This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

A payment gateway serves as the intermediary between merchants and financial institutions, ensuring that transactions are authenticated, encrypted, and processed efficiently. The industry has grown beyond traditional credit and debit card payments, incorporating alternative payment methods such as digital wallets, cryptocurrencies, and buy-now-pay-later (BNPL) services.

With evolving regulatory frameworks, heightened security concerns, and growing consumer expectations, payment gateways continue to innovate and redefine the financial ecosystem. The global payment gateway market has seen exponential growth, driven by increasing e-commerce penetration, rising smartphone usage, and advancements in financial technology. According to industry reports, the market size is projected to reach several hundred billion dollars in the coming years, with double-digit compound annual growth rates (CAGR).

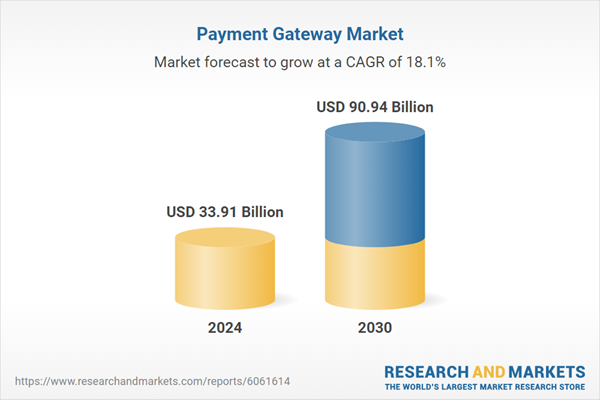

According to the research report "Global Payment Gateway Market Outlook, 2030," the Global Payment Gateway market was valued at more than USD 33.91 Billion in 2024, and expected to reach a market size of more than USD 90.94 Billion by 2030 with the CAGR of 18.13% from 2025-30. Key players in the market include PayPal, Stripe, Square, Adyen, Authorize.net, and global financial institutions offering proprietary payment solutions. These companies compete based on transaction speed, security features, pricing, and integration capabilities with various business platforms.

The rise of fintech startups has intensified competition, with new entrants offering specialized solutions for small businesses, subscription-based models, and cross-border transactions. The shift toward embedded finance, where payment processing is integrated into non-financial platforms, is also a significant trend shaping the industry. Advancements in technology have revolutionized the way payment gateways operate. Artificial intelligence (AI) and machine learning (ML) play a crucial role in fraud detection and risk assessment, enabling real-time monitoring of transactions for suspicious activities. Blockchain technology is gaining traction, offering decentralized payment solutions that enhance security and reduce processing costs.

The adoption of near-field communication (NFC) and biometric authentication has improved transaction speed and security for contactless payments. Additionally, cloud-based payment gateways provide scalability and flexibility, allowing businesses to manage transactions more efficiently across multiple geographies. The integration of APIs has also become a standard practice, enabling seamless connectivity between payment gateways and various e-commerce platforms, mobile apps, and enterprise resource planning (ERP) systems.

Market Drivers

- Expansion of Cross-Border E-commerce: The rise of global e-commerce has significantly fueled the demand for advanced payment gateway solutions. As businesses expand beyond their domestic markets, they require payment gateways that support multi-currency transactions, localized payment methods, and seamless cross-border payments. Consumers expect hassle-free checkout experiences, whether they are purchasing from a local online store or an international retailer. Payment gateways that offer dynamic currency conversion, fraud prevention for international transactions, and compliance with diverse regulatory requirements have become crucial for facilitating global trade.

- Adoption of Embedded Payments in Digital Ecosystems: The integration of payment gateways into non-financial platforms, commonly known as embedded payments, is a game-changer. This driver is particularly evident in industries such as ride-sharing, food delivery, and subscription-based services, where payments are processed seamlessly within an app or platform without redirection to external payment pages. Companies like Uber and Amazon have set new standards by embedding payment functionalities within their ecosystems, making transactions nearly invisible to users. This trend is encouraging more businesses to adopt white-label payment gateway solutions to enhance user convenience and brand control over the payment experience.

Market Challenges

- Rising Cybersecurity Threats and Data Breaches: With the increasing volume of digital transactions, payment gateways have become prime targets for cybercriminals. The industry faces continuous threats such as phishing attacks, credential stuffing, ransomware, and advanced persistent threats (APTs). Fraudsters exploit vulnerabilities in online payment systems, leading to financial losses and reputational damage. Payment gateways must implement advanced fraud detection mechanisms using AI-driven behavioral analytics, multi-factor authentication (MFA), and real-time transaction monitoring to counteract these threats. However, staying ahead of evolving cyber threats remains a significant challenge.

- Fragmented Regulatory Compliance Across Regions: Payment gateways must comply with a wide range of financial regulations, which vary significantly across different countries and regions. For example, in Europe, PSD2 (Revised Payment Services Directive) mandates Strong Customer Authentication (SCA), while the U.S. follows PCI DSS (Payment Card Industry Data Security Standard) for transaction security. Meanwhile, emerging markets have their own evolving frameworks, often requiring additional localization efforts. Managing these regulatory complexities while ensuring seamless transactions across multiple jurisdictions poses a significant operational burden for payment providers.

Market Trends

- Rise of AI-Powered Smart Payment Solutions: Artificial intelligence (AI) is revolutionizing payment gateways by enabling real-time fraud detection, personalized payment recommendations, and enhanced transaction security. Machine learning models analyze vast datasets to identify transaction patterns, anomalies, and potential fraudulent activities before they occur. Additionally, AI-powered chatbots and virtual assistants are being integrated into payment gateways to assist customers with payment-related queries, refunds, and chargebacks. The increasing use of AI-driven automation is helping businesses streamline payment processing and improve customer experience.

- Growing Influence of Cryptocurrencies and Decentralized Payment Systems: The acceptance of cryptocurrencies such as Bitcoin, Ethereum, and stablecoins as a payment method is gaining traction. Businesses and consumers are exploring blockchain-based payment gateways that offer lower transaction fees, faster settlements, and enhanced security compared to traditional banking systems. Additionally, central bank digital currencies (CBDCs) are being developed in several countries, which could reshape how digital payments are processed globally. As regulatory frameworks around cryptocurrencies become more defined, more payment gateways are expected to support blockchain-based transactions, further transforming the industry.

When a customer makes a transaction, they are redirected to the payment service provider’s (PSP) secure page, where the payment is processed. This setup ensures that merchants do not have to handle or store card details directly, significantly lowering their risk of data breaches, fraud, and regulatory non-compliance. Hosted gateways come with built-in security measures, including PCI DSS (Payment Card Industry Data Security Standard) compliance, encryption protocols, tokenization, and fraud detection tools, all of which protect both the merchant and the consumer. Additionally, these gateways simplify payment integration for businesses, eliminating the need for complex in-house infrastructure and security maintenance.

Companies, especially small and mid-sized enterprises (SMEs), prefer hosted gateways because they offer a plug-and-play solution with automatic updates, minimal IT overhead, and seamless compatibility with multiple payment methods, including credit/debit cards, digital wallets, and BNPL (Buy Now, Pay Later) options. Moreover, hosted gateways support global transactions with multi-currency processing and localized payment preferences, making them an ideal choice for businesses looking to scale internationally.

Large enterprises lead the payment gateway market primarily because they handle a massive volume of transactions and require customized, scalable, and secure payment processing solutions.

Large enterprises, spanning industries such as e-commerce, fintech, travel, and retail, process thousands to millions of transactions daily, necessitating high-speed, reliable, and cost-efficient payment solutions that can seamlessly manage peak traffic and global payments. Unlike small businesses that rely on standard payment gateway services, large enterprises often demand advanced features such as multi-currency support, white-label payment solutions, fraud detection powered by AI, automated reconciliation, and seamless API integration with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems.

Additionally, they have the financial capability to invest in dedicated payment infrastructure, ensuring complete control over payment flows, branding, and customer experience. Security and regulatory compliance are also critical concerns, as large enterprises must adhere to global payment regulations like PCI DSS, GDPR, PSD2, and local taxation laws. To minimize risks and enhance operational efficiency, they often deploy hybrid models, combining hosted and self-hosted payment gateways, or even developing proprietary payment solutions in collaboration with financial institutions.

Furthermore, large enterprises drive innovation in payment technology by adopting biometric authentication, blockchain-based payments, and embedded finance solutions, shaping the future of digital transactions. Their influence in the market extends beyond adoption; they also dictate trends, push for lower transaction fees, and partner with fintech companies to develop cutting-edge payment experiences.

The Banking, Financial Services, and Insurance (BFSI) sector leads the payment gateway market because it serves as the foundation of digital payments, offering robust infrastructure, financial security, and regulatory compliance that power global transactions.

As the primary facilitators of payment processing, banks and financial institutions own and control payment networks, ensuring seamless fund transfers between merchants, consumers, and businesses. Unlike third-party fintech companies, BFSI institutions have direct access to banking systems, clearinghouses, and real-time payment settlement networks, allowing them to provide highly secure and efficient payment gateway services. Additionally, regulatory requirements such as PCI DSS, AML (Anti-Money Laundering) laws, PSD2 (in Europe), and data protection regulations place BFSI firms at the forefront of ensuring transaction security and fraud prevention.

Their extensive experience in handling financial risk, coupled with advanced security measures like tokenization, AI-driven fraud detection, and biometric authentication, makes them the most trusted payment service providers. BFSI institutions also have the capital and resources to invest in cutting-edge fintech innovations, including real-time payments, blockchain-based settlements, and open banking APIs, which enable seamless integration with e-commerce, digital wallets, and mobile banking apps. Furthermore, as consumer preferences shift towards contactless, mobile, and embedded payments, BFSI firms are continuously evolving their payment gateway offerings to remain competitive, partnering with fintech companies and leveraging AI for personalized financial services.

The Asia-Pacific (APAC) region leads the payment gateway market due to its fast-paced digital transformation, booming e-commerce sector, and widespread adoption of mobile payment solutions.

Countries like China, India, Japan, and Southeast Asian nations have witnessed an explosion in digital transactions, driven by the increasing penetration of smartphones, internet connectivity, and government-led initiatives promoting cashless economies. The region is home to some of the world’s largest e-commerce giants, such as Alibaba, Tencent, Flipkart, and Rakuten, which rely on sophisticated payment gateway solutions to handle millions of daily transactions. Additionally, the dominance of super apps like WeChat Pay, Alipay, and Paytm has revolutionized how consumers engage with digital payments, moving beyond traditional card transactions to QR code-based and biometric authentication methods.

The rise of real-time payment systems, such as India’s Unified Payments Interface (UPI) and China’s Faster Payments System (FPS), has made instant, secure, and low-cost transactions the norm, further accelerating the demand for advanced payment gateways. Furthermore, the region's large unbanked and underbanked population has driven the adoption of alternative payment methods, including digital wallets, buy-now-pay-later (BNPL) services, and cryptocurrencies, creating a thriving market for innovative payment solutions.

Governments and financial regulators in APAC are also actively promoting digital payment adoption through policies and initiatives that encourage financial inclusion and digital infrastructure development. The combination of high consumer demand, government support, fintech innovation, and an increasingly cashless society positions Asia-Pacific as the dominant force in the global payment gateway market, with continuous growth expected in the coming years.

Recent Developments

- In August 2024, PayU announced its partnership with Fynd to offer enhanced payment experiences for merchants in India. The partnership aligns well with both companies’ commitment to helping Indian merchants become digital-first and unlock new revenue opportunities.

- In August 2024, Leading financial services business Cardstream and multichannel payments provider PayPoint Plc (PayPoint) have officially announced their collaboration. The powerful partnership sees PayPoint integrating Cardstream’s Gateway Connectivity into their MultiPay digital payments platform, which will allow it to continue to build a robust and scalable solution for clients.

- In May 2022, A Blockchain payment gateway was built by MooPay, a user-friendly cryptocurrency payment platform, to democratize cryptocurrency payments. As a result of an increase in cyberattacks on cryptocurrency exchanges around the world, non-custodial wallets are becoming more popular among cryptocurrency users.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Payment Gateway Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Hosted

- Non-Hosted

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprise

By End user

- BFSI

- Media & Entertainment

- Retail & E-Commerce

- Travel & Hospitality

- Other

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- PayPal Holdings, Inc.

- Stripe, Inc

- Fiserv, Inc.

- Visa Inc.

- Adyen N.V.

- Block, Inc.

- Alipay

- PayU

- Mastercard Inc.

- Amazon.com, Inc.

- PhonePe

- Paysafe Limited

- NOWPayments

- Worldline SA

- BlueSnap Inc

- Fidelity National Information Services, Inc.

- GMO PAYMENT GATEWAY, INC.

- Network International L.L.C

- Telr

- Cielo S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 33.91 Billion |

| Forecasted Market Value ( USD | $ 90.94 Billion |

| Compound Annual Growth Rate | 18.1% |

| Regions Covered | Global |