Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Rising Vehicle Ownership and Increasing Road Traffic

One of the primary drivers of the global auto insurance market is the continuous increase in vehicle ownership worldwide. As economies develop and disposable incomes rise, particularly in emerging markets such as India, China, and Brazil, more consumers are purchasing vehicles, leading to higher demand for auto insurance. Additionally, urbanization and expanding middle-class populations contribute to greater vehicle penetration. Increased road traffic results in a higher probability of accidents, making insurance coverage essential for financial protection. This trend is further fueled by government mandates requiring vehicle owners to have at least third-party liability insurance, ensuring sustained market growth.Key Market Challenges

Rising Insurance Fraud and Claims Management Complexity

One of the most significant challenges in the global auto insurance market is the increasing prevalence of fraudulent claims, which leads to substantial financial losses for insurers. Fraudulent activities include staged accidents, inflated repair costs, and false injury claims, all of which inflate claim expenses and put pressure on insurance premiums. In some regions, organized fraud rings exploit loopholes in claim processes, making it difficult for insurers to detect and prevent fraudulent activities.Additionally, the complexity of claims management is increasing due to the growing number of insurance policies, vehicle types, and regulatory requirements. Insurers must invest in advanced technologies, such as artificial intelligence (AI) and machine learning, to enhance fraud detection, streamline claim processing, and ensure fair settlements. However, integrating these technologies requires significant capital investment, skilled workforce development, and ongoing technological updates, creating further operational challenges.

Key Market Trends

Growth of Usage-Based Insurance (UBI) and Telematics

One of the most significant trends in the global auto insurance market is the rise of usage-based insurance (UBI), driven by telematics and connected car technology. UBI models allow insurers to customize premium rates based on individual driving behavior, mileage, and real-time vehicle usage. This shift is fueled by consumer demand for personalized insurance plans that offer more flexibility and cost savings.Telematics devices, smartphone apps, and in-car sensors collect data on driving patterns, such as speed, braking, and acceleration, enabling insurers to assess risk more accurately. As UBI adoption increases, insurers are encouraging safer driving habits through incentives and discounts, ultimately reducing claim frequencies and improving overall road safety. The growing penetration of connected cars and advancements in AI-driven analytics further enhance insurers' ability to assess risk dynamically and offer tailored coverage options.

Key Market Players

- Allianz SE

- Allstate Insurance Company

- Admiral Group Plc

- China Pacific Insurance (Group) Co., Ltd.

- Ping An Insurance (Group) Company of China, Ltd

- Zurich Insurance Company Ltd

- AXA SA

- Property and Casualty Company Limited (PICC)

- Tokio Marine Holdings, Inc.

- GEICO General Insurance Company

Report Scope:

In this report, the global Auto Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Auto Insurance Market, By Coverage:

- Third-Party Liability Coverage

- Collision/Comprehensive/ Other Optional Coverage

Auto Insurance Market, By Vehicle Type:

- New Vehicle

- Used Vehicle

Auto Insurance Market, By Provider:

- Insurance Companies

- Insurance Agents/Brokers

- Others

Auto Insurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Auto Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Allianz SE

- Allstate Insurance Company

- Admiral Group Plc

- China Pacific Insurance (Group) Co., Ltd.

- Ping An Insurance (Group) Company of China, Ltd

- Zurich Insurance Company Ltd

- AXA SA

- Property and Casualty Company Limited (PICC)

- Tokio Marine Holdings, Inc.

- GEICO General Insurance Company

Table Information

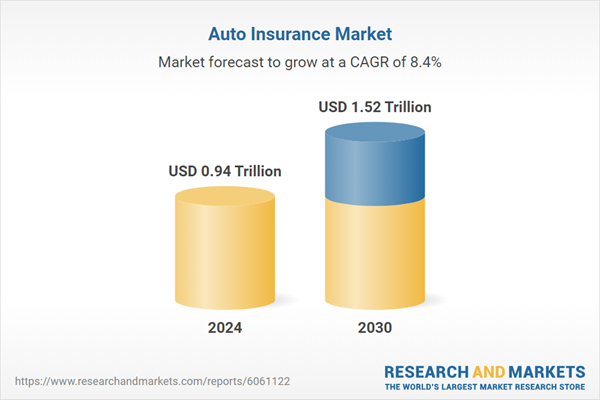

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.94 Trillion |

| Forecasted Market Value ( USD | $ 1.52 Trillion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |