This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The increasing demand for high-definition (HD) and ultra-high-definition (UHD) content has boosted the need for advanced broadcasting infrastructure, where coaxial cables remain a preferred choice. Additionally, the growing adoption of broadband internet and the expansion of 5G networks have fueled market demand, as coaxial cables are essential for backhaul connectivity and hybrid fiber-coaxial (HFC) networks. The defense and aerospace sectors also rely on coaxial cables for secure and high-frequency signal transmission. Furthermore, the expansion of smart homes, IoT (Internet of Things), and industrial automation has increased the use of coaxial cables in networking and surveillance applications.

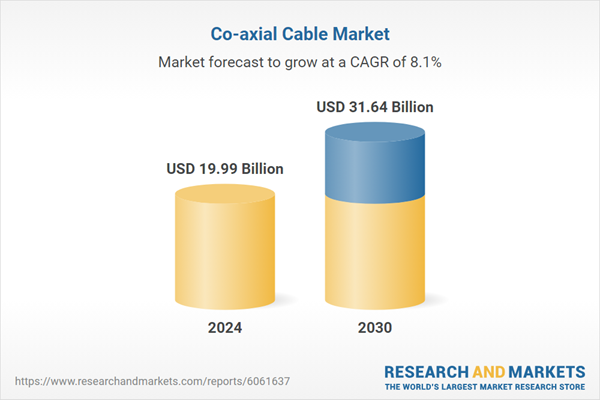

According to the research report "Global Coaxial Cable Market Outlook, 2030," the Global Coaxial Cable market was valued at more than USD 19.99 Billion in 2024, and expected to reach a market size of more than USD 31.64 Billion by 2030 with the CAGR of 8.12% from 2025-30. The market adoption and penetration of coaxial cables remain strong across multiple industries, driven by their cost-effectiveness, durability, and reliable signal transmission capabilities. While fiber optics are gaining traction, coaxial cables continue to be widely used in cable television (CATV), broadband internet, telecommunications, aerospace, and defense applications.

The hybrid fiber-coaxial (HFC) infrastructure, commonly deployed by internet service providers, ensures the continued relevance of coaxial cables in high-speed broadband networks. Additionally, the increasing adoption of 5G, IoT, and smart home technologies has reinforced the demand for advanced coaxial cables with improved shielding and signal integrity.

Emerging markets, particularly in Asia-Pacific and Latin America, are experiencing increased penetration due to ongoing infrastructure development and expanding digital connectivity initiatives. Despite competition from fiber optics, the coaxial cable industry maintains a strong foothold in various sectors, ensuring sustained market adoption in the coming years.

Market Drivers

- Expansion of Hybrid Fiber-Coaxial (HFC) Networks: The growing demand for high-speed broadband and digital TV services has led to the expansion of hybrid fiber-coaxial (HFC) networks, which combine the advantages of fiber optics and coaxial cables. Many telecom and cable providers continue to rely on coaxial cables for the last-mile connectivity between fiber nodes and end users. This driver is particularly strong in regions where fully fiber-based networks are not yet economically viable, ensuring sustained demand for advanced coaxial cable solutions.

- Rising Adoption in Aerospace and Defense Applications: Coaxial cables are increasingly used in aerospace and defense sectors for secure, high-frequency signal transmission in radar systems, military-grade communication, and avionics. The need for reliable, low-loss cables capable of withstanding harsh environments is fueling innovation in lightweight and high-performance coaxial cables designed for critical defense and space applications.

Market Challenges

- Growing Competition from Fiber Optic Technology: The rapid advancement and cost reduction of fiber optics pose a significant challenge to the coaxial cable industry. Fiber offers higher bandwidth, lower latency, and better long-distance performance, leading many telecom providers to transition from coaxial to fiber-based networks, particularly in urban areas. This shift requires coaxial cable manufacturers to innovate and find niche applications to maintain market relevance.

- Fluctuations in Raw Material Costs: The production of coaxial cables heavily depends on materials like copper, aluminum, and plastic insulation, all of which are subject to price volatility due to supply chain disruptions and global economic conditions. Rising raw material costs can impact profit margins and lead to higher prices, making it challenging for manufacturers to stay competitive against alternative technologies.

Market Trends

- Development of Low-Loss and High-Frequency Coaxial Cables: To counter competition from fiber optics, manufacturers are focusing on developing advanced coaxial cables with improved shielding, reduced attenuation, and enhanced high-frequency performance. These innovations cater to applications in 5G networks, aerospace, and IoT, where reliability and signal integrity are critical.

- Sustainability and Eco-Friendly Manufacturing: As environmental concerns grow, companies are exploring recyclable and low-carbon footprint materials for coaxial cables. Manufacturers are also implementing energy-efficient production processes and focusing on cable designs that minimize electronic waste, aligning with global sustainability goals and regulatory requirements.

Hardline coaxial cables are designed with a rigid outer conductor, often made of solid copper or aluminum, which provides excellent shielding against electromagnetic interference (EMI) and radio frequency interference (RFI). This makes them the preferred choice for critical applications such as broadband internet infrastructure, satellite communications, and broadcast transmission, where maintaining signal integrity over long distances is essential. Hardline cables also have lower attenuation compared to flexible coaxial cables, ensuring stable and high-speed data transmission, which is crucial for emerging technologies like 5G and advanced networking systems.

Additionally, their robust construction allows them to withstand harsh environmental conditions, including extreme temperatures and moisture, making them ideal for outdoor and industrial applications. As telecommunication providers and broadcasting companies continue to expand their networks to meet growing data demands, the need for reliable, high-performance coaxial cables like hardline continues to rise, reinforcing its dominance in the market.

Internet data transfer is leading in the coaxial cable market due to the growing demand for high-speed broadband services and the continued reliance on hybrid fiber-coaxial (HFC) networks by internet service providers (ISPs) .

Despite the rise of fiber optics, coaxial cables remain an essential component in broadband infrastructure, particularly in last-mile connectivity where fiber deployment is not yet economically viable. Coaxial cables offer a cost-effective and reliable solution for delivering high-speed internet to homes and businesses, supporting applications such as video streaming, online gaming, cloud computing, and remote work. With advancements like DOCSIS (Data Over Cable Service Interface Specification) technology, modern coaxial cables can now handle gigabit-speed data transmission, bridging the gap between traditional copper-based networks and full fiber-optic deployments.

Additionally, the expansion of smart homes, IoT devices, and high-definition content consumption has further reinforced the need for stable and high-bandwidth internet connections, making coaxial cables a crucial component in meeting the world's increasing data transfer demands. As broadband networks continue to evolve, coaxial cables remain a dominant player in enabling high-speed internet access across various regions, ensuring their sustained leadership in the market.

Internet service providers (ISPs) are leading in the coaxial cable market because of their extensive reliance on hybrid fiber-coaxial (HFC) networks to deliver high-speed broadband to millions of households and businesses worldwide.

While fiber optics are gaining popularity, fully replacing coaxial infrastructure is costly and time-consuming, making coaxial cables a crucial part of ISP operations. Coaxial cables, particularly when enhanced with technologies like DOCSIS (Data Over Cable Service Interface Specification), enable ISPs to provide gigabit-speed internet while utilizing their existing cable infrastructure. This makes them an efficient and cost-effective solution for expanding broadband coverage without requiring full fiber-to-the-home (FTTH) deployment. Additionally, ISPs depend on coaxial cables for cable television, VoIP (Voice over Internet Protocol) services, and bundled offerings, making them indispensable in the telecom sector.

As demand for high-speed internet continues to grow, driven by factors like remote work, online education, and streaming services, ISPs are maintaining and upgrading their coaxial cable networks to meet user expectations. Their dominance in the market is further reinforced by government initiatives to expand broadband access, particularly in underserved and rural areas where coaxial remains a practical solution for internet connectivity.

North America is leading in the coaxial cable market due to its well-established broadband infrastructure, high demand for high-speed internet services, and extensive deployment of hybrid fiber-coaxial (HFC) networks by major internet service providers (ISPs).

The region has one of the highest internet penetration rates in the world, with millions of households and businesses relying on coaxial cables for broadband access, cable television, and telecommunications. Large ISPs such as Comcast, Charter Communications, and Rogers Communications continue to invest in upgrading their coaxial networks with advanced technologies like DOCSIS 3.1 and 4.0, enabling gigabit-speed internet without requiring a complete transition to fiber optics. Additionally, the rising consumption of streaming services, online gaming, cloud computing, and remote work solutions has further increased the demand for stable and high-bandwidth internet connections, reinforcing the importance of coaxial cable infrastructure.

Government initiatives to expand broadband access in rural areas, coupled with investments in smart city projects and IoT networks, also contribute to the sustained growth of the coaxial cable market in North America. The presence of key coaxial cable manufacturers, continuous technological advancements, and strong consumer demand ensure that North America remains the dominant region in the global coaxial cable industry.

Recent Developments

- I-PEX introduced the CABLINE®-CAP in August 2023, a micro coax cable assembly designed for enterprise communications equipment, servers, and switches. With a 1.15 mm mating height and 0.4 mm pitch, it supports high-speed data transmission up to 64 Gbps per lane using PAM4 modulation. The integration of paddle card technology enhances signal integrity, catering to the increasing demand for high-performance data connectivity in advanced network infrastructure.

- In March 2023, Times Microwave Systems launched the XtendedFlex 178, a continuous flex coaxial cable designed for robotics and industrial automation. Featuring a stranded silver-plated copper-clad steel center conductor, FEP dielectric, and a flexible rubber jacket, it ensures durability and reliability in high-motion environments. Rigorous testing confirmed that the cable maintains low insertion loss and VSWR specifications even after one million flexes, making it ideal for demanding automation applications.

- Mobiyu introduced multiple coaxial cable solutions for various applications. The PSC18SL with a slim body connector is designed for compact spaces, allowing easy installation. The RG405 SMP Long Neck Right Angle Cable Assembly is tailored for specialized test equipment applications, providing efficient signal transmission in confined areas. Meanwhile, the PSC18UL Ultra Low Loss Cable is optimized for long-distance cable runs, ensuring minimal signal degradation over extended use.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Co-Axial Cable Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Cable Type

- Hardline

- RG - 6

- Triaxial Cable

- Radiating

- Others

By Application

- Internet Data Transfer

- Radio Frequency Transfer

- Aerospace & Defense

- Video Distribution

By End-User

- Internet Service Provider

- Television

- Telecommunication Service Providers

- System Integrators

- Others

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- TE Connectivity plc

- Amphenol Corporation

- Prysmian S.p.A.

- Nexans S.A.

- W. L. Gore & Associates, Inc.

- Belden Incorporated

- HUBER+SUHNER

- LS Cable & System Ltd.

- Molex Incorporated

- Southwire Company

- LS Cable & System Ltd.

- Leoni AG

- Radiall

- Times Microwave Systems

- Rosenberger Group

- Delton Cables Ltd

- L-Com, Inc.

- Alpha Wire Company

- WireMasters Inc.

- Dacon Systems Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.99 Billion |

| Forecasted Market Value ( USD | $ 31.64 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |