Fuel cells are being widely adopted in the manufacturing sector, where uninterrupted power supply and low-emission solutions are critical. Their capability to produce electricity with minimal pollution has drawn the attention of governments and private players alike. With a growing number of countries rolling out policies focused on reducing carbon footprints and improving energy efficiency, the use of fuel cells across a range of applications is expanding steadily. Financial institutions and government bodies are pouring significant investments into research and development to drive technological advancements in this space. As innovation progresses, fuel cells are expected to become increasingly viable for both commercial and residential energy systems.

Investments from both public and private sectors are also contributing to the growth of the market. Organizations across the globe are stepping up efforts to develop advanced technologies that improve the performance, efficiency, and affordability of fuel cells. These initiatives are encouraging companies across multiple industries to adopt fuel cell systems as part of their energy transition strategies. In response to these developments, the demand for next-generation fuel cell systems is growing rapidly.

Among the various types of fuel cells, the Proton Exchange Membrane Fuel Cell (PEMFC) segment is expected to surpass USD 8.8 billion by 2034. These fuel cells are known for their low operating temperature and quick startup times, making them ideal for a variety of applications, from backup power solutions to portable energy systems and automotive uses. As these technologies evolve and become more reliable, their use in sectors such as data centers, residential buildings, and mobile infrastructure is anticipated to increase significantly.

In terms of application, the market is categorized into stationary, portable, and transport sectors. The transport segment dominated the market in 2024, accounting for more than 78.4% of the total share. This segment is witnessing accelerated adoption of fuel cell systems in electric bikes, unmanned aerial vehicles, and commercial fleets. The transportation sector’s increasing focus on reducing emissions and transitioning to greener technologies is propelling the integration of hydrogen fuel cell systems. As infrastructure for hydrogen production and distribution improves, the deployment of these systems across various transport applications, including maritime logistics and commercial shipping, is expected to expand.

The North American fuel cell market, led by the United States, is also witnessing steady progress. The US market alone recorded a value of over USD 1.52 billion in 2022, USD 1.53 billion in 2023, and reached USD 1.55 billion in 2024. Across the continent, the market is forecasted to grow at a CAGR of over 6% through 2034. The development of on-site hydrogen generation stations using integrated methane reforming technologies has provided cost-effective solutions for fueling infrastructure, thus boosting regional adoption. These advancements are creating a more favorable environment for the widespread deployment of fuel cells in both public and private sectors.

The global fuel cell market is currently shaped by the presence of several key players who are continuously working to strengthen their market position through innovation and collaboration. The top five companies - Cummins, Ballard Power Systems, Fuji Electric, Toshiba Corporation, and Plug Power - collectively account for around 40% of the global market share. Their strategies include forming alliances with energy companies, automotive manufacturers, and research institutions to enhance product offerings and accelerate technology development. These collaborative efforts are expanding the reach of fuel cell technology and opening new avenues for commercialization.

Strategic partnerships, joint ventures, and increased funding from both government and private entities are accelerating the pace of research and development. These efforts are not only driving innovation but also improving the scalability and market readiness of fuel cell solutions. As a result, the industry is moving closer to achieving large-scale deployment, with significant implications for the global energy landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Fuel Cell market report include:- Cummins

- Ballard Power Systems

- Plug Power

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- Bloom Energy

- Panasonic Corporation

- Doosan Fuel Cell

- Aisin Corporation

- Ceres

- SFC Energy

- Toshiba Corporation

- Robert Bosch

- TW Horizon Fuel Cell Technologies

- AFC Energy

- FuelCell Energy

- Fuji Electric

- Hyundai Motor Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 205 |

| Published | May 2025 |

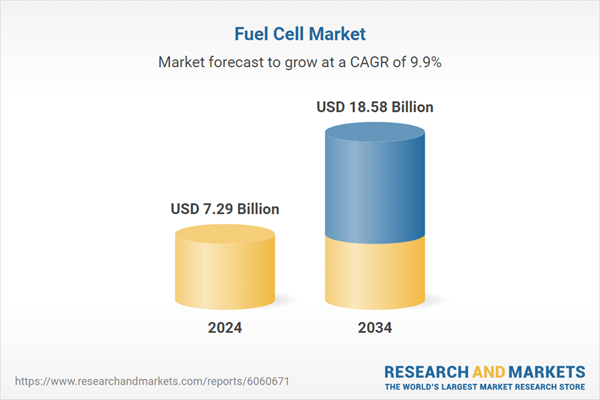

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.29 Billion |

| Forecasted Market Value ( USD | $ 18.58 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |