Governments in various countries, including the US, UK, and China, are enforcing stricter emissions policies, prompting automakers to develop advanced heat management solutions. Technologies like exhaust gas recirculation (EGR) systems are being incorporated to reduce nitrogen oxide emissions and enhance fuel efficiency. The growing emphasis on sustainability has further accelerated innovations in thermal management, making heat exchangers a crucial component in modern vehicles.

The automotive heat exchanger market is categorized by product, with radiators leading at over 30% market share in 2024 and expected to surpass USD 11 billion by 2034. Radiators are essential for engine cooling, preventing overheating, and optimizing fuel efficiency, particularly in internal combustion engine (ICE) vehicles. Despite the rise of alternative fuels, gasoline and diesel vehicles remain prevalent due to cost and accessibility, reinforcing the demand for efficient cooling systems.

By vehicle type, passenger cars accounted for 65% of the market share in 2024, driven by their widespread usage. Heat exchangers are critical in these vehicles for ensuring safety, comfort, and operational efficiency. The increasing demand for automobiles is fueling the adoption of moderate radiation heat management systems that include radiators, oil coolers, and condensers to maintain engine performance and longevity.

Government initiatives to curb emissions are leading to advancements in thermal management solutions. Approximately 31% of CO2 emissions in the US originate from vehicles, emphasizing the need for stricter regulations and technological enhancements. Enhanced heat exchanger systems are increasingly integrated into vehicles to meet these evolving standards, further propelling market growth.

Material-wise, aluminum dominated the market in 2024, attributed to its cost-effectiveness, lightweight nature, and high thermal conductivity. The automotive industry is shifting towards more lightweight materials to improve fuel efficiency and vehicle performance, with aluminum emerging as the preferred choice due to its durability and resistance to corrosion. This extends component lifespan, reducing long-term costs for manufacturers and consumers.

In terms of sales channels, original equipment manufacturers (OEMs) held a significant share in 2024. Automakers collaborate closely with heat exchanger manufacturers to develop standard and custom components tailored to vehicle specifications. The growing EV and hybrid vehicle market has led to increased partnerships between OEMs and heat exchanger suppliers, streamlining production and integration processes.

Asia Pacific led the automotive heat exchanger market with a 37% share in 2024. China remains the dominant player, projected to reach USD 3 billion by 2034. The region's strong automobile manufacturing base, combined with lower production and labor costs, has attracted global automakers, driving high demand for heat exchanger components. Additionally, the aftermarket for these components is thriving due to the region's high vehicle population, leading to consistent replacement demand.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Automotive Heat Exchanger market report include:- Ahaus Tool & Engineering

- AKG Group

- American Industrial Heat Transfer

- Banco Products

- Denso

- G&M Radiator

- Hanon Systems

- HAUGG Group

- Koyorad

- Mahle

- Modine Manufacturing

- Nippon Light Metals

- Nissens

- S.M. Auto Engineering

- Sanden

- Senior

- Spectra Premium

- T.RAD Co.

- Tokyo Radiator

- Valeo

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | February 2025 |

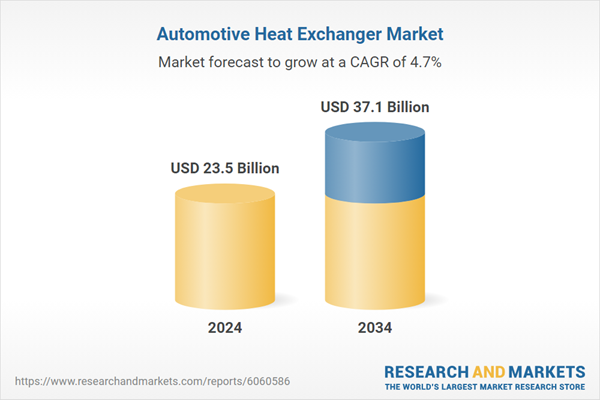

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 23.5 Billion |

| Forecasted Market Value ( USD | $ 37.1 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |