The milk powder packaging market is witnessing remarkable growth due to the rising awareness of infant health and nutrition. With more parents emphasizing the importance of meeting their babies' nutritional needs, the demand for fortified baby formula continues to grow. This growing trend requires packaging solutions that not only protect the product but also preserve its nutritional value over time. As a result, there is an increasing demand for packaging that provides superior barrier protection against moisture, oxygen, and light. Functional and protective packaging, particularly those offering airtight seals, ensures the longevity and safety of milk powder, contributing significantly to the market’s expansion.

Materials used in milk powder packaging play a crucial role in ensuring product quality and longevity. The plastic segment generated USD 1.1 billion in 2024, with its key advantages driving its dominance in the market. Plastic packaging offers moisture resistance, airtight sealing, and protection from light exposure, making it ideal for preserving the quality and shelf life of milk powder. Additionally, the rising demand for convenient, resealable packaging solutions, such as stand-up pouches and spouted pouches, is further accelerating the adoption of plastic packaging in the industry. These formats cater to the increasing preference for single-serve and portion-sized products, aligning with modern consumer lifestyles.

The market is also segmented by packaging type, with flexible packaging generating USD 1.4 billion in 2024. Flexible packaging is gaining significant traction due to its ability to provide lightweight, cost-effective, and portable solutions for consumers. The rise in demand for on-the-go milk powder packaging, such as single-serve sachets and travel-friendly packs, has led to an increased preference for flexible options. As e-commerce continues to flourish, there is a growing need for durable, tamper-proof, and leak-proof packaging that safeguards product integrity during transportation and storage. These factors are contributing to the sustained growth of flexible packaging solutions within the industry.

North America milk powder packaging market captured a 28.3% share in 2024, driven by the demand for convenient, long-lasting packaging solutions in the dairy sector. As more consumers seek easy-to-store and transport dairy alternatives, the need for packaging that maintains product quality over extended periods has spurred the adoption of innovative packaging technologies. With increasing consumer preferences for high-quality, resealable, and portable packaging solutions, North America remains a key player in driving the growth of the milk powder packaging market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Milk Powder Packaging market report include:- Advanced Industries Packaging

- Bowe Pack

- CarePac

- Constantia Flexibles

- Coveris

- Evergreen Goods

- Hassia-Redatron

- Honokage

- Huhtamaki

- Mondi

- NNZ

- Novel

- Premier Polymers

- Sadhi Krupa Polysacks

- Sonoco Product Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

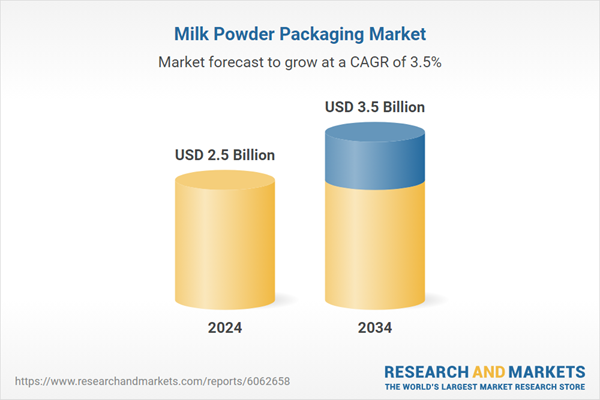

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |