As automation becomes a cornerstone of industrial growth, demand for pinch tube valves continues to rise, ensuring contamination-free, efficient fluid handling. Additionally, technological advancements in valve design and materials are improving durability, performance, and adaptability, further fueling market penetration across various sectors. The growing focus on sustainability and energy efficiency is also prompting industries to adopt pinch tube valves, which offer minimal maintenance, reduced operational costs, and superior fluid control. With increasing investments in automation and process optimization, the market is poised for steady growth in the coming years.

The pinch tube valve market is segmented based on operating type, primarily into manual and automatic valves. In 2024, manual pinch tube valves held the largest market share, reaching USD 364 million. Their widespread adoption is attributed to their simplicity, cost-effectiveness, and ease of maintenance. Small and medium-sized enterprises, as well as industries in the early stages of automation, prefer manual pinch valves for reliable fluid control without the complexity or cost of automated systems. These valves are widely used in applications where constant, high-volume automation is not a necessity, but precise fluid handling remains essential.

By material type, the pinch tube valve market is categorized into metal, plastic, and other materials. Metal valves dominated the market in 2024, accounting for a 70% share. Stainless steel, brass, and aluminum pinch valves are preferred for their superior durability, resistance to harsh operating conditions, and ability to withstand high pressure. Industries such as pharmaceuticals, chemical processing, and oil and gas opt for metal valves due to their reliability in extreme environments involving aggressive chemicals, elevated temperatures, and stringent safety requirements. The demand for corrosion-resistant and high-performance valve solutions continues to propel the adoption of metal pinch tube valves across industrial applications.

The U.S. pinch tube valve market was valued at USD 141.4 million in 2024, driven by the growing adoption of automation and process control technologies. Industries such as food processing, pharmaceuticals, and water treatment increasingly implement automated systems that require precise, contamination-free fluid flow control. Pinch tube valves play a critical role in ensuring operational efficiency, reliability, and compliance with hygiene standards in these sectors. As the need for accurate, maintenance-friendly, and durable valve solutions intensifies, the U.S. market is expected to witness consistent growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Pinch Tube Valve market report include:- Badger Meter

- Bürkert Fluid Control Systems

- ControlAir

- Crane

- Emerson Electric

- Festo

- Gore

- Graco

- Kitz Corporation

- Nordson Corporation

- Omega Engineering

- Parker Hannifin Corporation

- Pentair

- Schneider Electric

- Swagelok Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

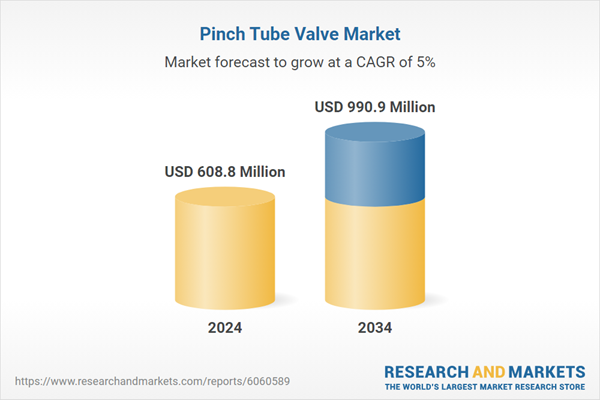

| Estimated Market Value ( USD | $ 608.8 Million |

| Forecasted Market Value ( USD | $ 990.9 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |