need for effective pain management with concerns about opioid dependency. While strict regulations on opioid prescriptions have been implemented in various regions, innovations in opioid formulations with abuse-deterrent properties are helping sustain market growth. Additionally, pharmaceutical companies are investing in research to develop safer opioid alternatives while maintaining their efficacy in pain relief. Advancements in drug delivery systems, such as extended-release formulations, are further contributing to market expansion. As healthcare providers adopt personalized pain management approaches, the opioid market is expected to remain a crucial segment within the pharmaceutical industry.

The market is categorized by drug type, including oxycodone, hydrocodone, morphine, fentanyl, tramadol, and other opioids. Oxycodone continues to hold a dominant market position, generating USD 8.7 billion in 2023 and is projected to reach USD 10.9 billion by 2034. Oxycodone’s widespread use in treating moderate to severe pain, including post-surgical pain and injury-related conditions, plays a key role in its sustained market leadership. Its significant application in cancer pain management, particularly for chemotherapy patients, further solidifies its prominence. As demand for effective pain relief solutions grows, oxycodone remains an essential component of treatment protocols worldwide.

Pain management remains the largest application segment, accounting for a 74.3% market share in 2024. Opioids are extensively used for managing pain in patients suffering from chronic and intense conditions. By binding to opioid receptors in the brain, spinal cord, and other areas, these medications block pain signals, providing essential relief for patients recovering from surgery, undergoing cancer treatments, or managing degenerative diseases like arthritis. This consistent demand for opioids in pain management ensures that the segment will maintain its market dominance over the forecast period.

The U.S. Opioid Market was valued at USD 10.4 billion in 2024 and is projected to grow at a CAGR of 1.9% over the next decade. The increasing prevalence of conditions such as arthritis, cancer, and post-surgical recovery fuels the demand for opioid-based pain management solutions. The U.S. benefits from a well-established healthcare infrastructure and widespread opioid usage, which significantly influences market growth. With healthcare providers continuously seeking effective pain relief solutions, the country remains a key contributor to overall opioid market expansion. As regulatory frameworks evolve and new pain management strategies emerge, the opioid market is expected to sustain steady growth in the U.S. and beyond.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Opioid market report include:- Allergan

- Amneal Pharmaceuticals

- AstraZeneca

- Camurus AB

- Grunenthal

- Hikma Pharmaceuticals

- Indivior

- Mallinckrodt Pharmaceuticals

- Pfizer

- Purdue Pharma

- Rusan Pharma

- Sun Pharmaceutical

- Teva Pharmaceuticals

Table Information

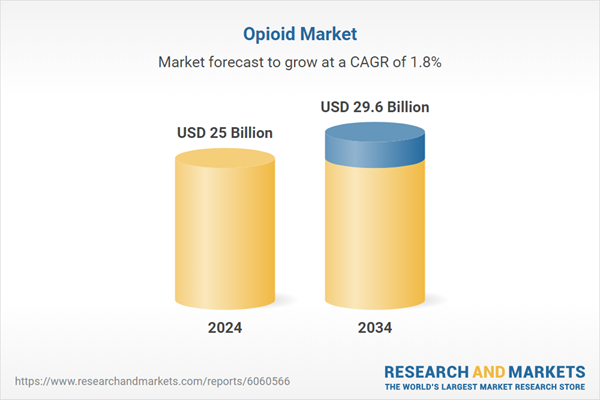

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 25 Billion |

| Forecasted Market Value ( USD | $ 29.6 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |