With innovation and R&D shaping the future of power systems, switchgear technologies are undergoing rapid transformation. Investment in new power transmission lines and grid modernization is intensifying the demand for intelligent switchgear capable of real-time data monitoring, remote access, and predictive maintenance. The evolution of digital switchgear integrated with IoT capabilities is revolutionizing the industry, enabling better system control and significantly minimizing operational downtimes. This trend is attracting attention from energy companies, commercial establishments, and manufacturing plants aiming for greater efficiency, safety, and streamlined operations.

The medium voltage category accounted for a 33.8% share in 2024 and continues to grow as more utility-scale developments emerge across various sectors. Numerous energy and infrastructure projects in development will create widespread demand for both switchgear and supporting electrical systems. The increasing application of medium voltage switchgear is notably prominent in manufacturing hubs and renewable energy installations.

The gas-insulated switchgear segment is expected to grow at a CAGR of 7% through 2034. Driven by innovation and increased global demand for gas-based technologies, gas-insulated systems are gaining favor for their compact design, durability, and efficient power handling in critical applications. These systems offer dependable performance in densely populated or limited-space environments, making them ideal for both industrial and urban setups.

U.S. Switchgear Market is anticipated to reach USD 31 billion by 2034, propelled by the country's focus on modernizing electrical networks and enhancing operational energy management. Upgrades in grid infrastructure and adoption of advanced distribution equipment are reinforcing the need for cutting-edge switchgear solutions.

Key companies actively operating in the Global Switchgear Market include Hitachi Energy, Toshiba, Mitsubishi Electric, Fuji Electric, Schneider Electric, Eaton, Bharat Heavy Electricals, HD Hyundai Electric, ABB, General Electric, Siemens, Powell Industries, Legrand, Lucy Group, Ormazabal, Panasonic, Chint Group, Larsen & Toubro Limited, CG Power and Industrial Solutions, SGC, Hyosung Heavy Industries, and Orecco Electric. Leading switchgear manufacturers are enhancing their global reach through targeted mergers, acquisitions, and long-term strategic alliances with energy providers and infrastructure firms. These partnerships enable them to tailor solutions for large-scale transmission and distribution projects. Significant R&D investment is focused on developing smart switchgear integrated with IoT, real-time diagnostics, and automation.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Switchgear market report include:- ABB

- Bharat Heavy Electricals

- CG Power and Industrial Solutions

- Chint Group

- Eaton

- Fuji Electric

- General Electric

- HD Hyundai Electric

- Hitachi Energy

- Hyosung Heavy Industries

- Larsen & Toubro Limited

- Lucy Group

- Legrand

- Mitsubishi Electric

- Orecco Electric

- Ormazabal

- Panasonic

- Powell Industries

- Schneider Electric

- SGC

- Siemens

- Toshiba

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

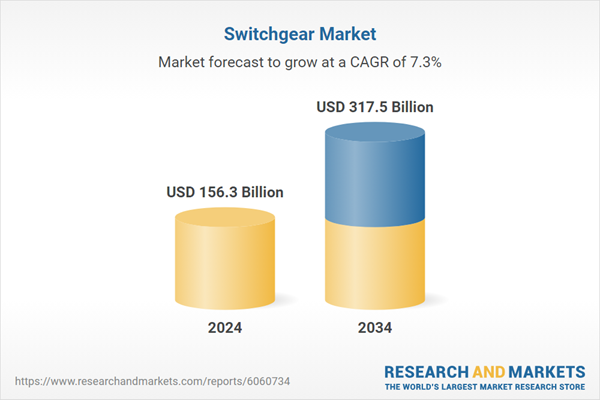

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 156.3 Billion |

| Forecasted Market Value ( USD | $ 317.5 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |