The telecommunications sector continues to be a significant driver of demand in the commercial wire and cable market. The fiber optics cable segment alone is expected to generate USD 40 billion by 2034, fueled by the rising need for reliable and high-speed connectivity in telecommunications and commercial sectors. Over the past decade, the telecom industry has invested an average of USD 50 billion annually in upgrading networks, reinforcing the importance of commercial wire and cable solutions. Companies operating in this sector are allocating substantial resources to enhance production capacity and meet growing industry requirements, further solidifying market expansion over the coming years.

Based on voltage, the low voltage segment is projected to grow at a CAGR of 7.5% by 2034, primarily driven by the increasing demand for wire and cable in infrastructure development projects. Governments and private enterprises worldwide are investing heavily in electrical grid modernization, contributing to market expansion. In 2023, China alone allocated USD 59 billion for electric power grid construction projects, emphasizing the critical role of commercial wire and cable in powering the future of urbanization and industrial advancements.

The U.S. commercial wire and cable market, valued at USD 12.77 billion in 2024, is set to witness steady growth owing to substantial investments in electrical infrastructure. In 2022, the U.S. invested approximately USD 89 billion in electricity networks, marking one of the highest expenditures in recent years. The country’s strong push towards renewable energy adoption further drives the demand for advanced wire and cable solutions. North America is positioning itself as a leader in energy transition, enhancing the market potential for commercial wire and cable manufacturers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Commercial Wire and Cable market report include:- Bergen Cable Technology

- Belden Inc.

- FURUKAWA ELECTRIC CO. Ltd.

- Havell India Ltd.

- KEI Industries Limited

- Klaus Faber AG

- LS Cables

- Leoni Cables

- NKT A/S

- Polycab

- Prysmian Group

- RR Kabel

- Riyadh Cables

- Sumitomo Electric Industries Ltd.

- Southwire Company LLC

- Top Cables

- Thermo Cables

- ZM Cables

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

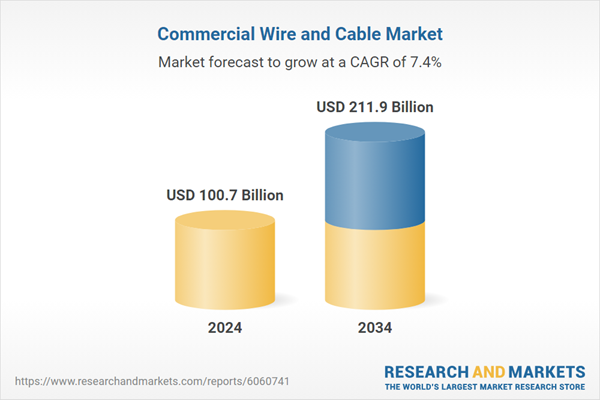

| Estimated Market Value ( USD | $ 100.7 Billion |

| Forecasted Market Value ( USD | $ 211.9 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |