The rising global aging population - more vulnerable to neurological disorders - is also expected to further elevate the demand for epilepsy medications. Drug developers are prioritizing therapies that offer better tolerability, sustained release, and improved patient compliance. This shift, paired with improved healthcare infrastructure in developing nations and streamlined regulatory pathways in key markets, is creating a favorable environment for innovation and product adoption. Moreover, the transition toward more personalized medicine strategies, particularly for drug-resistant epilepsy, is improving treatment outcomes and driving long-term market growth.

Anti-epileptic drugs (AEDs), also referred to as anticonvulsants, work by stabilizing irregular electrical signals in the brain, helping to prevent seizures and manage the overall symptoms of epilepsy. Based on drug class, the market is divided into first-generation, second-generation, and third-generation drugs. In 2024, second-generation AEDs accounted for the largest revenue share, contributing 47.2% to the global market. This segment is forecasted to expand at a CAGR of 4.6% from 2025 to 2034. Their broader acceptance is attributed to lower incidences of drug interactions, improved side effect profiles, and better patient adherence compared to older-generation therapies.

In terms of product type, the market is categorized into branded and generic drugs. Branded drugs generated USD 2.6 billion in 2024 and are projected to reach USD 4.1 billion by 2034. Pharmaceutical firms are increasingly focusing on producing branded treatments with improved pharmacokinetics, fewer adverse reactions, and greater therapeutic benefits. The rising need for novel treatments, especially among individuals who do not respond to conventional therapies, is also driving the demand for branded anti-epileptic medications.

When analyzing the route of administration, oral formulations held the largest share in 2024, accounting for USD 5.2 billion. This segment is projected to grow at a CAGR of 4.9% over the forecast period. Oral medications are preferred due to their convenience, ease of use, and the introduction of extended-release versions that improve dosage scheduling and patient adherence. The availability of diverse oral formulations is also accelerating adoption in both developed and emerging markets.

Based on patient demographics, the market is segmented into adult and pediatric populations. The adult segment led with a market value of USD 6 billion in 2024 and is expected to expand at a CAGR of 4.5% through 2034. The increasing incidence of epilepsy among adults is linked to age-related neurological conditions such as strokes, brain injuries, and degenerative disorders. As a result, the demand for reliable and targeted treatment approaches is rising, with a growing emphasis on multi-drug regimens and long-term therapy for improved seizure control.

According to seizure type, the market is segmented into focal seizures, generalized seizures, and combined seizures. The generalized seizure segment generated USD 2.5 billion in 2024 and is estimated to reach USD 4 billion by 2034. A rising number of generalized seizure cases, including tonic-clonic and absence seizures, is prompting the need for more robust therapeutic solutions. This trend is being supported by greater government funding for neurological research, insurance coverage expansions, and policy initiatives aimed at enhancing access to epilepsy care.

In terms of distribution channels, hospital pharmacies, retail pharmacies, and online pharmacies are the major segments. Retail pharmacies captured USD 2.3 billion in revenue in 2024 and are expected to register a CAGR of 4.9% during the forecast period. The growing availability of cost-effective generic drugs in retail settings, especially in low- and middle-income countries, is helping patients manage epilepsy more affordably. Additionally, insurance coverage and subsidy programs are making it easier for patients to access essential medications via retail outlets.

Regionally, North America led the global epilepsy treatment drugs market with a 41% share in 2024. The U.S. alone contributed USD 3.1 billion in revenue that year, driven by high awareness, well-developed healthcare systems, and consistent efforts to improve patient access to advanced neurological treatments. The U.S. market has shown steady year-on-year growth, moving from USD 2.8 billion in 2021 to USD 3 billion in 2023 and reaching USD 3.1 billion in 2024. The increasing prevalence of epilepsy in the region, coupled with favorable regulatory conditions and the presence of global pharmaceutical leaders, continues to push market development.

Major industry players are actively investing in advanced formulations and combination therapies, aiming to enhance patient outcomes and reduce the overall burden of epilepsy on healthcare systems.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this epilepsy treatment drugs market report include:- AbbVie

- Bausch Health Companies

- Dr. Reddy’s Laboratories

- Eisai

- GSK

- Jazz Pharmaceuticals

- Lupin Pharmaceuticals

- Neurelis

- Novartis

- Pfizer

- Sanofi

- SK Biopharmaceuticals

- Sumitomo Pharma

- Sun Pharmaceutical Industries

- UCB

Table Information

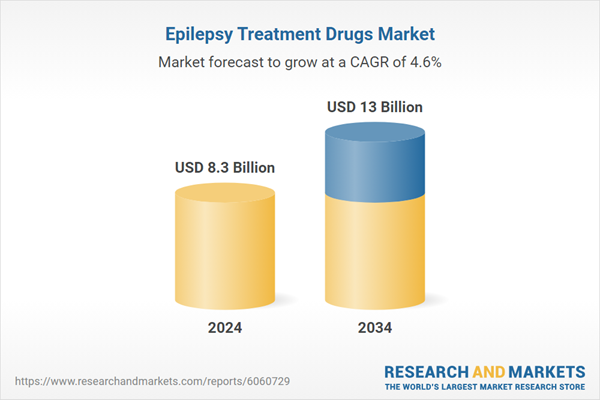

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 13 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |