Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is driven by the demand for cost-effective, lightweight, and sustainable packaging solutions across industries such as food & beverage, pharmaceuticals, chemicals, and industrial liquids. The increasing preference for eco-friendly alternatives to rigid packaging, coupled with stringent regulations promoting sustainable practices, has fueled the adoption of BIB containers. These containers significantly reduce carbon footprints due to their space-efficient design, lower transportation costs, and reduced material usage compared to traditional packaging formats like glass or rigid plastic.

Key Market Drivers

Rising Demand for Sustainable and Eco-Friendly Packaging

The increasing global emphasis on sustainability and environmentally friendly packaging solutions is a major driver for the Bag-in-Box (BIB) container market. Consumers and businesses alike are prioritizing eco-conscious purchasing decisions, leading to a surge in demand for packaging solutions that reduce waste and carbon footprint. Unlike traditional rigid containers, BIB packaging is lightweight, requires fewer raw materials, and minimizes transportation costs and emissions due to its compact design. Additionally, its collapsible nature significantly reduces waste volume post-use, making it an attractive option for industries aiming to comply with stringent environmental regulations and sustainability goals.Key Market Challenges

High Initial Investment and Production Costs

The Bag-in-Box (BIB) container market faces a significant challenge in terms of high initial investment and production costs, which can hinder adoption, especially among small and medium-sized enterprises (SMEs). The manufacturing process of BIB containers involves specialized machinery, multi-layered packaging materials, and advanced sealing technologies to ensure product integrity and durability. Unlike traditional rigid packaging solutions, BIB containers require precise engineering to maintain flexibility while preventing leaks, punctures, or contamination.The initial capital expenditure for setting up a BIB manufacturing facility is substantial, covering costs for extrusion and lamination equipment, bag-forming machines, filling systems, and sealing technologies. Additionally, companies must invest in research and development (R&D) to continuously enhance material quality, improve shelf-life, and address compatibility with various liquid and semi-liquid products. This poses a considerable barrier for new market entrants, limiting competition and innovation.

Key Market Trends

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

The Bag-in-Box (BIB) container market is witnessing a significant shift toward sustainable and eco-friendly packaging solutions, driven by increasing consumer awareness, stringent environmental regulations, and the global push for reducing plastic waste. With growing concerns over single-use plastics and their impact on the environment, businesses and consumers are actively seeking alternatives that minimize carbon footprints and promote circular economy principles.BIB containers, known for their lightweight, recyclable, and reduced material usage, are becoming the preferred choice in various industries, including food & beverage, industrial liquids, and household products. These containers significantly reduce packaging waste compared to traditional rigid packaging solutions such as plastic bottles and metal cans. The collapsible inner bag used in BIB containers allows for maximum product utilization, minimizing residual waste and enhancing cost efficiency for manufacturers. Additionally, leading companies in the market are investing in research and development to innovate biodegradable and compostable inner liners, further enhancing the sustainability quotient of BIB containers.

Key Market Players

- Amcor Ltd.

- Smurfit Kappa Group

- DS Smith Plc

- Liquibox Corporation’s

- SIG Group AG

- CDF Corporation

- Arlington Packaging (Rental) Limited

- Optopack Ltd.

- Accurate Box Company, Inc.

- Central Package & Display

Report Scope:

In this report, the Global Bag-in-Box Container Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bag-in-Box Container Market, By Material:

- Polyethylene Terephthalate (PET)

- Aluminum

- Polypropylene

- Polyethylene (PE)

- Others

Bag-in-Box Container Market, By Capacity:

- Below 1 Liter

- 1-3 Liters

- 3-5 Liters

- 5-10 Liters

- Above 10 Liters

Bag-in-Box Container Market, By End-User:

- Beverages

- Food Products

- Chemicals

- Personal Care & Cosmetics

- Others

Bag-in-Box Container Market, By Application:

- Industrial

- Commercial

- Residential

Bag-in-Box Container Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bag-in-Box Container Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amcor Ltd.

- Smurfit Kappa Group

- DS Smith Plc

- Liquibox Corporation’s

- SIG Group AG

- CDF Corporation

- Arlington Packaging (Rental) Limited

- Optopack Ltd.

- Accurate Box Company, Inc.

- Central Package & Display

Table Information

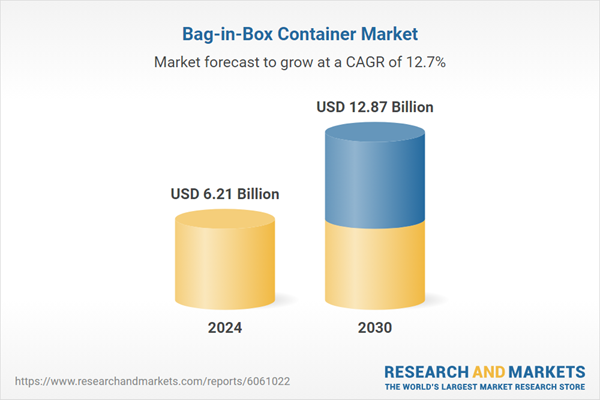

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.21 Billion |

| Forecasted Market Value ( USD | $ 12.87 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |