This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

With increasing awareness about the harmful effects of high sugar intake, consumers are actively seeking healthier choices without compromising on taste. This shift has led food manufacturers to reformulate their products by incorporating alternative sweeteners that provide sweetness with fewer or no calories. Additionally, government regulations on sugar taxes and nutritional labeling have further fueled the demand for sugar substitutes, prompting companies to innovate and develop new formulations to meet both regulatory requirements and evolving consumer demands. One of the key trends shaping the sweeteners industry is the rising popularity of natural sweeteners.

Consumers are becoming more conscious of ingredient lists, preferring plant-based and minimally processed alternatives over synthetic options. Stevia, derived from the leaves of the Stevia rebaudiana plant, has gained immense popularity due to its zero-calorie content and natural origin. Similarly, monk fruit extract, which provides intense sweetness without a glycemic impact, is gaining traction among health-conscious individuals. Other plant-based sweeteners, such as coconut sugar and agave syrup, are also seeing increased adoption due to their perceived health benefits and lower glycemic index.

However, despite the demand for natural sweeteners, artificial sweeteners continue to hold a significant share in the market due to their cost-effectiveness and stability in various food applications. Sucralose, aspartame, and acesulfame potassium remain widely used in diet sodas, sugar-free candies, and low-calorie desserts, catering to consumers who prioritize weight management and reduced sugar intake. While artificial sweeteners face scrutiny over potential health risks, scientific studies and regulatory approvals continue to support their safe consumption within prescribed limits, ensuring their sustained presence in the industry.

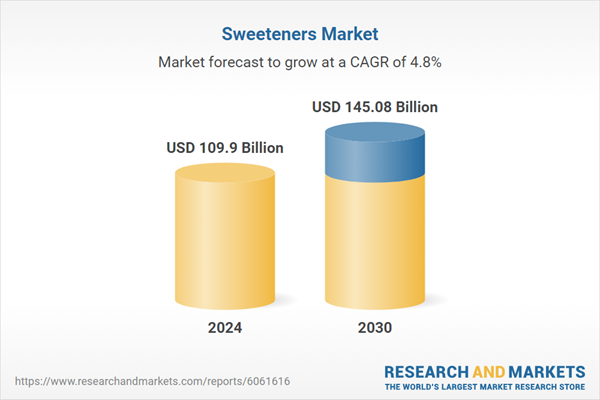

According to the research report "Global Sweeteners Market Outlook, 2030," the Global Sweeteners market was valued at more than USD 109.90 Billion in 2024, and expected to reach a market size of more than USD 145.08 Billion by 2030 with the CAGR of 4.84% from 2025-30. Sugar alcohols, including erythritol, maltitol, and sorbitol, are gaining popularity due to their benefits beyond sweetness. These sweeteners are commonly used in sugar-free gums, chocolates, and protein bars due to their ability to provide bulk, texture, and a cooling effect without significantly impacting blood sugar levels.

Additionally, prebiotic sweeteners such as inulin and allulose are emerging as game-changers in the industry, offering both sweetness and digestive health benefits. Allulose, in particular, has garnered attention as a rare sugar with minimal caloric value and a taste profile similar to regular sugar. The demand for such innovative sweeteners is growing as consumers seek products that not only replace sugar but also contribute to overall well-being. The rise of keto, paleo, and diabetic-friendly diets has further propelled the need for alternative sweeteners that align with specific dietary requirements, prompting companies to develop formulations that cater to niche health-conscious markets.

The sweeteners industry is also experiencing a shift in formulation strategies among food manufacturers. As consumers become more mindful of sugar intake, companies are exploring blends of different sweeteners to achieve a more balanced taste while minimizing the drawbacks associated with individual sugar substitutes. For example, combining stevia with erythritol helps mask the bitter aftertaste of stevia while maintaining a sugar-like texture. Similarly, mixing monk fruit extract with allulose allows for a more natural and sugar-like experience without the glycemic impact.

This trend of "sweetener synergies" is leading to the development of better-tasting and more consumer-friendly products, allowing manufacturers to cater to diverse taste preferences while maintaining a health-oriented approach. Additionally, advancements in biotechnology are enabling companies to produce high-purity sweeteners through fermentation and enzymatic processes, reducing reliance on traditional extraction methods and improving scalability for mass production.

Market Drivers

- Rising Health Consciousness and the Shift Away from Sugar: One of the most significant drivers of the sweeteners industry is the increasing awareness of health-related issues caused by excessive sugar consumption. The global rise in obesity, diabetes, and other metabolic disorders has led consumers to seek sugar alternatives that provide sweetness without negative health impacts. Governments and health organizations worldwide are also implementing sugar taxes, stricter labeling laws, and awareness campaigns to reduce sugar intake, further accelerating the demand for low-calorie and natural sweeteners. This shift is driving innovation in the industry, with companies developing healthier sugar substitutes, including plant-based and functional sweeteners that align with dietary trends such as keto, paleo, and diabetic-friendly lifestyles.

- Advancements in Food Science and Sweetener Formulation: The growing need for better-tasting and more functional sweeteners has led to significant advancements in food technology. Manufacturers are continuously working on improving the taste, texture, and application of sweeteners by combining multiple ingredients to mimic the sensory experience of sugar more closely. Innovations such as enzymatic conversion and fermentation-based production are helping create high-purity, sustainable sweeteners with better taste profiles. Biotechnology is also playing a role in developing novel sweeteners, such as rare sugars like allulose and tagatose, which offer sugar-like properties with minimal calories. These advancements are driving the expansion of the sweeteners market, making sugar substitutes more appealing to consumers and food manufacturers.

Market Challenges

- Regulatory and Safety Concerns: The sweeteners industry faces strict regulatory scrutiny, as different countries have varying guidelines regarding the safety, approval, and labeling of artificial and natural sweeteners. Some artificial sweeteners, such as aspartame and saccharin, have been subject to health-related controversies, causing consumer skepticism despite regulatory approvals. Additionally, new sweeteners must undergo rigorous safety testing before being allowed in food products, which can slow down market entry. The complexity of navigating global regulatory frameworks creates a challenge for manufacturers looking to expand into new regions while ensuring compliance with food safety standards.

- Taste Limitations and Consumer Acceptance: One of the biggest challenges for the sweeteners industry is replicating the taste and mouthfeel of sugar without undesirable aftertastes or textural differences. Many artificial and natural sweeteners have taste drawbacks, such as bitterness (stevia), cooling effects (sugar alcohols), or a delayed sweetness perception. Consumers often hesitate to switch from traditional sugar due to these sensory differences, making taste optimization a crucial challenge for manufacturers. While blending different sweeteners can help mitigate taste issues, achieving the perfect sugar-like experience remains an ongoing hurdle in the industry.

Market Trends

- Growing Demand for Natural and Plant-Based Sweeteners: As consumers become more conscious of the ingredients in their food and beverages, there is a rising preference for plant-based and minimally processed sweeteners. Natural sweeteners like stevia, monk fruit, agave syrup, and coconut sugar are gaining popularity due to their clean-label appeal and perceived health benefits. Brands are increasingly marketing these sweeteners as "natural" and "organic," aligning with the growing trend of clean eating and holistic health. Additionally, sustainable sourcing and eco-friendly production methods are becoming key factors influencing purchasing decisions.

- Expansion of Functional and Prebiotic Sweeteners: The demand for sweeteners that offer additional health benefits beyond just sweetness is growing rapidly. Prebiotic sweeteners such as inulin and chicory root fiber are gaining traction due to their ability to support gut health while acting as a sugar substitute. Rare sugars like allulose and tagatose, which provide sweetness without impacting blood sugar levels, are also becoming more widely available. These functional sweeteners cater to health-conscious consumers, particularly those following specific dietary trends like keto, diabetic-friendly, or weight management-focused diets. As the food industry embraces wellness-driven innovations, functional sweeteners are expected to become a major force shaping the future of sugar alternatives.

Sucrose, commonly known as table sugar, continues to dominate the sweeteners market despite the rise of alternative sugar substitutes. One of the key reasons for its market leadership is its unparalleled taste profile, which provides the ideal balance of sweetness without the aftertastes or sensory drawbacks associated with many artificial and natural sweeteners. Sucrose is universally accepted and widely used in nearly all food and beverage categories, including baked goods, confectionery, dairy, beverages, and processed foods, due to its ability to enhance flavor, improve texture, and contribute to browning and caramelization in cooking.

Its natural origin and familiarity make it the preferred choice for consumers and manufacturers alike, as it does not carry the same concerns or regulatory scrutiny as synthetic sweeteners like aspartame or saccharin. Another major factor contributing to sucrose's dominance is its cost-effectiveness and large-scale availability. Derived primarily from sugarcane and sugar beets, sucrose production is well-established, making it one of the most affordable and accessible sweeteners globally. Its easy availability ensures that food manufacturers can use it without supply chain limitations or price volatility concerns that may affect newer, alternative sweeteners.

Additionally, sucrose's functional properties extend beyond sweetness, as it plays a crucial role in food preservation, fermentation, and texture enhancement, making it indispensable in many industries. While health concerns regarding excessive sugar consumption and regulations such as sugar taxes are prompting some shifts toward alternative sweeteners, sucrose remains the benchmark for sweetness in the industry. Even as companies explore sugar reduction strategies, many are opting for sucrose reduction rather than complete elimination, highlighting its enduring significance in the global sweeteners market.

High-intensity sweeteners dominate the sweeteners market due to their ability to provide intense sweetness with minimal calories, making them ideal for sugar reduction in food and beverage applications.

High-intensity sweeteners (HIS) have gained a leading position in the global sweeteners market primarily because of their exceptionally high sweetness levels, which allow manufacturers to use them in extremely small quantities while achieving the desired level of sweetness. Unlike sucrose, which contributes significant calories and can lead to health concerns like obesity and diabetes, HIS options such as aspartame, sucralose, saccharin, acesulfame potassium, and stevia provide little to no caloric content, making them highly attractive for health-conscious consumers and diet-focused food formulations.

The growing consumer demand for sugar-free and reduced-calorie products has driven widespread adoption of HIS, particularly in the beverage industry, where they are extensively used in diet sodas, energy drinks, and flavored waters. Another major advantage of high-intensity sweeteners is their cost efficiency - since they are hundreds to thousands of times sweeter than sugar, only a tiny amount is needed, reducing production costs for manufacturers while still delivering a strong sweetness impact. Additionally, HIS options are highly versatile and stable, making them suitable for a broad range of applications, including baking, confectionery, dairy, and pharmaceuticals, where sugar substitution is a key priority.

Governments and health organizations worldwide are actively encouraging sugar reduction through policies such as sugar taxes and stricter nutritional labeling, further propelling the demand for HIS as viable sugar alternatives. While some concerns over taste, aftertaste, and consumer skepticism about artificial ingredients persist, ongoing advancements in formulation techniques and blending strategies - such as combining HIS with natural sweeteners - are helping to mitigate these issues and enhance their market appeal. As the global push toward healthier, low-calorie diets continues to grow, high-intensity sweeteners are expected to maintain their dominant position, playing a crucial role in the future of sugar reduction and reformulation efforts across industries.

Powdered sweeteners lead the sweeteners market due to their superior stability, long shelf life, and ease of use in a wide range of food and beverage applications.

Powdered sweeteners have become the dominant form in the global sweeteners market because of their versatility, convenience, and superior shelf stability compared to liquid or granular alternatives. Many high-intensity sweeteners, including aspartame, sucralose, stevia, and saccharin, are commonly available in powdered form due to their high concentration and easy dispersion in food and beverage formulations. The powdered format ensures uniform mixing, making it ideal for large-scale food manufacturing processes where consistency is crucial. Additionally, powdered sweeteners offer a significantly longer shelf life than liquid counterparts, as they are less prone to degradation caused by moisture, heat, or microbial contamination.

This extended shelf stability makes them highly suitable for packaged and processed food products, ensuring manufacturers can maintain product quality over time. Another key factor driving the popularity of powdered sweeteners is their cost-effectiveness and efficiency. Since they are lightweight and easy to transport, they reduce logistical costs for manufacturers and retailers. Furthermore, their high concentration means that only a small amount is needed to achieve the desired sweetness, making them economical for both consumers and businesses.

Powdered sweeteners are also widely used in at-home applications, as they can be easily measured and blended into recipes, beverages, and meal preparations without altering texture or moisture content. With growing demand for sugar-free and low-calorie products, powdered sweeteners continue to be the preferred choice for manufacturers looking to formulate healthier alternatives while maintaining cost efficiency and product stability. As food innovation advances and clean-label trends gain momentum, powdered sweeteners are expected to retain their market leadership, offering an optimal balance of functionality, convenience, and affordability across various industries.

The food and beverage (F&B) industry leads the sweeteners market due to its extensive use of sweeteners in product formulations, driven by consumer demand for taste, convenience, and healthier alternatives to sugar.

The dominance of the food and beverage (F&B) sector in the sweeteners market is largely attributed to the widespread application of sweeteners across multiple product categories, including baked goods, confectionery, dairy, beverages, and processed foods. Sweeteners play a crucial role in enhancing the taste, texture, and overall sensory experience of food products, making them an indispensable ingredient for manufacturers looking to meet consumer expectations.

As global health concerns over excessive sugar consumption continue to rise, food and beverage companies are aggressively reformulating their products by incorporating low-calorie and alternative sweeteners such as stevia, sucralose, aspartame, and sugar alcohols to cater to health-conscious consumers. Additionally, the beverage industry, particularly soft drinks, energy drinks, flavored water, and juices, is one of the largest users of sweeteners, as sugar reduction remains a key priority due to sugar taxes and shifting consumer preferences toward sugar-free or reduced-sugar beverages.

The growing trend of functional and fortified foods, including protein bars, yogurt, and plant-based alternatives, has further fueled the demand for innovative sweetener solutions that align with dietary trends like keto, paleo, and diabetic-friendly lifestyles. Moreover, sweeteners offer cost advantages for manufacturers, as high-intensity and sugar substitute options require smaller quantities while maintaining the desired level of sweetness, ultimately lowering production costs.

As clean-label and natural ingredient trends gain momentum, F&B companies are also investing in plant-based and minimally processed sweeteners like monk fruit, allulose, and agave syrup to attract health-conscious consumers. With continuous product innovation, evolving dietary trends, and regulatory pressures to reduce sugar content, the F&B industry remains the largest and most influential driver of the global sweeteners market, ensuring sustained growth and innovation in sugar alternatives.

Supermarkets and hypermarkets lead the sweeteners market due to their wide product variety, strong consumer footfall, and convenience, making them the preferred retail channel for purchasing sweeteners.

Supermarkets and hypermarkets dominate the distribution of sweeteners primarily because of their extensive product offerings, accessibility, and ability to cater to diverse consumer preferences. These large retail chains provide a one-stop shopping experience where customers can find a variety of sweeteners, including traditional sugar, artificial sweeteners, natural alternatives like stevia and monk fruit, and specialty sugar-free products, all under one roof. Their ability to stock multiple brands and formats - such as powdered, liquid, and granulated sweeteners - allows consumers to compare options easily, fostering higher sales volumes.

Additionally, supermarkets and hypermarkets benefit from high consumer traffic and impulse purchasing behavior, as sweeteners are often bought alongside other grocery items. Promotions, discounts, and attractive in-store placements further encourage sales, making these retail outlets the preferred shopping destination for both individual consumers and bulk buyers like bakeries and restaurants. Another key factor driving their leadership in the market is consumer trust and brand visibility - established brands and private-label sweetener products gain credibility through their presence in well-known supermarket chains, influencing purchasing decisions.

Furthermore, supermarkets and hypermarkets offer better accessibility in both urban and suburban areas, ensuring that consumers can conveniently purchase sweeteners without relying on online platforms or specialty stores. With the increasing demand for healthier alternatives, these retail chains are also expanding their selection of organic and low-calorie sweeteners, catering to shifting consumer preferences. As purchasing habits continue to evolve, supermarkets and hypermarkets remain the dominant sales channel, ensuring that sweeteners remain widely available and easily accessible to a broad consumer base.

The Asia-Pacific region leads the sweeteners market due to its large population, increasing demand for processed foods and beverages, and the rising shift toward healthier sugar alternatives.

Asia-Pacific has emerged as the dominant player in the global sweeteners market, driven by a rapidly growing consumer base, changing dietary habits, and increasing demand for both traditional and alternative sweeteners. The region is home to some of the world’s most populous countries, including China and India, where high consumption of sweetened foods and beverages fuels significant demand for sweeteners. The expansion of the food and beverage industry, particularly in urban areas, has further accelerated the market’s growth, as processed foods, soft drinks, bakery products, and confectionery become increasingly popular.

Additionally, economic growth and rising disposable incomes have led to a shift in consumer preferences toward premium and healthier food options, creating demand for low-calorie and natural sweeteners such as stevia, monk fruit, and erythritol. Governments across the region are also taking initiatives to combat rising obesity and diabetes rates, leading to increased regulatory scrutiny and taxation on sugar-heavy products. This has encouraged food manufacturers to reformulate products using artificial and natural sugar substitutes, thereby boosting the market for alternative sweeteners.

Moreover, Asia-Pacific is a major producer of key raw materials for sweeteners, including sugarcane, stevia, and other plant-based sources, ensuring a steady and cost-effective supply for domestic and international markets. The growing adoption of Western dietary patterns, coupled with traditional preferences for sweetened beverages and desserts, further reinforces the region’s dominance in the industry. With ongoing product innovation, a strong manufacturing base, and evolving consumer trends, Asia-Pacific is set to maintain its leadership position in the global sweeteners market, driving growth across multiple sweetener categories.

Recent Developments

- In June 2022, Natural food production and the consumption of animal-based goods are becoming increasingly popular among consumers. Adding plant-based feed additives to healthy animal feed has a very high development potential. Cargill, the world's top agribusiness, stated it has reached a binding deal to buy Delacon, the world's foremost expert in plant-based phytogenic additives, to help feed clients in this expanding market.

- In June 2022, T&L PLC (Tate & Lyle) announced on 9th June 2022 that it has completed the acquisition of Quantum Hi-Tech (Guangdong) Biological Co., Ltd (Quantum), one of China's leading prebiotic dietary fibre businesses situated in China. On March 31, 2022, it was announced that the signing of a conditional agreement for this transaction would take place.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Sweeteners Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product Type

- Natural Sweeteners

- Artificial Sweeteners

- Sucrose

- High-fructose Corn Syrup

- Sugar Alcohol

- Others

By Form

- Powder

- Liquid

- Crystals

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Other Applications

By Distribution Channel

- Supermarket and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Store

- Others

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill, Incorporated

- Archer-Daniels-Midland Company

- Tate & Lyle Public Limited Company

- Ingredion Inc.

- Associated British Foods plc

- Südzucker AG

- Kerry Group plc

- Anderson Advanced Ingredients

- Roquette

- Ajinomoto Co., Inc.

- Tereos S.A.

- GLG Life Tech Corp

- Daesang Corporation

- Van Wankum Ingredients

- Celanese Corporation

- Capilano Honey Ltd

- Icon Food

- Whole Earth Brands, Inc.

- Matsutani Chemical Industry Co. Ltd

- Foodchem International Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 209 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 109.9 Billion |

| Forecasted Market Value ( USD | $ 145.08 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |