Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

E-commerce platforms and supermarket chains are expanding vegan product offerings, enhancing accessibility. Government initiatives promoting plant-based diets and investments in food innovation further support market expansion. According to a United Nations report, 60% of human infectious diseases and 75% of newly emerging ones originate from animals. Increasing plant-based food consumption can help reduce the risk of future pandemics.

Key Market Drivers

Rising Health Consciousness and Lifestyle Changes

One of the primary drivers of the India vegan food market is the increasing awareness of health and wellness. Consumers are shifting towards plant-based diets due to growing concerns about lifestyle diseases such as obesity, diabetes, and heart conditions. Research linking excessive consumption of animal-based products to health risks has encouraged a transition to vegan diets, which are perceived as healthier alternatives. India has a significant vegetarian population (around 30%),Key Market Challenges

High Costs and Affordability Issues

One of the primary challenges in the India vegan food market is the relatively high cost of plant-based alternatives compared to conventional dairy and meat products. Vegan food items, especially plant-based dairy and meat substitutes, are often priced at a premium due to high production costs, expensive raw materials, and limited economies of scale. Many plant-based products rely on imported ingredients, which further increases costs due to duties, logistics, and supply chain complexities.As a result, vegan alternatives remain out of reach for a significant portion of the Indian population, particularly in price-sensitive rural and middle-class urban segments. In contrast, traditional vegetarian diets, which already form a large part of Indian cuisine, are more affordable and easily accessible, reducing the urgency for consumers to switch to specialized vegan products. To make vegan food more affordable and widely accepted, companies need to focus on local sourcing, scaling up production, and investing in cost-effective food processing technologies.

Key Market Trends

Growing Popularity of Plant-Based Dairy Alternatives

One of the most prominent trends in the India vegan food market is the increasing demand for plant-based dairy alternatives. With a significant portion of the population experiencing lactose intolerance and growing health concerns related to dairy consumption, consumers are actively seeking alternatives such as almond milk, soy milk, oat milk, and coconut milk. Brands like Sofit, Epigamia, and RAW Pressery have capitalized on this trend by expanding their portfolios with dairy-free beverages, yogurts, and cheese.In addition to individual consumers, the foodservice industry is also responding to this trend, with cafés and restaurants offering plant-based milk options for coffee and other beverages. International chains such as Starbucks and homegrown brands like Blue Tokai have incorporated almond and oat milk into their menus to cater to the growing vegan and lactose-intolerant consumer base. As plant-based dairy becomes more mainstream, the affordability and availability of these products are expected to improve, further driving market expansion.

Key Market Players

- GoodDot Enterprises Pvt. Ltd.

- Veggie Champ

- Naturise Consumer products Pvt Ltd

- Dhond Green Ventures Private Limited (Wakao)

- Jus Amazin Food and Beverages Pvt. Ltd.

- Life Health Foods

- Piperleaf India Private Limited

- Nutricia International Private Limited (Danone)

- Vezlay Foods Pvt Ltd

- Imagine Foods Pvt. Ltd

Report Scope:

In this report, the India Vegan Food Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Vegan Food Market, By Product Type:

- Dairy Alternative

- Meat Substitute

- Vegan Bakery

- Vegan Confectionery

- Others

India Vegan Food Market, By Distribution Channel:

- Online

- Offline

India Vegan Food Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Vegan Food Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GoodDot Enterprises Pvt. Ltd.

- Veggie Champ

- Naturise Consumer products Pvt Ltd

- Dhond Green Ventures Private Limited (Wakao)

- Jus Amazin Food and Beverages Pvt. Ltd.

- Life Health Foods

- Piperleaf India Private Limited

- Nutricia International Private Limited (Danone)

- Vezlay Foods Pvt Ltd

- Imagine Foods Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | March 2025 |

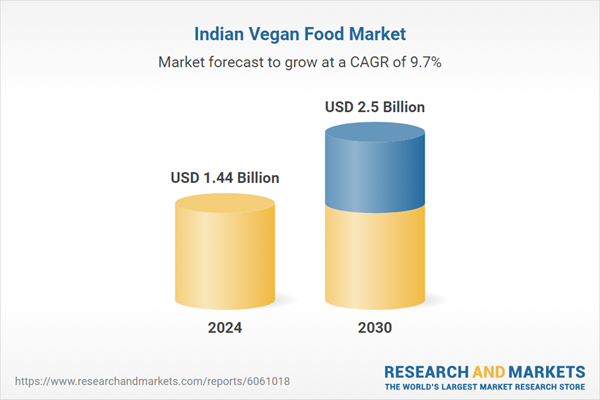

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |