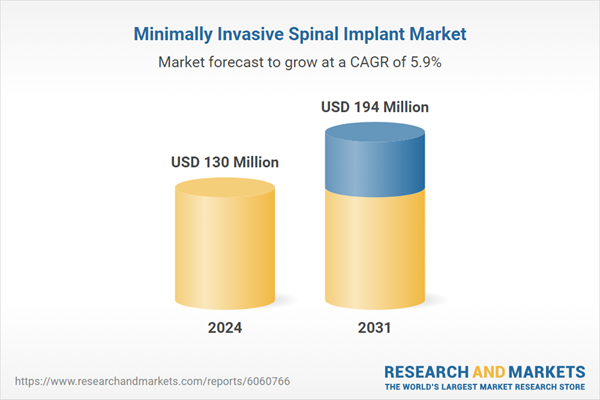

The Australian MIS implant market was valued at $130 million in 2024 and is projected to grow at a CAGR of 5.9%, reaching $194 million by 2031.

Market growth is driven by:

- Increasing patient preference for minimally invasive procedures

- Advancements in robotic-assisted MIS technologies

- AI-guided surgical planning improving clinical outcomes

The 2025 report provides an in-depth analysis of the Australian MIS market, covering:

- MIS Interbody (IB) Devices

- MIS Pedicle Screws

- Spinous Process Fixation

- Facet Fixation

- SI Joint Devices

- Spine Endoscopes

- MIS Surgical Instrumentation

The report explores emerging trends and technological advancements across all segments.

Market Report Data Types Included

- Unit Sales & Average Selling Prices (ASP)

- Market Value & Growth Trends

- Procedure Numbers

- Forecasts Until 2031

- Historical Data (2021-2023)

- Market Drivers & Limiters for Each Segment

- Competitive Analysis with Market Shares for Each Segment

- Recent Mergers & Acquisitions

- Company Profiles & Product Portfolios

- Leading Competitors

Australia’s Minimally Invasive Spinal Implant Market Trends

MIS procedures continue to gain traction due to:

- Minimized muscle and tissue damage

- Reduced complication rates

- Shorter recovery periods

Robotic-assisted MIS technologies and AI-guided surgical planning are revolutionizing spinal procedures by enhancing:

- Surgical precision

- Patient outcomes

- Efficiency in spinal surgeries

Australia’s Minimally Invasive Spinal Implant Market Share Insights (2024)

1 Medtronic - Market Leader

- Leading competitor in the Australian MIS market.

- Dominates the pedicle screw segment.

- Second-largest share in facet fixation and MIS IB device markets.

- Strong presence in the spinous process and MIS SI joint fusion markets.

2 Globus Medical/NuVasive - Strong Competitor

- Second-largest competitor in the overall MIS market.

- Merged in 2023, expanding global market share.

- Leading competitor in the MIS IB device market.

- Large market shares in pedicle screws, spinous process, facet fixation, and MIS SI joint fusion.

3 DePuy Synthes - Third-Largest Competitor

- Leading competitor in facet fixation.

- Strong presence in MIS IB devices and pedicle screws.

Market Segmentation Summary

MIS Interbody Device Market - Further segmented into:

- Minimally Invasive Posterior Lumbar Interbody Fusion (MIPLIF)

- Minimally Invasive Transforaminal Lumbar Interbody Fusion (MITLIF)

- Lateral Lumbar Interbody Fusion (LLIF)

- Oblique Lumbar Interbody Fusion (OLIF)

MIS Pedicle Screw Market - Further segmented into:

- Percutaneous Cannulated

- Retractor Cannulated

- Retractor Non-Cannulated

- Spinous Process Fixation Market

- Facet Fixation Market

- MIS SI Joint Fusion Market

- Spine Endoscope Market

Research Scope Summary

- Regions Covered

- Australia

- Base Year: 2024

- Forecast Period: 2025-2031

- Historical Data: 2021-2023

Quantitative Coverage

- Procedure Numbers

- Market Size & Growth Rates

- Unit Sales & ASP

- Market Shares & Forecasts through 2031

Qualitative Coverage

- Market Growth Trends & Limiters

- Competitive Analysis & SWOT for Top Competitors

- Mergers & Acquisitions

- Company Profiles & Product Portfolios

- FDA Recalls & Regulatory Developments

- Disruptive Technologies & Emerging Innovations

- Disease Overviews

Data Sources

- Primary Interviews with Industry Leaders

- Government Physician Data

- Regulatory Data

- Hospital Private Data

- Import & Export Data

- Internal Database

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A-Spine

- Integra LifeSciences

- AND Science & Technology

- JMDM

- ATEC Spine

- Joimax

- Apiary Medical

- KangLi Orthopaedics

- Asap Endoscopic Products

- Karl Storz

- Aurora Spine

- L & K

- B. Braun

- Life Instruments

- BAUI Biotech

- Life Spine

- BK Meditech

- Maxer Endoscopy

- BM Korea

- Medacta International

- BMK

- Medfix Instruments

- BioMech Poanan Biotech

- Medi-Tech

- Bless ALL

- Medline

- Boss Instruments

- Medtronic

- CTL Amedica

- Medyssey

- Chunlizhengda Medical

- Mizuho Medical

- DIO Medical

- Norer Medical

- DePuy Synthes

- Orthofix

- Double Medical

- Precision Spine

- Drappon Medical

- Razek Equipamentos

- GS Medical

- SI-BONE

- Globus Medical/NuVasive

- SIGNUS Medical

- Huvexel

- SOLCO

- IDEAL Medical

- STERIS Corporation

- INTAI

- Sanyou Medical

- Innomed

- SeaSpine

- Shanghai Kinetic

- Teijin

- Shanghai Shiyin Photoelectric

- Teleflex

- Sklar

- Tian Song

- SpineCraft

- Tonglu Ba Medical

- Spineart

- U & I Corporation

- Spineology

- Weigao Medical

- Spirt Spine

- Weigao Orthopedic

- Stryker

- Wiltrom Medical

- TDM

- Xtant Medical

- TeDan Surgical Innovations

- ZimVie/Highridge Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | February 2025 |

| Forecast Period | 2024 - 2031 |

| Estimated Market Value ( USD | $ 130 Million |

| Forecasted Market Value ( USD | $ 194 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Australia |