The market growth is driven by the increasing incidence of colorectal cancer, rising public health initiatives for early screening, and continuous technological advancements in diagnostic modalities. Innovations such as liquid biopsy, AI-assisted imaging, and stool-based DNA tests are reshaping the landscape of colorectal cancer detection, offering less invasive, more accurate, and patient-friendly diagnostic options.

Growing awareness campaigns and updated screening guidelines, such as lowering the recommended age for routine CRC screening to 45, contribute to early diagnosis rates. Furthermore, an aging global population, combined with lifestyle factors like sedentary behavior and dietary habits, has heightened the global burden of colorectal cancer, underscoring the urgent need for effective and accessible diagnostics.

Governments and healthcare organizations worldwide are launching large-scale initiatives to improve access to colorectal cancer screening, while private companies are investing heavily in R&D to bring next-generation diagnostic tools to the market. Artificial intelligence, next-generation sequencing (NGS), and microfluidic technologies are poised to enhance diagnostic precision and patient outcomes significantly.

The colorectal cancer diagnostics market is primarily segmented by test type, with the imaging tests segment holding 34.3% share in 2024. Imaging modalities such as CT colonography, MRI, and PET scans remain crucial for early detection, staging, and treatment planning. Adopting AI-enhanced imaging has improved detection accuracy, helping to identify precancerous lesions at earlier stages. Moreover, imaging tests' non-invasive or minimally invasive nature continues to drive patient acceptance and screening rates.

In terms of end-use, the hospitals segment held 44.2% share in 2024, solidifying its position as the leading end-user for colorectal cancer diagnostics. Hospitals are the primary centers for colorectal cancer detection, diagnosis, staging, and treatment planning, supported by a comprehensive diagnostic infrastructure that includes advanced imaging systems, molecular pathology labs, endoscopic equipment, and surgical oncology units. Their multidisciplinary approach - bringing together oncologists, radiologists, pathologists, gastroenterologists, and surgeons - enables the seamless coordination of care for colorectal cancer patients, from early detection through post-treatment monitoring.

North America Colorectal Cancer Diagnostics Market held a 35.2% share in 2024. The region's dominance stems from a robust healthcare infrastructure, widespread implementation of screening programs, and high adoption rates of advanced diagnostic technologies, such as AI-enabled colonoscopy, liquid biopsies, and molecular biomarker testing. In the United States, initiatives like the Colorectal Cancer Control Program (CRCCP) by the CDC have been instrumental in increasing early screening rates, particularly among underserved populations.

Key market players such as Abbott Laboratories, Exact Sciences Corporation, Siemens Healthineers AG, Guardant Health Inc., F-Hoffmann-La Roche Ltd., and GE HealthCare Technologies, Inc. are heavily investing in expanding their diagnostic portfolios through innovations in liquid biopsy, AI-driven imaging, and molecular diagnostics. Strategic partnerships, mergers and acquisitions, and regulatory approvals for new products remain crucial strategies for these players to strengthen their global presence and drive future market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this colorectal cancer diagnostics market report include:- Abbott Laboratories

- Danaher Corporation

- DiaCarta

- Exact Sciences Corporation

- F-Hoffmann-La Roche

- GE HealthCare Technologies

- Geneoscopy

- Guardant Health

- H.U. Group Holdings

- New Day Diagnostics

- Olympus Corporation

- Phase Scientific International

- QIAGEN N.V.

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | June 2025 |

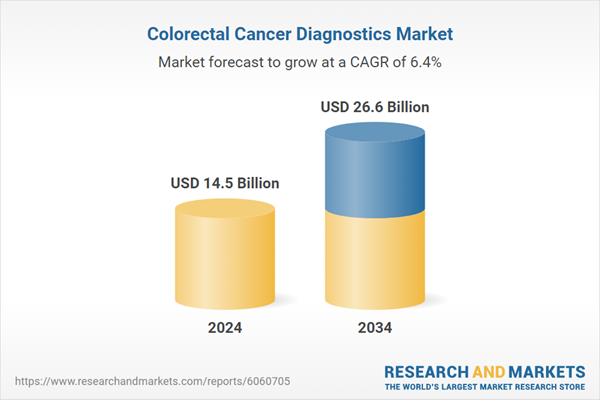

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 26.6 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |