The market is witnessing a substantial shift toward automation as businesses seek to address the rising expectations for shorter delivery times and flawless operations. Additionally, the growing adoption of cloud-based warehouse management systems (WMS) and predictive analytics is enabling organizations to make data-driven decisions that further refine their logistics processes. The increasing prominence of micro-fulfillment centers in urban areas, designed to meet the surging demand for same-day or next-day deliveries, is also contributing to the accelerated growth of the warehouse automation market.

Advancements in robotics and artificial intelligence (AI) are transforming warehouse operations by driving improvements in order fulfillment speed and operational precision. Companies are investing heavily in AI-driven solutions to manage inventory more effectively, boost picking and sorting accuracy, and reduce operational errors. The integration of AI and sensor-powered systems into warehouse automation is enhancing material handling efficiency, with innovations such as robotic vision systems and high-speed conveyors playing a critical role. Businesses are increasingly incorporating the Internet of Things (IoT) and AI technologies to enable predictive maintenance and ensure seamless coordination between various warehouse components, resulting in greater scalability and innovation.

The market is segmented into three core components: hardware, software, and services. The hardware segment, which includes robotics, conveyor systems, and automated storage solutions, is projected to grow at a CAGR of 15.3% by 2034. A growing emphasis on AI-driven robotics and sensor-equipped systems is revolutionizing material handling, making processes more efficient, and minimizing downtime. As companies focus on maximizing warehouse space utilization and improving operational throughput, the demand for AI-powered hardware solutions continues to rise.

Warehouse types are also playing a pivotal role in the market’s expansion, with e-commerce fulfillment leading the way. The e-commerce fulfillment segment is expected to reach USD 31.3 billion by 2034, fueled by the rapid growth of online shopping and the need for faster, more accurate order processing. A key trend within this segment is the implementation of space-efficient storage systems and the establishment of micro-fulfillment centers in urban locations to meet rising consumer expectations for same-day or next-day delivery. Automated systems are being widely used to streamline picking, sorting, and packaging processes, enabling fulfillment centers to handle large-scale operations with minimal errors. AI-driven orchestration systems are further enhancing workflows, allowing for better inventory accuracy and improved supply chain management.

North America Warehouse Automation Market accounted for a 35.6% share in 2024, with the region experiencing a surge in the adoption of robotics and AI-powered solutions to improve warehouse efficiency. Businesses across the region are focusing on implementing autonomous systems to enhance storage, picking, and material handling processes, reducing the reliance on manual labor. With companies striving to stay competitive in the fast-paced e-commerce landscape, the increased adoption of cutting-edge warehouse automation solutions is contributing to the overall growth and technological advancement of the market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Warehouse Automation market report include:- 6 River Systems

- AutoStore

- Bastian Solutions

- Daifuku

- Dematic

- Element Logic

- Fives

- Fortna

- Gebhardt Intralogistics

- Honeywell

- Kardex

- Knapp

- Korber

- Locus Robotics

- Murata Machinery

- Savoye

- SSI Schaefer

- Stow Robotics

- Swisslog

- Symbotic

- System Logistics

- Vanderlande

- Witron

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

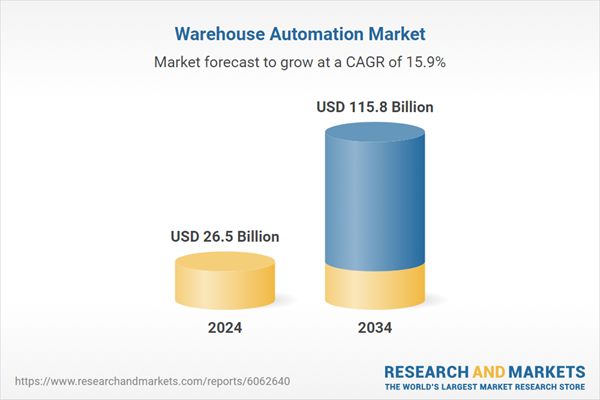

| Estimated Market Value ( USD | $ 26.5 Billion |

| Forecasted Market Value ( USD | $ 115.8 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |