The beverage industry plays a pivotal role in propelling the growth of the food and beverage metal cans market. As global beverage production expands, the need for secure and efficient packaging options grows in parallel. Metal cans, especially aluminum, remain highly sought after due to their superior recyclability and their ability to protect beverages from external factors such as light and oxygen, which can compromise product quality. The ongoing shift towards more sustainable packaging, driven by changing consumer preferences and stricter regulatory mandates, has significantly boosted the demand for metal cans in the beverage sector. Additionally, the rising popularity of functional drinks, energy beverages, and carbonated drinks further fuels the demand for aluminum cans, which provide optimal protection and maintain the integrity of these products over time.

The market is segmented by material type, with aluminum and steel emerging as the most common choices. The aluminum cans segment generated USD 36.4 billion in 2024, thanks to its lightweight nature that reduces transportation costs and its high recyclability, which aligns with growing global concerns over plastic waste. As consumers continue to favor sustainable packaging options, manufacturers increasingly prefer aluminum cans to meet evolving environmental standards. The growing demand for carbonated beverages, craft beers, and canned alcoholic drinks is also contributing to the increased adoption of aluminum cans in the beverage industry.

By application, the beverage cans segment dominated the market, generating USD 28.8 billion in 2024. This growth is primarily driven by the rising consumption of ready-to-drink beverages, including soft drinks, energy drinks, and canned alcoholic beverages. Additionally, the surging popularity of craft beers and functional drinks is fueling the demand for metal cans. Manufacturers are responding to growing consumer interest in sustainable packaging by shifting to aluminum cans, which offer environmental benefits and reduce the overall carbon footprint of transportation.

North America held a 34.1% share of the food and beverage metal cans market in 2024, reflecting the region’s increasing consumption of ready-to-drink beverages and the rapid expansion of the food and beverage industry. Stringent government regulations promoting plastic waste reduction and encouraging the adoption of sustainable packaging solutions are driving the demand for metal cans as a viable and eco-friendly alternative to plastic packaging. As sustainability becomes a key consideration in packaging, North America continues to witness significant growth in the adoption of metal cans across various segments.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Food and Beverage Metal Cans market report include:- Aaron Packaging

- Ardagh Group

- Ball Corporation

- Baixicans

- Canpack

- Ceylon Beverage Can

- Colep Packaging

- CPMC Holdings

- Crown Holdings

- Envases Group

- Massilly Holding

- Nampak

- Novelis

- Orora Packaging

- Scan Holdings

- Silgan Holdings

- Sonoco Products

- Toyo Seikan

- Trivium Packaging

- Visy Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

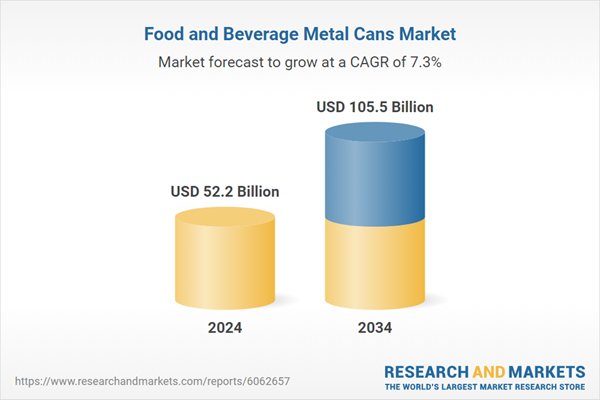

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 52.2 Billion |

| Forecasted Market Value ( USD | $ 105.5 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |